FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please step by step solution.

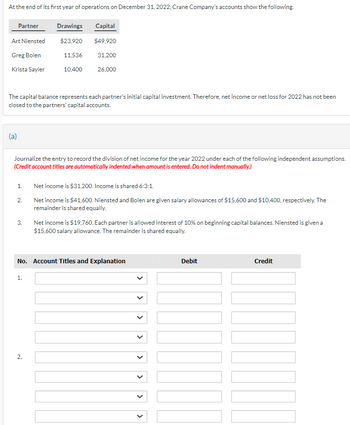

Transcribed Image Text:At the end of its first year of operations on December 31, 2022, Crane Company's accounts show the following.

Partner

Drawings

Capital

Art Niensted

$23,920

$49,920

Greg Bolen

11,536

31,200

Krista Sayler

10,400

26,000

The capital balance represents each partner's initial capital investment. Therefore, net income or net loss for 2022 has not been

closed to the partners' capital accounts.

(a)

Journalize the entry to record the division of net income for the year 2022 under each of the following independent assumptions.

(Credit account titles are automatically indented when amount is entered. Do not indent manually.)

2.

Net income is $41,600. Niensted and Bolen are given salary allowances of $15,600 and $10,400, respectively. The

remainder is shared equally.

1.

Net income is $31,200. Income is shared 6:3:1.

3.

Net income is $19,760. Each partner is allowed interest of 10% on beginning capital balances. Niensted is given a

$15,600 salary allowance. The remainder is shared equally.

No. Account Titles and Explanation

1.

2.

>

>

>

>

>

>

Debit

Credit

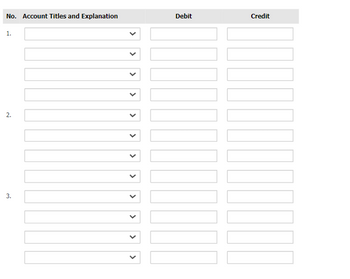

Transcribed Image Text:No. Account Titles and Explanation

1.

2.

3.

>

Debit

Credit

>

>

>

>

> > >

>

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Where did you find the formlulas for this solution?arrow_forwardKrumple Inc. produces aluminum cans. Production of 12-ounce cans has a standard unit quantity of 4.6 ounces of aluminum per can. During the month of April, 300,000 cans were produced using 1,000,000 ounces of aluminum. The actual cost of aluminum was $0.18 per ounce and the standard price was $0.08 per ounce. There are no beginning or ending inventories of aluminum. Required: Calculate the total variance for aluminum for the month of April. Enter amount as a positive number and select Favorable or Unfavorable.$fill in the blank 1arrow_forwardExplain LIFO method and list three advantages of LIFO method?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education