SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

am. 02.

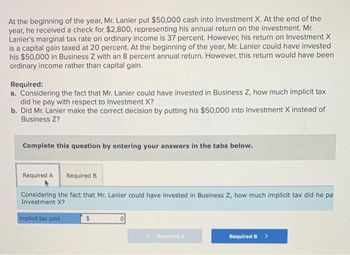

Transcribed Image Text:At the beginning of the year, Mr. Lanier put $50,000 cash into Investment X. At the end of the

year, he received a check for $2,800, representing his annual return on the investment. Mr.

Lanier's marginal tax rate on ordinary income is 37 percent. However, his return on Investment X

is a capital gain taxed at 20 percent. At the beginning of the year, Mr. Lanier could have invested

his $50,000 in Business Z with an 8 percent annual return. However, this return would have been

ordinary income rather than capital gain.

Required:

a. Considering the fact that Mr. Lanier could have invested in Business Z, how much implicit tax

did he pay with respect to Investment X?

b. Did Mr. Lanier make the correct decision by putting his $50,000 into Investment X instead of

Business Z?

Complete this question by entering your answers in the tabs below.

Required A Required B

Considering the fact that Mr. Lanier could have invested in Business Z, how much implicit tax did he pa

Investment X?

Implicit tax paid

$

0

< Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the year, Mr. Lanier put $50,000 cash into Investment X. At the end of the year, he received a check for $2,800, representing his annual return on the investment. Mr. Lanier’s marginal tax rate on ordinary income is 37 percent. However, his return on Investment X is a capital gain taxed at 20 percent. At the beginning of the year, Mr. Lanier could have invested his $50,000 in Business Z with an 8 percent annual return. However, this return would have been ordinary income rather than capital gain. Required: Considering the fact that Mr. Lanier could have invested in Business Z, how much implicit tax did he pay with respect to Investment X? Did Mr. Lanier make the correct decision by putting his $50,000 into Investment X instead of Business Z?arrow_forward"At the beginning of the year, Mr. Lanier put $50,000 cash into Investment X. At the end of the year, he received a check for $2,800, representing his annual return on the investment. Mr. Lanier’s marginal tax rate on ordinary income is 37 percent. However, his return on Investment X is a capital gain taxed at 20 percent. Compute the value of the preferential rate to Mr. Lanier. "arrow_forwardDon't use Aiarrow_forward

- Samuel Jenkins made two investments; the first was 13 months ago and the second was two months ago. He just sold both investments and has a capital gain of $10,000 on each. If Samuel is single and has taxable income of $40,000, what will be the amount of capital gains tax on each investment? See Capital Gains table and Taxable income rate table. Investment 1: held 13 months: whats the capital gains tax? Investment 2: held 2 months: Whats the capital gains tax?arrow_forwardThoren has the following items for the year: $4,000 of short-term capital gain, $5,000 of 0%/15%/20% long-term capital gain, and $1,500 of 28% capital loss. Which of the following is correct? a.The $1,500 loss will first be offset by the $5,000 long-term gain. b.The taxpayer will have a net short-term capital loss. c.The $1,500 loss will first be offset by the $4,000 short-term gain. d.The $4,000 short-term gain will first be offset by the $5,000 long-term gain.arrow_forwardSamuel Jenkins made two invstments, the first was 13 months ago and the second was two months ago. He just sold both investments and has a capital gain of $3,000 on each. If Samuel is in the 28 percent tax bracket, what will be the amount of capital gains tax on each investment?arrow_forward

- Taxpayer Y, who has a 30 percent marginal tax rate, invested $65,000 in a bond that pays 8 percent annual interest. Compute Y’s annual net cash flow from this investment assuming that a. The interest is tax-exempt income.b. The interest is taxable income.arrow_forwardHank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December, he performed $27,000 of legal services for a client. Hank typically requires his clients to pay his bills immediately upon receipt. Assume his marginal tax rate is 32 percent this year and will be 35 percent next year, and that he can earn an after-tax rate of return of 12 percent on his investments. Use Exhibit 3.1. What is the after-tax income if Hank sends his client the bill in January? What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January?arrow_forwardDeon made $30.000 in taxable income last year. Suppose the income tax rate is 15% for the first $8500 plus 17% for the amount over $8500. How much must Deon pay in income tax for last year?arrow_forward

- Kim's net worth at the beginning of the year is $250,000. Across the year she earns $60,000 before tax and pays tax of $15,000, spends $30,000, and makes a capital loss on her assets of $10,000. By the end of the year, her net worth isarrow_forwardColby's gross income was $93,000last year. If he had $1646.92withheld for federal income taxfrom each of his monthly paychecks,what percentage of his gross incomearrow_forwardIsabel, a calendar year tax payer, uses the cash method of accounting for her soul proprietor ship. In late December she received a $60,000 bill from her accountant for consulting services related to her small business. Isabel can pay the $60,000 bill anytime before January 30 of next year without penalty. Assume her marginal tax rate is 37 percent this year and next year, and that she can earn an after-tax rate of return of 8 percent on her investments. What is the after-tax cost if Isabel pays the $60,000 bill in January?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT