FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:**Journal Entry Worksheet Instructions**

**Required**

Record these transactions in a general journal. *(If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)*

**Buttons:**

- **View transaction list**: Click to view the list of transactions.

**Journal Entry Worksheet**

- **Transaction Description**: "Provided $69,200 of services on account."

**Notes**:

- Enter debits before credits.

**Entry Table:**

| Event | General Journal | Debit | Credit |

|-------|-----------------|-------|--------|

| 1 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

**Buttons:**

- **Record entry**: Click to save the journal entry.

- **Clear entry**: Click to clear the current journal entry fields.

- **View general journal**: Click to view the compiled journal entries.

This worksheet helps in organizing and recording financial transactions accurately in a general journal, which is a foundational step in accounting processes.

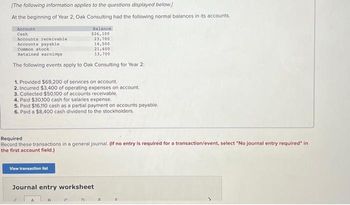

Transcribed Image Text:**Financial Transactions and Journal Entries for Oak Consulting**

*Initial Account Balances (Beginning of Year 2)*

- **Cash**: $26,100

- **Accounts Receivable**: $42,700

- **Accounts Payable**: $14,500

- **Common Stock**: $21,600

- **Retained Earnings**: $13,700

*Events for Year 2*

1. Provided $69,200 of services on account.

2. Incurred $3,400 of operating expenses on account.

3. Collected $50,100 of accounts receivable.

4. Paid $30,100 cash for salaries expense.

5. Paid $16,100 cash as a partial payment on accounts payable.

6. Paid an $8,400 cash dividend to the stockholders.

**Required Action**

Record these transactions in a general journal. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

**Interactive Components**

- **View Transaction List**: An option to view all transactions.

- **Journal Entry Worksheet**: A tool to input and review journal entries.

This information provides the basis for practicing financial accounting by recording transactions that affect a company's financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 20X1, the company reported a debit balance of $200,000 in accounts receivable and a credit balance of $5,000 in the allowance for expected credit losses. December 31 is the company’s reporting date. During 20X2, the company had the following transactions: a. The company made a credit sale of $300,000. b. The company collected accounts receivable for 350,000. c. The company wrote off the uncollectible accounts for $12,000. d. The company collected the receivable of $4,000 that had been written off previously. Required Note: Show calculation: (1) Prepare journal entries to record the above four transactions. (2) Assume that 2% of the company’s accounts receivable cannot be collected, prepare the adjusting journal entry at the end of 20X2.arrow_forwardThe following account balances come from the records of Ourso Company: Beginning Balance $2,800 Ending Balance $3,600 350 Accounts receivable Allowance for doubtful accounts 280 During the accounting period, Ourso recorded $14,000 of sales revenue on account. The company also wrote off a $150 account receivable. Required a. Determine the amount of cash collected from receivables. b. Determine the amount of uncollectible accounts expense recognized during the period. a Collections of accounts receivable b. Uncollectible accounts expensearrow_forwardOn January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forward

- The companys balance sheet showed an accounts receivble balance of $80,000 at the begininng of the year and $47,000 at the end of the year. The company reported $720,000 in credit sales for the year. What was the amount of cash collected on account receivables durig the yeararrow_forwardThe following information is available for Monty's Best Corporation about the age of its receivables at December 31, its year end: Number of days outstanding Accounts Receivable Estimated percentage uncollectible (a) 0-30 $410,000 3% Total Estimated Uncollectible Accounts $ tA 31-60 $250,000 5% 61-90 $210,000 10% Over 90 $90,000 Using the above aging schedule, determine the total estimated uncollectible accounts. 15%arrow_forwardThe balance in Accounts Receivable was $650,000 at the beginning of the year and $770,000 at the end of the year. Credit sales for the year totaled $4,120,000. During the year, $450,000 in customer accounts were written off. How much cash was collected from customers during the period? A) $3,550,000 B) $4,000,000 C) $4,450,000 D) $4,690,000 10arrow_forward

- A company had beginning accounts receivable of $175,000. All sales were on account and totaled $550,000. Cash collected from customers totaled $650,000. Calculate the ending accounts receivable balance.arrow_forwardVulcan Service Company experienced the following transactions for Year 1, its first year of operations: 1. Provided $80,000 of services on account. 2. Collected $48,000 cash from accounts receivable. 3. Paid $32,000 of salaries expense for the year. 4. Adjusted the accounts using the following information from an accounts receivable aging schedule: Number of Days Past Due Current 0 to 30 31 to 60 61 to 90 Over 90 days Amount $23,680 1,600 2,240 1,920 2,560 Percent Likely to Be Uncollectible 0.01 0.05 0.10 0.30 0.50 Allowance Balance Required a. Record the given transactions in general journal form and post to T-accounts. b. Prepare the income statement for Vulcan Service Company for Year 1. c. What is the net realizable value of the accounts receivable at December 31, Year 1?arrow_forwardOn January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education