FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

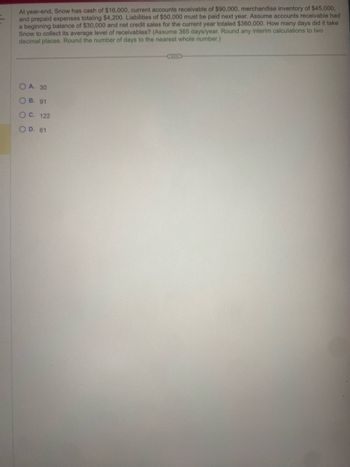

Transcribed Image Text:At year-end, Snow has cash of $16,000, current accounts receivable of $90,000, merchandise inventory of $45,000,

and prepaid expenses totaling $4,200. Liabilities of $50,000 must be paid next year. Assume accounts receivable had

a beginning balance of $30,000 and net credit sales for the current year totaled $360,000. How many days did it take

Snow to collect its average level of receivables? (Assume 365 days/year. Round any interim calculations to two

decimal places. Round the number of days to the nearest whole number.)

OA. 30

OB. 91

O C. 122

OD. 61

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shannon made periodic deposits into a savings account at the end of every month for 2 years. The investments were earning 5.70% compounded quarterly and grew to $13,625.00 at the end of 2 years. a. Calculate the size of the month-end deposits. b. How long will it take for the $13,625.00 to accumulate to $39,360.00 if the interest rate remained the same and he continued making the same month-end deposits throughout the term? Please answer both subparts. I will really upvotearrow_forwardAn individual earns $75,000 annually. Monthly rent is $2,200, and 20% of monthly cash income is spent on utilities, groceries, and transportation. To pay off a credit card in six months, the client agrees to monthly payments of $1,650.What is the monthly debt-to-income ratio?arrow_forwardCarla borrowed $1010.00 from the Central Bank at 8.8% per annum calculated on the monthly unpaid balance. She agreed to repay the loan in blended payments of $220.00 per month. Construct a complete repayment schedule for the loan including totals for Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Payment Number Balance Before Payment Amount Paid Interest Paid Principal Repaid Balance After Payment S1010.00 1 $1010.00 $220.00arrow_forward

- You deposited $150 the first year in an account that earns 12% annual interest. You also deposited $300 and $350 the second and fourth year respectively in that account with the same interest rate. All the deposits happened at the beginning of the years. How much money do get in that account at the end of the fourth year? Check your answer with interest table.arrow_forwardWhat's the answer?arrow_forwardDuring the year, the following sales transactions occur. There is a charge of 3% on all credit card transactions and a 1% charge on all debit card transactions. Total cash sales = $380,000 Total check sales = $230,000 Total credit card sales = $480,000 Total debit card sales = $210,000 calculate the amount recorded as cash receipts from these transactionsarrow_forward

- Jumbotron Inc. collects its receivables in 15 days and pays its payables in 20 days. All sales and purchases are on credit. All months have 30 days. December purchases were $7,000, January purchases were $8,700, February purchase were $6,600 and March purchases were $6,000. What were Jumbotron's total cash disbursements in February? (To the nearest $) ● ● $7,667 $8,000 $1,867 $6,533 $5,600arrow_forwardAccounts receivable in the amount of $658,000 were assigned to the Fast Finance Company by Sunland, Inc., as security for a loan of $564,000. The finance company assessed a 4% finance charge on the face amount of the loan, and the note bears interest at 8% per year.During the first month, Sunland collected $366,600 on assigned accounts. This amount was remitted to the finance company along with one month's interest on the note.Make all the entries for Sunland Inc. associated with the transfer of the accounts receivable, the loan, and the remittance to the finance company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Account Titles and Explanation Debit Credit (To record the transfer of the accounts receivable.) (To record the loan amount…arrow_forwardOn January 1, the Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $40,000 and $1,500 respectively. During the year, the company reported $80,000 of credit sales. There were $500 of receivables written off as uncollected during the year. Cash collections of receivables amounted to $78,200. The company estimates that it will be unable to collect 4% of the year-end accounts receivable balance. The net realizable value of receivables appearing on the balance sheet will amount toarrow_forward

- Jayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 2. Prepare the journal entries to record all the transactions during 2023 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…arrow_forwardIf Service World has $1,950 cash, $400 of government Treasury bills purchased last month with a six-week maturity, and $940 of cash set aside for legal reasons, how much will the company report on the balance sheet as “Cash and Cash Equivalents”?arrow_forwardSparks Corporation has a cash balance of $24,100 on April 1. The company must maintain a minimum cash balance of $6,500. During April, expected cash receipts are $49,000. Cash disbursements during the month are expected to total $68,500. Ignoring interest payments, during April the company will need to borrow:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education