Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

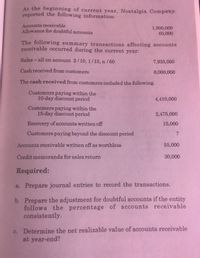

Transcribed Image Text:reported the following information:

At the beginning of current year, Nostalgia Company

Accounts receivable

Allowance for doubtful accounts

1,500,000

60,000

The following summary transactions affecting accounts

receivable occurred during the current year:

Sales- all on account 2/10, 1/15, n /60

7,935,000

Cash received from customers

8,000,000

The cash received from customers included the following.

Customers paying within the

10-day discount period

4,410,000

Customers paying within the

15-day discount period

2,475,000

Recovery of accounts written off

15,000

Customers paying beyond the discount period

Accounts receivable written off as worthless

55,000

Credit memoranda for sales return

30,000

Required:

a. Prepare journal entries to record the transactions.

b. Prepare the adjustment for doubtful accounts if the entity

follows the percentage of accounts receivable

consistently.

c. Determine the net realizable value of accounts receivable

at year-end?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Last year, Nikkola Company had net sales of 2.299.500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardJinx Company provided the following information for the current year in relation to accounts receivable: Accounts receivable, January 1 1,300,000Credit sales 5,500,000Sales return 150,000Accounts written off 100,000Collections from customers 5,000,000Estimated future sales return on December 31 50,000Estimated uncollectible accounts per aging at year-end 250,000 What amount should be reported as net realizable value of accounts receivable on December 31?arrow_forwardThe following data are taken from the financial statements of Colby Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 Accounts Receivable turnover Average collection period (b) B I U T₂ T² Ix 2022 $550,000 4,300,000 2022 7.9 times lil 2021 What conclusions about the management of accounts receivable can be drawn from the accounts receivable turnover and the average collections period. € $540,000 4,000,000 2021 46.2 days 48.7 days 7.5 times W 144 144 들 3 99 = á T ¶₁arrow_forward

- 10) DEF Company has the following data relating to accounts receivable for the year ended December 31, 2022: Accounts receivable, January 1, 2022 P 480,000 Allowance for doubtful accounts, 1/1/22 28,600 Cash sales 300,000 Sales on account, terms: 2/10, 1/15, n/30 2,560,000 Cash received from customers during the year 2,400,000 Accounts written off during the year 17,600 Cash refunds given to cash customers for sales returns and allowances 15,000 Credit memoranda issued to credit customers for sales returns and allowances 25,000 The P2,400,000 collection is composed of the following: Collection from customers availing the 10-day discount period: Gross selling price P 1,440,000 Discount taken (1,440,000 x 2%) (28,000) P 1,411,200 Collection from customers availing the 15-day discount period: Gross selling price 800,000 Discount taken (800,000 x 1%) ( 8,000) 792,000 Collection from customers paying beyond the discount period: 192,000 Collection of accounts previously written…arrow_forwardStarboy Company has the following data relating to accounts receivable for the year ended December 31, 2022: Accounts receivable, January 1, 2022 P 480,000 Allowance for doubtful accounts, 1/1/22 28,600 Cash sales 300,000Sales on account, terms: 2/10, 1/15, n/30 2,560,000 Cash received from customers during the year 2,400,000 Accounts written off during the year 17,600 Cash refunds given to cash customers for sales returns and allowances 15,000 Credit memoranda issued to credit customers for sales returns and allowances 25,000 The P2,400,000 collection is composed of the following: Collection from customers availing the 10-day discount period: Gross selling price P 1,440,000 Discount taken (1,440,000 x 2%) ( 28,800) P 1,411,200 Collection from customers availing the 15-day discount period: Gross selling price 800,000 Discount taken (800,000 x 1%) ( 8,000) 792,000 Collection from customers paying beyond the discount period: 192,000 Collection of accounts previously written and…arrow_forwardThe following information is related to December 31, 2024 balances. • Accounts receivable . Allowance for doubtful accounts (credit) . Cash realizable value $1430000 (103000) 1327000 During 2025 sales on account were $390000 and collections on account were $217000. The company wrote off $21100 in uncollectible accounts. An analysis of outstanding receivable accounts at year-end indicated that uncollectibles should be estimated at $144000. Bad debt expense for 2025 is: O $62100. O $144000. O $41000. O $19900arrow_forward

- What is the solution to the question I uploadedarrow_forwardVan Company provided the following data for the current year in relation to accounts receivable: Debits January 1 balance after deducting credit balance P30,000 Charge sales Charge for goods out on consignment Shareholders' subscriptions 530,000 5,250,000 50,000 1,000,000 10,000 25,000 Accounts written off but recovered Cash paid to customer for January 1 credit balance Goods shipped to cover January 1 credit balance Deposits on long-term contract Claim against common carrier Advances to supplier 5,000 500,000 400,000 300,000 Credits Collections from customers, including over payment of P50,000 Writeoff 5,200,000 35,000 25,000 15,000 50,000 Merchandise returns Allowances to customers for shipping damages Collection on carrier claim Collection on subscription What total amount of trade and other receivables should be reported under current 200,000 assets?arrow_forwardThe following selected transactions occurred during the year ended December 31, 2026 of RANOA COMPANY: Gross sales (cash and credit) P900,736.80 Collections from credit customers, net of 2% cash discount 294,000.00 Cash sales 180,000.00 Uncollectible accounts written off 19,200.00 Credit memos issued to credit customers for sales ret./allow. 10,080.00 Cash refunds given to cash customers for sales ret./allow. 15,168.00 Recoveries on accounts receivable written-off in prior years (not included in cash received stated above) 6,505.20 At year-end, the company provides for estimated bad debts losses by crediting the Allowance for Bad Debts account for 2% of its net credit sales for the year. The allowance for bad debts at the beginning of the year is P19,327.20. 9. How much is the RANOA COMPANY’s gross sales? 10. RANOA credit sales at December 31, 2026 is: 11. How much is the RANOA COMPANY’s net credit sales? 12. The Bad Debts Expense of RANOA COMPANY at December 31,…arrow_forward

- Star Company provided the following transactions affecting accountsreceivable during the year ended December 31, 2014:Sales (cash and credit) 5,900,000Cash received from credit customers, all of whomtook advantage of the discount feature of theentity’s credit terms 4/10, n/30 3,024,000Cash received from cash customers 2,100,000Accounts receivable written off as worthless 50,000Credit memorandum issued to credit customersfor sales returns and allowances 250,000Cash refunds given to cash customers for salesreturns and allowances 20,000Recoveries on accounts receivable written off asuncollectible in prior periods (not included incash amount stated above) 80,000The following balances were taken from January 1, 2014 statement of financial position:Accounts receivable 950,000Allowance for doubtful accounts 100,000The entity provided for uncollectible accounts losses by crediting allowance for doubtful accountsin the amount of P 70,000 for the current year.23. What is the balance of accounts…arrow_forwardThe following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Υ2 20Υ1 Accounts receivable, end of year $212,000 $226,000 $241,200 Sales on account 1,270,200 1,214,720 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Υ2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has . This can be seen in both the in accounts receivable turnover and the in the collection period.arrow_forwardd. The company collects Y5,000 subsequently on a specific account that had previously been determined to be uncollectible in (c.). Prepare the journal entry(ies) necessary to restore the account and record the cash collection.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning