Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

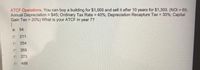

Transcribed Image Text:ATCF Operations. You can buy a building for $1,000 and sell it after 10 years for $1,300. (NOI = 60;

Annual Depreciation = $45; Ordinary Tax Rate = 40%; Depreciation Recapture Tax = 30%; Capital

Gain Tax = 20%) What is your ATCF in year 7?

1.

6 54

!3!

C 211

C 254

C 268

C 273

C 489

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- RRarrow_forwardWhat will be the annual cash outflows for Mimi Inc. if it leased a milling machine for $8, 200 per year for 5 years. Assume that the new machine cost $ 42,000 and will depreciate on a straight line basis over the 5 years and that Mimi has a tax rate of 32 percent. Question 15Select one: a. - $5,576 b. $42,000 C. -$8,264 d. $33,800 e. - $2,688arrow_forward24. Steven found that the value of his new car is currently $31,200 and willdepreciate 6.9% per year. Based on the rate of depreciation, find the value ofhis car in 5 years. A. $21,822.42B. $20,436.00C. $6,240.00D. $15,600.00arrow_forward

- 2. You plan on buying a bottling machine for $2 million, which can be salvaged for $400,000 in 8 years. Your tax rate is 43% and the CCA rate is 30%. Your cost of capital is 13%. What is present value of the CCA tax sheild? (Answer: E) a. $338,447 b. $378,521 c. $422,781 d. $458, 402 e. $520,348arrow_forwardklp.7arrow_forwardQ5.arrow_forward

- Max. score: 1.00 Ultra-Corporation purchased an equipment costing $300,000. The expected after-tax net income of $9,000 each year. It is predicted that the machine is expected to have a 12-year service life and a residual value $60,000. Company uses straight-lin depreciation. Compute this machine's accounting rate of return. 3% 2.5% 5% 3.75%arrow_forwardi will 10 upvotes urgentarrow_forward10arrow_forward

- A28arrow_forward3. Solar Solutions has purchased new manufacturing equipment that cost $400,000. Calculate the yearly tax savings from the CCA tax shield for the next three years. Assume that the income tax rate is 30%, the CCA rate is 30%, and the weighted-average cost of capital (WACC) is 12%. Assume that CCA in the first year is subject to the accelerated depreciation method for the year of acquisition. (Hint. Use Microsoft Excel to calculate the discount factor(s).) (Do not round your intermediate calculations. Round your final answers to 2 decimal places.) X Answer is complete but not entirely correct. Year 1 2 3 $ $ $ PV of Tax Savings 91,071.43 x 56,919.64 X 35,574.78 Xarrow_forwardAn equipment's with 5 years useful life is with initial cost of $1,000,000. After 5 years, the equipment's useful life will be The equipment's value will be depreciated linealy. Tax rate = 20% . What is the after tax residual value of this equipment at the end of 4th year if the equipment was sold at 2,000. $ 18200 $ 25700 $20300 $41600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education