FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

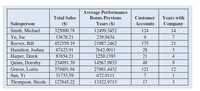

A sales manager is trying to determine appropriate sales performance bonuses for her team

this year. The following table contains the data relevant to determining the bonuses, but it

is not easy to read and interpret. Reformat the table to improve readability and to help the

sales manager make her decisions on bonuses.

Transcribed Image Text:Average Performance

Bonus Previous

Total Sales

Customer

Years with

Salesperson

($)

Years ($)

Accounts

Company

Smith, Michael

325000.78

12499.3452

124

14

Yu, Joe

13678.21

239.9434

9.

Reeves, Bill

452359.19

21987.2462

175

21

Hamilton, Joshua

Harper, Derek

Quinn, Dorothy

87423.91

7642.9011

28

3

87654.21

1250.1393

21

234091.39

14567.9833

48

9.

Graves, Lorrie

Sun, Yi

379401.94

27981.4432

121

12

31733.59

672.9111

7

1

Thompson, Nicole

127845.22

13322.9713

17

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Which of the following is an example of qualitative factors that can effect investment decisions? Select one: a. All of the choices b. Over time, how will the quality of goods produced impact the company financially? c. How will any changes affect worker productivity? Will they have any impact on employee morale? d. How will the proposed acquisition or upgrade affect the company’s flexibility?arrow_forwardWhy the answer is letter D. Company A’s lower voluntary employee turnover rate will likely increase valuation? How will performance on SASB metrics impact Company A’s valuation as compared to Company B?A. Company B’s higher percentage of revenue from leisure customers will likely decrease valuation.B. Company B’s lower reclamation rate of hotel room keys will likely increase valuation.C. Company A’s lower percentage of revenue from coastal regions will likely decrease valuation.D. Company A’s lower voluntary employee turnover rate will likely increase valuationarrow_forwardWe have seen how cost and volume assumptions affect net income. A common application of CVP analysis is a tool to forecast sales, costs, and income. Assume that you are actively searching for a job. Identify and discuss three assumptions relating to your expected revenue (salary), and three assumptions related to your expected costs (expenses) for the first year on the job.arrow_forward

- Among the best things to do to maintain firm value is to: a. Improve sales at all costs b. Spend as much as possible on public relations and marketing C. Economize on employee training programs d. In so far as possible, make costs reactive to sales e. Wait until the last moment to pay billsarrow_forwardAccounting information helps key stakeholders of the business to make decisions.From the following options,which one is the decision that an internal stakeholder is unlikely to make? A.Make decisions about how toset product selling price,whether to advertise and how much to spend on advertising B.Decide which products to continue to sell and when to add new products or drop old ones C.Identify what resources and employees the business needs,and to set benchmarks against which they can later measure the business's progress towards its goals D.Analyse the business's financial reports to decide whether to purchase shares of the companyarrow_forwardThe financial accounting system is the primary source of information for: Multiple Choice planning the budget for next year. decision making on the factory floor. preparing the Income statement for shareholders. Improving the performance level of customer service.arrow_forward

- Would you change a performance appraisal to reflect more positively on an individual whose advancement is important to your supervisor? Explain.arrow_forwardplease provide explanation of each and examples thank youarrow_forwardBalanced scorecards use both financial and nonfinancial measures to evaluate employees. The four categories of a balanced scorecard are financial perspective, internal business perspective, customer perspective, and learning and growth perspective. Are the above statements True / False? If the above statements are true then what are: the financial perspective the internal business perspective the customer perspective the learning and growth perspectivearrow_forward

- Calculate materiality for the client, assuming that it is a profit-oriented company and moderate audit risk. Explain why you chose the base you did and why you chose the percentage. You may use guidelines from the textbook or the case study and should refer to the specific guidelines you used in your answer. Current Year Prior Year Sales/revenue (net) 30,381,954 26,290,518 Expenses 7,263,786 6,519,376 Gross Margin 8,378,660 7,280,887 Pre-tax Income 1,114,873 761,510 Current Assets 18,993,546 16,966,273 Current Liabilities 8,221,991 6,810,164 Total Assets 19,679,541 17,670,625arrow_forwardJalancu Juviai u The following are a number of measures associated with the Balanced Scorecard. Required: 1. Classify each performance measure as belonging to one of the following perspectives: financial, customer, internal business process, or learning and growth. a. Number of new customers b. Percentage of customer complaints resolved with one contact C. Unit product cost d. Cost per distribution channel e. Suggestions per employee f. Warranty repair costs Consumer satisfaction (from surveys) Cycle time for solving a customer problem Strategic job coverage ratio j. On-time delivery percentage k. Percentage of revenues from new products 2. Select an additional measure that would be appropriate for each of the four perspectives. Contribution margin by product ▾ Number of complaints Number of accidents per month Hours of continuing education provided per month g. h. i. Financial Customer Customer Internal business process Financial Financial Learning and growth Learning and growth…arrow_forwardMeasure Maps Silver Lining Inc. has a balanced scorecard with a strategy map that shows that delivery time and the number of erroneous shipments are expected to affect the company’s ability to satisfy the customer. Further, the strategy map for the balanced scorecard shows that the hours from ordered to delivered affects the percentage of customers who shop again, and the number of erroneous shipments affects the online customer satisfaction rating. The following information is also available: The company’s target hours from ordered to delivered is 20. Every hour over the ordered-to-delivered target results in a 0.5% decrease in the percentage of customers who shop again. The company’s target number of erroneous shipments per year is no more than 70. Every error over the erroneous shipments target results in a 0.05 point decrease in the online customer satisfaction rating and an added future financial loss of $500. The company estimates that for every 1% decrease in the percentage of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education