FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

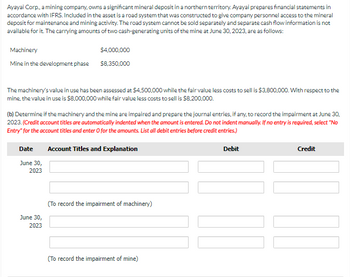

Transcribed Image Text:Ayayai Corp., a mining company, owns a significant mineral deposit in a northern territory. Ayayai prepares financial statements in

accordance with IFRS. Included in the asset is a road system that was constructed to give company personnel access to the mineral

deposit for maintenance and mining activity. The road system cannot be sold separately and separate cash flow information is not

available for it. The carrying amounts of two cash-generating units of the mine at June 30, 2023, are as follows:

Machinery

Mine in the development phase

The machinery's value in use has been assessed at $4,500,000 while the fair value less costs to sell is $3,800,000. With respect to the

mine, the value in use is $8,000,000 while fair value less costs to sell is $8,200,000.

$4,000,000

$8,350,000

(b) Determine if the machinery and the mine are impaired and prepare the journal entries, if any, to record the impairment at June 30,

2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Date

June 30,

2023

June 30,

2023

(To record the impairment of machinery)

(To record the impairment of mine)

Debit

Credit

MT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Anglogold Ashanti (a gold mining company in South Africa) paid $500 million for the right to explore and extract rare metals from land owned by the Government of Namibia. To obtain the rights, Anglogold Ashanti agreed to restore the land to a suitable condition for other uses after its exploration and extraction activities. Anglogold incurred exploration and development costs of $80 million on the project. The company's credit-adjusted risk free interest rate is 7%. It estimates the possible cash flows for restoring the land, three years after its extraction activities begin, as follows: Cash Outflow Probability $ 15 million 60 % $ 40 million 40 % The asset retirement obligation (rounded) that should be reported on Anglogold's balance sheet one year after the extraction activities begin is? NOTE: For (PV of $1, PVA of $1), use 0.81630 as the appropriate discount factor to solve this problem..…arrow_forwardPlease don't give answers in an image thnxarrow_forwardok D ences General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant Cost Accumulated depreciation General's estimate of the total cash flows to be generated by selling the products manufactured at its Arizona plant, not discounted to present value The fair value of the Arizona plant is estimated to be $14 million. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. & 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $15 million instead of $16.2 million and (4) $24.35 million instead of $16.2 million. Complete this question by entering your answers in the tabs below. Req 1 Req 2 Impairment loss Req 3 and 4 Determine the amount of…arrow_forward

- hich of the following is leakages from the circular flow in a closed economy? a. household saving and government spending b. government spending and business investment c. household saving and net taxes d. household saving and business investmentarrow_forwardOriole Corp., a public company located in Manitoba, both purchases and constructs various pieces of machinery and equipment that it uses in its operations. The following items are for machinery that was purchased and a piece of equipment that was constructed during the 2020 fiscal year: Machinery Cash paid for machinery, including sales tax of $10,150 and recoverable GST of $7,250 $162,400 Freight and insurance cost while in transit 2,820 Cost of moving machinery into place at factory 3,200 Wage cost for technicians to test machinery 3,900 Materials cost for testing 500 Insurance premium paid on the machinery for its first year of operation 1,900 Special plumbing fixtures required for new machinery 8,050 Repair cost on machinery incurred in first year of operations 1,000 Cash received from provincial government as incentive to purchase machinery 26,300 Equipment (Self-Constructed) Material and purchased parts (gross cost $190,000; failed to take 1% cash discount; the company uses the…arrow_forwardThe Thunderman Company operates several factories that manufacture board games. Near the end of the company’s 2018 year, a change in business climate due to a competitor’s innovative products indicated to management that the $170 million book value (original cost of $300 million less accumulated depreciation of $130 million) of the assets of one of Thundermans Factories may not be recoverable. Management is able to identify cash flows from this factory and estimates that future cash flows over the remaining useful l life of the factory will be $150 million. The fair value of the factory’s assets is not readily available but is estimated to be $135 million.1- Recoverability2- Measurement of Impairment loss3- Record Impairmentarrow_forward

- During 2023, Bird Company sold a building with a book value of $162.093 for proceeds of $179.332. The company also sold long-term investments for proceeds of $33.521. The company purchased land and a new building for $365,175 by signing a long-term note payable. No other transactions impacted long-term asset accounts during 2023. Instructions Compute net cash flows from investing activities.arrow_forwardPresented below is net asset information related to the Metlock Division of Horton, Inc. Cash Receivable Property, plant, and equipment (net) Goodwill METLOCK DIVISION NET ASSETS AS OF DECEMBER 31, 2025 (IN MILLIONS) Less: Notes payable Net assets (a) $50 151 2,063 160 (2,141) $283 The purpose of the Metlock division is to develop a nuclear-powered aircraft. If successful, traveling delays associated with refueling could be substantially reduced. Many other benefits would also occur. To date, management has not had much success and is deciding whether a write-down at this time is appropriate. Management estimated its future net cash flows from the project to be $322 million. Management has also received an offer to sell the division for $281 million. The book values and fair values are equal for all identifiable assets and liabilities. Prepare the journal entry (if any) to record the impairment at December 31, 2025. (Enter amounts in millions. If no entry is required, select "No Entry"…arrow_forwardB3.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education