Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

b) by what percentage did net income grow each year?

c) for example, revenues (increased or declined) in 2013 by 10.02%, however, cost of goods sold (declined or increased) by 7.70%

Transcribed Image Text:See Table 2.5 showing financial statement data and stock price data for Mydeco Corp.

a. By what percentage did Mydeco's revenues grow each year from 2013 to 2016?

b. By what percentage did net income grow each year?

c. Why might the growth rates of revenues and net income differ?

a. By what percentage did Mydeco's revenues grow each year from 2013 to 20167

The revenues growth for year 2013 is - 10.02 %. (Round to two decimal places.)

The revenues growth for year 2014 is 16.71 %. (Round to two decimal places.)

The revenues growth for year 2015 is 20.28 %. (Round to two decimal places.)

The revenues growth for year 2016 is 18.29%. (Round to two decimal places.)

b. By what percentage did net income grow each year

The net income growth for year 2013 is %. (Round to two decimal places.)

The net income growth for year 2014 is %. (Round to two decimal places.)

The net income growth for year 2015 is %. (Round to two decimal places.)

The net income growth for year 2016 is %. (Round to two decimal places.)

c. Why might the growth rates of revenues and net income differ? (Select from the drop-down menus.)

different rates than revenues. For example, revenues

in 2013 by 10.02%, however, cost of goods sold

V by 7.70%.

Net income growth rate differs from revenue growth rate because cost of goods sold and other expenses can move

Transcribed Image Text:This test: 6 point(s)

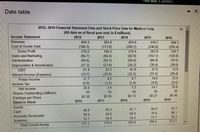

Data table

2012-2016 Financial Statement Data and Stock Price Data for Mydeco Corp.

(All data as of fiscal year end; in $ millions)

Income Statement

2012

2013

2014

2015

2016

Revenue

404.3

363.8

424.6

510.7

604.1

Cost of Goods Sold

(188.3)

(173.8)

(206.2)

(246.8)

263.9

(293.4)

Gross Profit

216.0

190.0

218.4

310.7

Sales and Marketing

(66.7)

(60.6)

(27.3)

61.4

(66.4)

(59.1)

(27.0)

(82.8)

(59.4)

(34.3)

(102.1)

(66.4)

(38.4)

(120.8)

(78.5)

(38.6)

Administration

Depreciation & Amortization

EBIT

37.5

41.9

57.0

72.8

Interest Income (Expense)

(33.7)

(32.9)

(32.2)

(37.4)

(39.4)

Pretax Income

27.7

4.6

9.7

19.6

33.4

Income Tax

(6.9)

(1.2)

(2.4)

(4.9)

(8.4)

Net Income

20.8

3.4

7.3

14.7

25.0

55

55

55

55

55

Shares Outstanding (millions)

Earnings per Share

$0.38

$0.06

$0.13

$0.27

$0.45

2012

2013

2014

2015

2016

Balance Sheet

Assets

80.9

91.7

48.8

69.3

87.7

Cash

76.9

86.1

88.6

69.8

69.8

Accounts Receivable

35.3

30.9

28.4

31.7

33.7

Inventory

185.9

189.5

213.1

171.1

170.0

Total Current Assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- LeapFrog Enterprises Inc. had the following quarterly net in- comes during its 2013 fiscal year. (Source: Leapfroginvestors. com) Quarter of Fiscal 2013 Net Income (in millions) First -$3.0 Second -$3.2 Third $26.4 Fourth $63.9 What was the total net income for fiscal year 2013?arrow_forwardNet Sales in 2012 = 33,075 Net Sales in 2013 = 37,580 What was the percentage increase(decrease) in net sales?arrow_forwardLast year, Jumpin' Trampolines (JT) had a quick ratio of 1.0, a current ratio of 1.8, an inventory turnover of 3.5, total current assets of $67,500, and cash and equivalents of $15,00. If the cost of goods sold equaled 70 percent of sales, what were JT's annual sales and DSO?arrow_forward

- Krogen Grocer’s 2016 financial statements show net income of $1,680 million, sales of $153,466 million, and average total assets of $46,350 million.How much is Krogen Grocer’s return on sales for the year? Question 22 options: A) 1.09% B) 30.20% C) 3.62% D) 6.42%arrow_forwardI need to find which year had the better performance . if : this years information : returns 8% with net sales of 756,000 last years information: returns 11.5% with gross sales of 875,000arrow_forwardSelected comparative financial statements of Haroun Company follow. HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2021-2015 ($ thousands) Sales 2021 Cost of goods sold $ 1,769 1,271 2020 $ 1,549 2019 2018 2017 2016 2015 $ 1,410 $ 1,292 $ 1,206 $ 1,121 $ 919 1,034 889 778 723 676 539 Gross profit 498 515 521 514 483 445 380 Operating expenses Net income 377 295 271 200 173 171 142 $ 121 $ 220 $ 250 $ 314 $ 310 $ 274 $ 238 HAROUN COMPANY Comparative Year-End Balance Sheets December 31, 2021-2015 ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity 2021 2020 2019 2018 2017 2016 2015 $ 108 773 $ 142 812 $ 148 735 2,797 2,036 1,779 $ 151 564 1,499 $ 157 496 $ 155 $ 160 470 332 1,346 1,144 829 72 65 40 71 60 61 32 e B 220 220 220 220 3,422 3,409 2,982 1,683 $ 7,172 $ 6,464 $ 5,684 $ 4,188 $ 4,019 1,740 1,546 $ 3,596 $ 2,900 1,327 Current liabilities…arrow_forward

- ! Required information Use the following information for the Quick Studies below. (Algo) ($ thousands) Net sales Current Year $ 803,470 394,775 Prior Year $ 455,095 135,878 Cost of goods sold QS 17-7 (Algo) Trend percents LO P1 Determine the Prior Year and Current Year trend percents for net sales using the Prior Year as the base year. (Enter the answers in thousands of dollars.) Current Year: Prior Year: Numerator: Trend Percent for Net Sales: 1 1 1 1 Denominator: = = = Trend Percent 0 % 0 %arrow_forwardI will always like all sections - Thanks for your help, I appreciate it.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education