FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Prepare

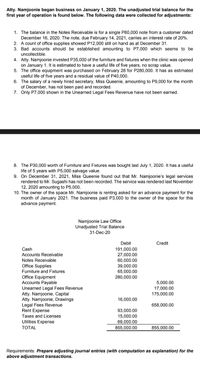

Transcribed Image Text:Atty. Namjoonie began business on January 1, 2020. The unadjusted trial balance for the

first year of operation is found below. The following data were collected for adjustments:

1. The balance in the Notes Receivable is for a single P60,000 note from a customer dated

December 16, 2020. The note, due February 14, 2021, carries an interest rate of 20%.

2. A count of office supplies showed P12,000 still on hand as at December 31.

3. Bad accounts should be established amounting to P7,000 which seems to be

uncollectible.

4. Atty. Namjoonie invested P35,000 of the furniture and fixtures when the clinic was opened

on January 1. It is estimated to have a useful life of five years, no scrap value.

5. The office equipment was purchased on February 28 for P280,000. It has as estimated

useful life of five years and a residual value of P40,000.

6. The salary of a newly hired secretary, Miss Queenie, amounting to P9,000 for the month

of December, has not been paid and recorded.

7. Only P7,000 shown in the Unearned Legal Fees Revenue have not been earned.

8. The P30,000 worth of Furniture and Fixtures was bought last July 1, 2020. It has a useful

life of 5 years with P5,000 salvage value.

9. On December 31, 2021, Miss Queenie found out that Mr. Namjoonie's legal services

rendered to Mr. Sugashi has not been recorded. The service was rendered last November

12, 2020 amounting to P5,000.

10. The owner of the space Mr. Namjoonie is renting asked for an advance payment for the

month of January 2021. The business paid P3,000 to the owner of the space for this

advance payment.

Namjoonie Law Office

Unadjusted Trial Balance

31-Dec-20

Debit

Credit

Cash

191,000.00

27,000.00

Accounts Receivable

Notes Receivable

60,000.00

Office Supplies

39,000.00

65,000.00

Furniture and Fixtures

Office Equipment

Accounts Payable

Unearned Legal Fees Revenue

Atty. Namjoonie, Capital

Atty. Namjoonie, Drawings

Legal Fees Revenue

Rent Expense

Taxes and Licenses

Utilities Expense

280,000.00

5,000.00

17,000.00

175,000.00

16,000.00

658,000.00

93,000.00

15,000.00

69,000.00

855,000.00

ТОTAL

855,000.00

Requirements: Prepare adjusting journal entries (with computation as explanation) for the

above adjustment transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The Ledger Where are the opening balances located when posting the journal entries? When are they used? Explain and provide example please.arrow_forwardWhat is the purpose of a journal? What is the purpose of a general ledger?arrow_forwardExplain the difference between an original journal entry and an adjusting journal entry?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education