FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

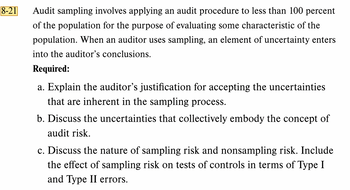

Transcribed Image Text:8-21

Audit sampling involves applying an audit procedure to less than 100 percent

of the population for the purpose of evaluating some characteristic of the

population. When an auditor uses sampling, an element of uncertainty enters

into the auditor's conclusions.

Required:

a. Explain the auditor's justification for accepting the uncertainties

that are inherent in the sampling process.

b. Discuss the uncertainties that collectively embody the concept of

audit risk.

c. Discuss the nature of sampling risk and nonsampling risk. Include

the effect of sampling risk on tests of controls in terms of Type I

and Type II errors.

Expert Solution

arrow_forward

Introduction

Sampling risk is the possibility that the items chosen in a pattern aren't truly representative of the population being examined. This is a major problem because an auditor no longer has the time to analyse the entire population and must instead rely on a trend.

One error that might result from the sample threat is that the auditor incorrectly determines that there are less problems with the populace than anticipated, which may result in an incorrect audit conclusion.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- s1: A stratified sample consist of sampling units selected without conscious bias. s2: All auditing procedures involve audit sampling. s3: A deviation from prescribed control procedures does not necessarily indicate the presence of monetary error A. all statements are true b. all statements are false c. s1 and s2 are true d. s1 and s3 are truearrow_forwardSTATEMENT 1: If the sampling unit is defined as the individual disbursement entry in the check register, the sampling frame would be the check voucher and its supporting documents. A STATEMENT 2: Not all audit tests applied to less than 100% of the populatian are considered audit sampling applications. A. Only Statement 1 is incorrect B. Only Statement 1 is correct C. Both statements are incorrect D. Both statements are correctarrow_forwardWhich of the following statements about attribute sampling is correct? A. Larger transactions have a higher chance of being selected into the sample than smaller transactions. B. The risk of over-reliance does not affect the sample size. C. Attribute sampling is often used in the test of controls. D. The haphazard selection method is often used for attribute sampling. E. If the estimated population deviation rate is higher than the tolerable deviation rate, auditors conclude the internal control is effective.arrow_forward

- Complete the statement. The lower the risk of material misstatement, a. the greater the maximum tolerable misstatement b. the higher the audit risk required. c. the later in the year that principal audit test procedures are performed d. the smaller the sample size needed for substantive testingarrow_forwardSTATEMENT 1: Nonstatistical sampling approach is determined based on pure judgment of the auditor. STATEMENT 2: The maximum rate of deviation that would support the auditor's planned assessed level of control risk is the expected error rate. A. Only Statement 1 is incorrect B. Only Statement 1 is correct C. Both statements are incorrect D. Both statements are correctarrow_forwardWhat is “tolerable misstatement”? How is this concept applied when auditors perform audit tests on a sample?arrow_forward

- STATEMENT 1: Since audit sampling is an essential part of the audit process, each step in an audit sampling application should be adequately planned. STATEMENT 2: No sampling method can provide the auditor with an absolute assurance that a particular sample is perfectly representative of the population. A. Only Statement 1 is incorrect B. Only Statement 1 is correct C. Both statements are incorrect D. Both statements are correctarrow_forwardWhich of the following statements is not true with respect to the calculation of the upperlimit on misstatements?a. The tainting percentage is determined based on the difference between the recorded balance and the audited value.b. A separate incremental allowance for sampling risk is calculated for each misstatementdiscovered by the auditor.c. If no misstatements are detected, the basic allowance for sampling risk equals zero.d. The projected misstatement is determined by multiplying the sampling interval by thetainting percentage.arrow_forwardState with reasons (in short) whether the following statements are correct or incorrect (a) The terms of audit engagement can restrict the scope of an audit. · (b) It is the function of an audit to establish that payments have been made validly to the persons who are shown to be recipients. (c) Letter of Representations received from Management relieve the auditors of their responsibility. (d) Stratified sampling method involves dividing the whole population to be tested in a few separate groups. (e) There is a very thin difference between advocacy threats and intimidation threats to an auditor while performing his dutyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education