FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

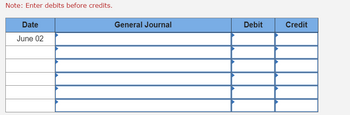

Transcribed Image Text:Note: Enter debits before credits.

Date

June 02

General Journal

Debit

Credit

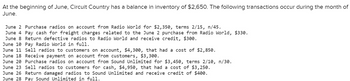

Transcribed Image Text:At the beginning of June, Circuit Country has a balance in inventory of $2,650. The following transactions occur during the month of

June.

June 2 Purchase radios on account from Radio World for $2,350, terms 2/15, n/45.

June 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $330.

June 8 Return defective radios to Radio World and receive credit, $300.

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,300, that had a cost of $2,850.

June 18 Receive payment on account from customers, $3,300.

June 20 Purchase radios on account from Sound Unlimited for $3,450, terms 2/10, n/30.

June 23 Sell radios to customers for cash, $4,950, that had a cost of $3,250.

June 26 Return damaged radios to Sound Unlimited and receive credit of $400.

June 28 Pay Sound Unlimited in full.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them with lamp fixtures. There is an agreement that Lamplight Plus is not required to provide cash payment immediately and instead will provide payment within thirty days of the invoice date. Cash Accounts Payable Purchases Accounts Receivable Merchandise Inventory Sales Provide the journal entries for the following transactions assuming a perpetual inventory system using the account names above Lamplight purchases thirty light fixtures for $20 each on August 1, invoice date August 1, with no discount terms Lamplight returns ten light fixtures, receiving a credit amount for the full purchase price on August 3: Lamplight purchases an additional fifteen light fixtures for $15 each on August 19, invoice date August 19, with no discount terms: Lamplight pays $100 toward its account on August 22. What amount does Lamplight Plus still owe to the supplier on August 30?arrow_forwardAt the beginning of November, Yoshi Inc.’s inventory consists of 67 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 75 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $150. November 9 Return 25 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,300. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $3 per unit for freight less $1 per unit for the purchase discount, or $102 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 53 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 65 units of inventory to…arrow_forwardAt the beginning of November, Yoshi Inc.’s inventory consists of 64 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 80 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $320. November 9 Return 16 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,600. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $5 per unit for freight less $1 per unit for the purchase discount, or $104 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 56 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 70 units of inventory to…arrow_forward

- Pets Unlimited sells pet supplies to retailers. The company uses a perpetual inventory. Journalize the following transactions for the company: June 1 Sold merchandise for $6,250 with terms 2/10, n/30. Inventory cost was $5,000. 5 Sold merchandise for $10,000 with terms 3/10, n/30. Inventory cost was $6,000. 11 Received a check from the customer paying the balance due within the discount period.arrow_forwardSwifty Distribution markets CDs of numerous performing artists. At the beginning of March, Swifty had in beginning inventory 3,900 CDs with a unit cost of $7. During March, Swifty made the following purchases of CDs. March 5 March 13 4,875 (a) 6,825 $8 $9 March 21 X Your answer is incorrect. March 26 During March 21,000 units were sold. Swifty uses a periodic inventory system. Determine the cost of goods available for sale. 7,850 @ $10 $11 Cost of goods available for sale $ 5,800 181725arrow_forward1arrow_forward

- Accountingarrow_forwardRecord journal entries for the following purchase transactions of Apex Industries. Nov. 6 Purchased 24 computers on credit for $560 per computer. Terms of the purchase are 4/10, n/60, invoice dated November 6. Nov. 10 Returned 5 defective computers for a full refund from the manufacturer. Nov. 22 Paid account in full from the November 6 purchase.arrow_forwardSandhill Wholesalers uses a perpetual inventory system.March. 1. Stellar Stores purchases $8,900 of merchandise for resale from Sandhill Wholesalers, terms 2/10, n/30, FOB shipping point.2. The correct company pays $150 for the shipping charges.3. Stellar returns $1,000 of the merchandise purchased on March 1 because it was the wrong colour. Sandhill gives Stellar a $1,000 credit on its account.21.Stellar Stores purchases an additional $12,500 of merchandise for resale from Sandhill Wholesalers, terms 2/10, n/30, FOB destination.22.The correct company pays $195 for freight charges.23.Stellar returns $450 of the merchandise purchased on March 21 because it was damaged. Sandhill gives Stellar a $450 credit on its account.30.Stellar paid Sandhill the amount owing for the merchandise purchased on March 1.31.Stellar paid Sandhill the amount owing for the merchandise purchased on March 21. Additional information: March.1. Sandhill's cost of the merchandise sold to Stellar was $4,100.3.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education