Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

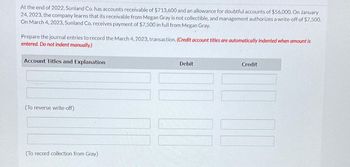

Transcribed Image Text:At the end of 2022, Sunland Co. has accounts receivable of $713,600 and an allowance for doubtful accounts of $56,000. On January

24, 2023, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $7,500.

On March 4, 2023, Sunland Co. receives payment of $7,500 in full from Megan Gray.

Prepare the journal entries to record the March 4, 2023, transaction. (Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

Account Titles and Explanation

(To reverse write-off)

(To record collection from Gray)

Debit

Credit

NO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardA customer was unable to pay the accounts receivable on time in the amount of $34,000. The customer was able to negotiate with the company and transferred the accounts receivable into a note that includes interest, along with an up-front cash payment of $6,000. The note maturity date is 24 months with a 15% annual interest rate. What is the entry to recognize this transfer?arrow_forward

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardAt the end of 2022, Carpenter Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $54,000. On January 24, 2023, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $6,200. On March 4, 2023, Carpenter Co. receives payment of $6,200 in full from Megan Gray. Prepare the journal entries to record the March 4, 2023, transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation (To reverse write-off) (To record collection from Gray) Debit Credit 10arrow_forwardAt the end of 2022, Cullumber Co. has accounts receivable of $717,900 and an allowance for doubtful accounts of $63,900. On January 24, 2023, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $6,900. (a) Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation e Textbook and Media Debit Creditarrow_forward

- At the end of 2022, Sheridan Co. has accounts receivable of $807,800 and an allowance for doubtful accounts of $58,300. On January 24, 2023, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $6,000. (a) Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardAt the end of 2022, Cullumber Co. has accounts receivable of $717,900 and an allowance for doubtful accounts of $63,900. On January 24, 2023, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $6,900. (a) Your Answer Correct Answer Your answer is correct. Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Account Titles and Explanation Allowance for Doubtful Accounts Accounts Receivable eTextbook and Media eTextbook List of Accounts Cash realizable value Debit Before Write-Off 6900 What is the cash realizable value of the accounts receivable before the write-off and after the write-off? Credit After Write-Off 6900 Assistance Used Attempts: 1 of 1 usedarrow_forwardHelparrow_forward

- At the end of 2020, Crane Co. has accounts receivable of $740,200 and an allowance for doubtful accounts of $69,900. On January 24, 2021, the company learns that its receivable from Megan Gray is not collectible, and management authorizes a write-off of $6,.400. Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit List of Accounts What is the cash realizable value of the accounts receivable before the write-off and after the write-off? Before Write-Off After Write-Off Cash realizable value List of Accountsarrow_forwardAt the end of 2021, Skysong Co. has accounts receivable of $665,400 and an allowance for doubtful accounts of $23,480. On January 24, 2022, it is learned that the company's receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,415. (a) Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not in manually.) Account Titles and Explanation Debit Credit (b) What is the cash realizable value of the accounts receivable before the write-off and after the write-off? Before Write-Off After Write-Off Cash realizable value $ $arrow_forwardAt the end of 2024, Concord Co. has accounts receivable of $704,700 and an allowance for doubtful accounts of $26,850. On January 24, 2025, it is learned that the company's receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,384. On March 4, 2025, Concord Co. receives payment of $4,384 in full from Madonna Inc. Prepare the journal entries to record the March 4 transaction. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To reverse write-off of accounts receivable.) (To record collection of accounts receivable.) eTextbook and Mediaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT