FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

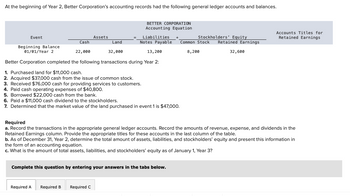

Transcribed Image Text:At the beginning of Year 2, Better Corporation's accounting records had the following general ledger accounts and balances.

Event

Beginning Balance

01/01/Year 2

Cash

22,000

Assets

Required A Required B

Land

BETTER CORPORATION

Accounting Equation

Liabilities

32,000

13, 200

Better Corporation completed the following transactions during Year 2:

1. Purchased land for $11,000 cash.

2. Acquired $37,000 cash from the issue of common stock.

3. Received $76,000 cash for providing services to customers.

4. Paid cash operating expenses of $40,800.

5. Borrowed $22,000 cash from the bank.

6. Paid a $11,000 cash dividend to the stockholders.

7. Determined that the market value of the land purchased in event 1 is $47,000.

Required C

Notes Payable

Complete this question by entering your answers in the tabs below.

Stockholders Equity

Common Stock

8,200

Retained Earnings

Required

a. Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the

Retained Earnings column. Provide the appropriate titles for these accounts in the last column of the table.

32,600

b. As of December 31, Year 2, determine the total amount of assets, liabilities, and stockholders' equity and present this information in

the form of an accounting equation.

c. What is the amount of total assets, liabilities, and stockholders' equity as of January 1, Year 3?

Accounts Titles for

Retained Earnings

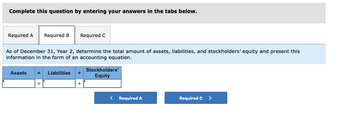

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

As of December 31, Year 2, determine the total amount of assets, liabilities, and stockholders' equity and present this

information in the form of an accounting equation.

Assets

II

Required C

Liabilities

Stockholders'

Equity

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lexington Company engaged in the following transactions during Year 1, its first year of operations. (Assume all transactions are cash transactions.) 1) Acquired $4,600 cash from issuing common stock. 2) Borrowed $3,000 from a bank. 3) Earned $3,900 of revenues. 4) Incurred $2,560 in expenses. 5) Paid dividends of $560. Lexington Company engaged in the following transactions during Year 2: 1) Acquired an additional $1,300 cash from the issue of common stock. 2) Repaid $1,860 of its debt to the bank. 3) Earned revenues, $5,300. 4) Incurred expenses of $3,070. 5) Paid dividends of $1,600. Total liabilities on Lexington's balance sheet at the end of Year 1 equal:arrow_forwardDo my A, B & C answers Look Correct? Could you Help me with C, D & E?arrow_forwardRequired information [The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $31,000 cash from the issue of common stock. 2. Borrowed $43,000 cash from National Bank. 3. Earned cash revenues of $59,000 for performing services. 4. Paid cash expenses of $50,500. 5. Paid a $2,100 cash dividend to the stockholders. 6. Acquired an additional $31,000 cash from the issue of common stock. 7. Paid $11,000 cash to reduce the principal balance of the bank note. 8. Paid $50,000 cash to purchase land. 9. Determined that the market value of the land is $70,000. . Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Net cash flows from operating activities Net cash flows from investing activities…arrow_forward

- Could you please help Me with this question?arrow_forwardRequired information [The following information applies to the questions displayed below.] Leach Incorporated experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $70,000 of services on account. 3. Provided $33,000 of services and received cash. 4. Collected $37,000 cash from accounts receivable. 5. Paid $16,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent. of the ending accounts receivable balance will be uncollectible. Year 2: 1. Wrote off an uncollectible account for $2,590. 2. Provided $90,000 of services on account. 3. Provided $25,000 of services and collected cash. 4. Collected $72,000 cash from accounts receivable. 5. Paid $22,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 6 percent of the…arrow_forward[The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $35,000 cash from the issue of common stock. 2. Borrowed $35,000 cash from National Bank. 3. Earned cash revenues of $53,000 for performing services. 4. Paid cash expenses of $47,500. 5. Paid a $1,500 cash dividend to the stockholders. 6. Acquired an additional $25,000 cash from the issue of common stock. 7. Paid $9,000 cash to reduce the principal balance of the bank note. 8. Paid $58,000 cash to purchase land. 9. Determined that the market value of the land is $81,000. c. Identify the asset source transactions and related amounts for Year 1. Sources of Assets Event Total sources of assets Amountarrow_forward

- Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $68,0002) borrowed $39,000 from its bank3) provided consulting services for $67,000 cash4) paid back $29,000 of the bank loan5) paid rent expense for $16,0006) purchased equipment for $26,000 cash7) paid $4,400 dividends to stockholders8) paid employees' salaries of $35,000 What is Yowell's net income for Year 1?arrow_forwardThe following transactions apply to Pecan Co. for Year 1, its first year of operations: 1. Received $33,000 cash in exchange for issuance of common stock. 2. Secured a $101,000 ten-year installment loan from State Bank. The interest rate is 6 percent and annual payments are $13,723. 3. Purchased land for $27,000. 4. Provided services for $95,000. 5. Paid other operating expenses of $49.000. 6. Paid the annual payment on the loan. Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement and balance sheet for Year 1. c. What is the interest expense for Year 2? Year 3? Complete this question by entering your answers in the tabs below. Req A Req B Inc Stmt Req B Bal Sheet Req C Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. If there is no effect on the Account Titles for Retained Earnings, leave the cell blank. Not all cells will require entry.)arrow_forwardPackard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $1.400 cash from the issue of common stock. 2) Borrowed $870 from a bank. 3) Earned $1,100 of revenues. 4) Paid expenses of $340 5) Paid a $140 dividend During Year 2. Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $775 of common stock. 2) Repaid $535 of its debt to the bank. 3) Earned revenues of $1,200. 4) Incurred expenses of $540. (5) Paid dividends of $190. The amount of total liabilities on Packard's Year 1 balance sheet is Multiple Choice с $870 $1,210 $610 $335 Drow 50 Nextarrow_forward

- Line following information applies to the questions displayed below.j The following transactions apply to Park Company for Year 1: 1. Received $31,000 cash from the issue of common stock. 2. Purchased inventory on account for $143,000. 3. Sold inventory for $172,500 cash that had cost $105,500. Sales tax was collected at the rate of 8 percent on the inventory sold. 4. Borrowed $24,000 from First State Bank on March 1, Year 1. The note had a 8 percent interest rate and a one-year term to maturity. 5. Paid the accounts payable (see transaction 2). 6. Paid the sales tax due on $153,500 of sales. Sales tax on the other $19,000 is not due until after the end of the year. 7. Salaries for the year for one employee amounted to $28,000. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income tax withheld was $5,300. 8. Paid $2,600 for warranty repairs during the year. 9. Paid $12,000 of other operating expenses during the year. 10. Paid a…arrow_forwardYowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $52,000 2) borrowed $37,000 from its bank 3) provided consulting services for $50,000 4) paid back $21,000 of the bank loan 5) paid rent expense for $12,000 6) purchased equipment costing $18,000 7) paid $3,600 dividends to stockholders 8) paid employees' salaries for work completed during the year, $27,000 What is Yowell's net income? Multiple Choice $8,400 $38,000 $24,600 $11,000arrow_forwardThe balance sheet for Gallinas Industries is as follows, Gallinas Industries Balance Sheet December 31 Assets Liabilities and Stockholders' Equity Cash $35,000 Accounts payable $101,920 Marketable securities 101,920 Notes payable 62,720 Accounts receivable 109,760 Accrued wages 62,720 Inventories 148,960 Total current liabilities $227,360 Total current assets $395,640 Long-term debt $203,840 Land and buildings (net) $145,635 Preferred stock $94,080 Machinery and equipment 242,725 Common stock (10,000 shares) 141,120 Total fixed assets (net) $388,360 Retained earnings 117,600 Total assets $784,000 Total liabilities and stockholders' equity $784,000 Additional information with respect to the firm is available: 1. Preferred stock can be liquidated at book value. 2. Accounts receivable and inventories can be liquidated at 85%of book value. 3. The firm…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education