FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

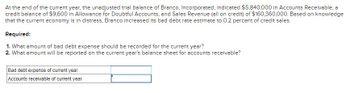

Transcribed Image Text:At the end of the current year, the unadjusted trial balance of Branco, Incorporated, indicated $5,840,000 in Accounts Receivable, a

credit balance of $9,600 in Allowance for Doubtful Accounts, and Sales Revenue (all on credit) of $160,360,000. Based on knowledge

that the current economy is in distress, Branco increased its bad debt rate estimate to 0.2 percent of credit sales.

Required:

1. What amount of bad debt expense should be recorded for the current year?

2. What amount will be reported on the current year's balance sheet for accounts receivable?

Bad debt expense of current year

Accounts receivable of current year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Required information [The following information applies to the questions displayed below.) At year-end December 31, Chan Company estimates its bad debts as 0.70% of its annual credit sales of $729,000. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $365 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries to record the transactions of December 31, February 1, and June 5.arrow_forwardPlease help mearrow_forwardWrangler Incorporated uses the percentage of credit sales method to estimate Bad Debt Expense. At the end of the year, the company's unadjusted trial balance inclúdes the following Accounts Receivable $ 353,000 Allowance for Doubtful Accounts (credit balance) 600 Net Credit Sales 904,000 Wrangler has experienced bad debt losses of 0.3% of credit sales in prior periods. What is the Bad Debt Expense to be recorded for the year? Multiple Choice $2.112 $3.912 $2.712 $3.312arrow_forward

- Indiana Jones Adventure Tours has the following year-end data; $775,000 in credit sales, $250,000 in accounts receivable, and a $10,000 debit balance in its allowance for doubtful accounts account. It estimates 6% of its accounts receivable will be uncollectible. During the year, the company writes off a $3,000 uncollectible account. What is the company’s bad debt expense for the year? Group of answer choices $15,000 $28,000 $18,000 $25,000arrow_forwardAlpesharrow_forwardAt the end of its annual accounting period, Midi Company estimated its bad debts as 0.74% of its $1,760,000 of credit sales made during the year. On December 31, Midi made an addition to its Allowance for Doubtful Accounts equal to that amount. On the following February 1, management decided that the $2,600 account of Catherine Hicks was uncollectible and wrote it off as a bad debt. Four months later, on June 5, Hicks unexpectedly paid the amount previously written off. Give the journal entries required to record these transactions. View transaction list es Journal entry worksheet 1 2 3 4 Record the entry for estimated bad debts. Note: Enter debits before credits. Date Dec 31 General Journal Debit Creditarrow_forward

- Required information [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $ 280,000 $ 700,000 In addition, its unadjusted trial balance includes the following items. $ 210,000 debit $ 2,500 debit Accounts receivable Allowance for doubtful accounts 2. Bad debts are estimated to be 2% of credit sales. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet. Current assets: $ 0arrow_forwardLibre, Incorporated has experienced bad debt losses of 5% of credit sales in prior periods. At the end of the year, the balance of Accounts Receivable is $117,000 and the Allowance for Doubtful Accounts has an unadjusted credit balance of $1,350. Net credit sales during the year were $184,000. Using the percentage of credit sales method, what is the estimated Bad Debt Expense for the year? Multiple Choice $9,200 $8.700 $5,850 $9,700 O Oarrow_forward4. Tooele Company's controller estimated bad debt expense using the percentage of accounts receivable method. Total sales for the year were $500,000 of which 250,000 are on account. The ending balance in accounts receivable was $100,000. An examination of the outstanding accounts at the end of the year indicates that approximately 12 percent of these accounts will ultimately prove to be uncollectible. Before any adjusting entries, the balance in the Allowance for Doubtful Accounts is $700 (CREDIT). Which is part of the correct adjusting entry to record bad debt expense for the year? (The Allowance for Doubtful Accounts is also known as the Allowance for Bad Debts or the Allowance for Uncollectible Accounts.) a. CREDIT Allowance for Bad Debts for $11,300 b. DEBIT Allowance for Bad Debts for $11,300 c. CREDIT Allowance for Bad Debts for $12,000 d. CREDIT Allowance for Bad Debts for $12,700 e. DEBIT Allowance for Bad Debts for $14,700arrow_forward

- Assume Simple Company had credit sales of $243,000 and cost of goods sold of $143,000 for the period. Simple uses the percentage of credit sales method and estimates that 2 percent of credit sales would result in uncollectible accounts. Before the end-of-period adjustment is made, the Allowance for Doubtful Accounts has a credit balance of $180. Required: What amount of Bad Debt Expense would the company record as an end-of-period adjustment?arrow_forwardNonearrow_forwardThe beginning Accounts Receivable and Allowance for Doubtful Accounts balances of Justin Corporation are 500,000 and 50,000. Net credit sales totaled 4,500,000 during the year while collections amounted to 4,400,000. Bad debt expense for the year is 30,000. Included in the collections was a 10,000 account that was written off in the prior year and was recovered during the current year. What is the net realizable value of the Accounts Receivable as of the end of the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education