FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

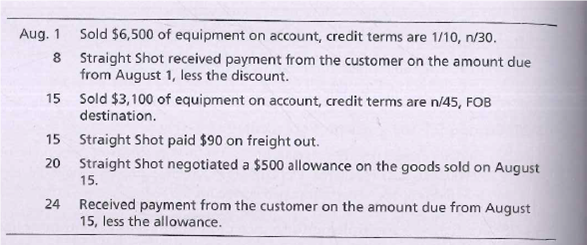

Journalizing sales transactions——periodic inventory system

Journalize the following sales transactions for Straight Shot Archery using the periodic inventory system. Explanations are not required. The company estimates sales returns and allowances at the end of each month.

Transcribed Image Text:Aug. 1 Sold $6,500 of equipment on account, credit terms are 1/10, n/30.

8 Straight Shot received payment from the customer on the amount due

from August 1, less the discount.

15 Sold $3,100 of equipment on account, credit terms are n/45, FOB

destination.

15 Straight Shot paid $90 on freight out.

20 Straight Shot negotiated a $500 allowance on the goods sold on August

15.

24 Received payment from the customer on the amount due from August

15, less the allowance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form with explanation , computation , narration for each and every step clearlyarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Every entry should have narration please Prepare journal entries to record the following merchandising transactions of Cabela’s, which uses the perpetual inventory system and the gross method. Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable—Boden. July 1 Purchased merchandise from Boden Company for $7,000 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Creek Company for $1,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $583. July 3 Paid $130 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $2,300 for $2,700 cash. July 9 Purchased…arrow_forwardRequesting a double check as I stuggle with this course.arrow_forward

- Montoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. Units Sold at Retail Units Acquired at Cost @$45 per unit $42 per unit @ $27 per unit Date January 1 February 10 March 13 March 15 August 21 Septeber 5 September 10 Activities Beginning inventory Purchase Purchase Sales Purchase Purchase Sales Totals Cost of goods available for sale Number of units available for sale Ending inventory Required: 1. Compute cost of goods available for sale and the number of units available for sale. (a) FIFO (b) LIFO (c) Weighted average (d) Specific identification 2. Compute the number of units in ending inventory. $ Sales Less: Cost of goods sold Gross profit 1,400 units Ending Inventory $ $ S O Weighted Average O Specific Identification O LIFO O FIFO 600 units 400 units 200 units 100 units 500 units 9,800 7,600 1,800 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d)…arrow_forwardCalculate the cost of goods sold for may and the ending inventory at may 31 using the FIFO formula.arrow_forwardNix'It Company's ledger on July 31, Its fiscal year-end, Includes the following selected accounts that have normal balances. Nix'It uses the perpetual Inventory system. Retained earnings Dividends Sales Sales discounts Sales returns and allowances Prepare the company's year-end closing entries. No 1 2 3 Date July 31 July 31 July 31 Sales Income summary Income summary Sales discounts $ 115,300 Cost of goods sold 7,000 Depreciation expense expense 170,000 Salaries expense 4,700 Miscellaneous expenses 6,500 Income summary X Answer is not complete. Sales returns and allowances Cost of goods sold Depreciation expense Salaries expense Retained earnings General Journal 33 333333 ✓ 33 $ 106,900 10,300 32,500 5,000 Debit 170,000✔ > 147,900 X 149,700 X Credit 170,000 4,700 6,500 106.900 10,300 32,500 3330 149,700 xarrow_forward

- Use this inventory information for the month of March to answer the following questions. Assuming that a periodic inventory system is used, what is ending inventory (rounded) under theaverage-cost method? What is cost of goods sold on a FIFO basis? What is ending inventory under the LIFO method?arrow_forwardRequired information [The following information applies to the questions displayed below] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 380 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning inventory Date January 1 January 10 January 20 January 25 January 30 View transaction list Activities Beginning inventory Sales Purchase Sales. Purchase Totals Journal entry worksheet 1 < 3 Record journal entries for Laker Company's sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and FIFO, All sales and purchases are made on account, and no discounts are offered. Record the sale of goods. 4 5 Units Acquired at Cost 240 units @ $16.50- 170 units @ $15.50 380 units @ $ 15.00- 790 units 6 $ 3,960 2,635 5,700 $ 12,295 Units sold at Retail 190 units 0 $25.50 e $25.50 190 units 380 unitsarrow_forwardHelp pleasearrow_forward

- Using the following accounts, record journal entries using the periodic inventory system for the following purchase transactions of Apex Industries. Accounts Receivable Cost of Goods Sold Purchase Returns and Allowances Accounts Payable Merchandise Inventory Sales Cash Purchases Sales Returns and Allowances PLEASE NOTE: You must enter the account names exactly as written above and all dollar amounts will be with "$" and commas as needed (i.e. $12,345). Purchased 24 computers on credit for $560 per computer. Terms of the purchase are 4/10, n/60, invoice dated November 6. DR CR Returned 5 defective computers for a full refund from the manufacturer on November 10. DR CR Paid account in full from the November 6 purchase on November 22. DR CRarrow_forwardPlease help mearrow_forwardBeginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 12 units @ $45 11 Purchase 13 units @ $47 14 Sale 18 units 21 Purchase 9 units @ $60 25 Sale 10 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using LIFO,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education