ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

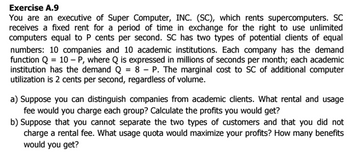

Transcribed Image Text:Exercise A.9

You are an executive of Super Computer, INC. (SC), which rents supercomputers. SC

receives a fixed rent for a period of time in exchange for the right use unlimited

computers equal to P cents per second. SC has two types of potential clients of equal

numbers: 10 companies and 10 academic institutions. Each company has the demand

function Q = 10 - P, where Q is expressed in millions of seconds per month; each academic

institution has the demand Q = 8 - P. The marginal cost to SC of additional computer

utilization is 2 cents per second, regardless of volume.

a) Suppose you can distinguish companies from academic clients. What rental and usage

fee would you charge each group? Calculate the profits you would get?

b) Suppose that you cannot separate the two types of customers and that you did not

charge a rental fee. What usage quota would maximize your profits? How many benefits

would you get?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

at point b) - The formula written down when MC is equated with MR is d(P x Q) / dQ. Then in the next step, dQ is cut down and only P is left. Shouldn't dP be left here?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

at point b) - The formula written down when MC is equated with MR is d(P x Q) / dQ. Then in the next step, dQ is cut down and only P is left. Shouldn't dP be left here?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Joe has just moved to a small town with only one golf course, the Northlands Golf Club. His inverse demand function is p=200-2q, where q is the number of rounds of golf that he plays per year. The manager of the Northlands Club negotiates separately with each person who joins the club and can therefore charge individual prices. This manager has a good idea of what Joe's demand curve is and offers Joe a special deal, where Joe pays an annual membership fee and can play as many rounds as he wants at $20, which is the marginal cost his round imposes on the Club. What membership fee would maximize profit for the Club? The manager could have charged Joe a single price per round. How much extra profit does the Club earn by using two-part pricing? The profit-maximizing membership fee (F) is $. (Enter your response as a whole number.)arrow_forwardYou are an executive for Super Computer, Inc. (SC), which rents out super computers. SC receives a fixed rental payment per time period in exchange for the right to unlimited computing at a rate of P cents per second. SC has two types of potential customers of equal number-10 businesses and 10 academic institutions. Each business customer has the demand function Q = 10 - P, where Q is in millions of seconds per month; each academic institution has the demand Q = 8-P. The marginal cost to SC of additional computing is 2 cents per second, regardless of volume. a. Suppose that you could separate business and academic customers. What rental fee and usage fee would you charge each group? What would be your profits? b. Suppose you were unable to keep the two types of customers separate and charged a zero rental fee. What usage fee would maximize your profits? What would be your profits? c. Suppose you set up one two-part tariff-that is, you set one rental and one usage fee that both business…arrow_forwardJoe has just moved to a small town with only one golf course, the Northlands Golf Club. His inverse demand function is p = 140-2q, where q is the number of rounds of golf that he plays per year. The manager of the Northlands Club negotiates separately with each person who joins the club and can therefore charge individual prices. This manager has a good idea of what Joe's demand curve is and offers Joe a special deal, where Joe pays an annual membership fee and can play as many rounds as he wants at $40, which is the marginal cost his round imposes on the Club. Joe marries Susan, who is also an enthusiastic golfer. Susan wants to join the Northlands Club. The manager believes that Susan's inverse demand curve is p = 120-2q. The manager has a policy of offering each member of a married couple the same two-part prices, so he offers them both a new deal. What two-part pricing deal maximizes the club's profit? Will this new pricing have a higher or lower access fee than in Joe's original…arrow_forward

- Let's say there is demand in a market. The unit cost of production of the good is fixed and is at level 3. If you had a technology that could reduce this cost to 1, how much would you sell the pantent of the technology you have? (Hint: How much does society spend to get the technology you have?)arrow_forwardYour task is to show what the profit of this firm might look like using a key economics diagram. To make graphing easier, we will consider the price of the Ozempic drug for the middle-income country Bangladesh, which is $38 (assumed the profit-maximising price). For this task, you will be required to illustrate and explain to a typical first-year undergrad student who has no economics background the profit the firm makes at $38 per month, and what has happened to profit (producer surplus), markup, consumer surplus and the output if the price was reduced from $38 to $10 per month.arrow_forwardJoe has just moved to a small town with only one golf course, the Northlands Golf Club. His inverse demand function is p=140-2q, where q is the number of rounds of golf that he plays per year. The manager of the Northlands Club negotiates separately with each person who joins the club and can therefore charge individual prices. This manager has a good idea of what Joe's demand curve is and offers Joe a special deal, where Joe pays an annual membership fee and can play as many rounds as he wants at $20, which is the marginal cost his round imposes on the Club. Joe marries Susan, who is also an enthusiastic golfer. Susan wants to join the Northlands Club. The manager believes that Susan's inverse demand curve is p=120-2q. The manager has a policy of offering each member of a married couple the same two-part prices, so he offers them both a new deal. What two-part pricing deal maximizes the club's profit? Will this new pricing have a higher or lower access fee than in Joe's original deal?…arrow_forward

- [Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet the monthly demand for electricity in these districts, which is given by the inverse demand function: P = 1,200 − 4Q, the company has set up two electric generating facilities: Q1 kilowatts are produced at facility 1 and Q2 kilowatts are produced at facility 2; where Q = Q1 + Q2. The costs of producing electricity at each facility are given by C1(Q1) = 8,000 + 6Q1 C2(Q2) = 6,000 + 3Q2 + 5Q22 Calculate the profit maximizing output levels of each factory?arrow_forwardDemand Factor Initial Value Average American household income $40,000 per year Round trip airfare from Los Angeles (LAX) to Las Vegas (LAS) $200 per round trip Room rate at the Lucky Hotel and Casino, which is near the Big Winner $200 per night Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. Graph Input Tool Market for Big Winner's Hotel Rooms 500 I Price (Dollars per room) 450 200 400 Quantity Demanded (Hotel rooms per night) 300 350 300 250 Demand Factors 200 150 Average Income (Thousands of dollars) Demand 40 100 50 Airfare from LAX to LAS (Dollars per round trip) 200 0 50 100 150 200 250 300 350 400 450 500 QUANTITY (Hotel rooms) Room Rate at Lucky (Dollars per night) 200 PRICE (Dollars per room)arrow_forward3arrow_forward

- Q1. Suppose the government is considering an increase in the toll on a certain stretch of highway from $3 to $4. At present, 1 million cars per week use that highway stretch; after the toll is imposed, the number of cars per week will change according to its price elasticity of demand of -0.8 (this elasticity value is estimated based on the initial-value method). If the marginal cost of highway use is constant (i.e., the supply curve is horizontal) and equal to $3 per car, what is the net annual cost to society attributable to the increase in the toll? (your answer must be rounded off to the nearest million dollars per year, i.e., no decimal places; there are 52 weeks in a year)arrow_forwardKnoebels Amusement Park in Elysburg, Pennsylvania, charges a lump-sum fee, L, to enter its Crystal Pool. It also charges p per trip down a slide on the pool's water slides. Suppose that 450 teenagers visit the park, each of whom has a demand function of q₁ = 6-p, and that 300 seniors also vist, each of whom has a demand function of q₂ = 5-p. Knoebels's objective is to set L and p so as to maximize its profit given that it has no (non-sunk) cost and must charge both groups the same prices. What are the optimal L and p? The optimal L and p are L=$and p=$. (Enter numeric responses using real numbers rounded to three decimal places.)arrow_forwardGliberace's Fashion Accessories of Las Vegas produces gem-stone encrusted formal wear for sale in Los Angeles and San Francisco subject to total cost TC = 100 + 5(QLA + QSF). Demand for Gliberace's stones in the two cities is given by QLA = 70 - 2PLA and QSF = 55 - PSF. If Gliberace price discriminates between the two cities, what will its maximum profits be? $975 $750 $825 $1,175 $1,075arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education