Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

B5.

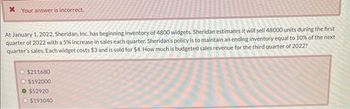

Transcribed Image Text:* Your answer is incorrect.

At January 1, 2022, Sheridan, Inc. has beginning inventory of 4800 widgets. Sheridan estimates it will sell 48000 units during the first

quarter of 2022 with a 5% increase in sales each quarter. Sheridan's policy is to maintain an ending inventory equal to 10% of the next

quarter's sales. Each widget costs $3 and is sold for $4. How much is budgeted sales revenue for the third quarter of 2022?

$211680

O $192000

O $52920

$191040

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ranger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forwardHalifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardPlease help me with calculation thankuarrow_forward

- At January 1, 2022, Sheridan Company has beginning inventory of 2000 surfboards. Sheridan estimates it will sell 14000 units during the first quarter of 2022 with a 12% increase in sales each for the following quarters. Sheridan's policy is to maintain an ending finished goods inventory equal to 25% of the next quarter's sales. Each surfboard costs $120 and is sold for $155. What is the budgeted sales revenue for the third quarter of 2022? $17562 $2722048 $2790000 $620000arrow_forwardAt January 1, 2022, Oriole Company has beginning inventory of 3000 surfboards. Oriole estimates it will sell 11000 units during the first quarter of 2022 with a 10% increase in sales each for the following quarters. Oriole's policy is to maintain an ending finished goods inventory equal to 25% of the next quarter's sales. Each surfboard costs $100 and is sold for $155. What is the budgeted sales revenue for the third quarter of 2022 $2247500 $2063050 $13310 5542500arrow_forward36. At January 1, 2020, Jake, Inc. has beginning inventory of 4,000 surfboards. Jake estimates it will sell 15,000 units during the first quarter of 2020 with a 10% increase in sales each quarter. Jake's policy is to maintain an ending inventory equal to 25% of the next quarter's sales. Each surfboard costs $200 and is sold for $250. How much is budgeted sales revenue for the third quarter of 2020? a) $18,150 b) $4,537,500 c) $907,500 d) $3,750,000arrow_forward

- Filmore Enterprises reports the year-end information from December 31, 2023 as follows: Sales (90,000 units) $1,170,000 Cost of goods sold $409,500 Gross margin $760,500 Operating expenses $620,100 Operating income $140,400 Filmore Enterprises is developing the next twelve- month budget. In January 2024, the company would like to increase selling prices by 3%. As a result, it is expected there will be a decrease in sales volume of 7%. All other operating expenses are expected to remain constant. Assume that COGS is a variable cost and that operating expenses are a fixed cost. Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. What is the budgeted operating income for the year? Budgeted Sales $Answer Budgeted cost of goods sold $Answer Budgeted gross margin $Answer Operating expenses $Answer Budgeted operating income $Answerarrow_forwardWimbledon, Inc. has 6,000 tennis rackets in beginning inventory. Wimbledon expects to sell 14,000 units during the first quarter of 2021 and sales are projected to increase by 12% increase in each quarter. Wimbledon requires an ending inventory target of 25% of the next quarter's sales. Each tennis racket cost $200 and is sold for $300. How much is budgeted sales revenue for the third quarter of 2021? A. $1,500,000 B. $35,124 C. $5,268,480 D. $5,700,000arrow_forward(S2, 2021) Woxy company is considering its forthcoming projections for budget purposes. Woxy's projected sales for next year and beginning and ending inventory data are as follows: Sâles Beginning inventory Desired ending inventory 50,000 units 4,000 units 8,000 units The selling price is $40 per unit. Each unit requires four pounds of material which costs $6 per pound. The beginning inventory of raw materials is 12,000 pounds. The company wants to have 3,000 pounds of material in inventory at the end of the year. Woxys' budgeted total purchase cost of direct materials would be O a. $1,350,00Ó O b. $1,242,000 O c. $1,206,000 O d. $1,296,000 O e. some other amount not listed here O Type here to searcharrow_forward

- Paddle Up, a retailer of paddle boards, has provided you with the following information: Budgeted Sales (units) February 2022 150 March 2022 110 April 2022 70 a) Paddle Up sells each board for $400 and purchases each board for $250. b) Paddle Up plans to maintain inventory on hand at the end of each month to be 20% of next month's sales volume. You can assume this to be the situation at the end of January 2022. c) 40% of sales are made on cash basis with the remaining 60% - on credit. All credit sales are collected in the month following the sale. d) 50% of inventory purchases are made on cash basis with the remaining 50% - on credit. All credit purchases are paid in the month following the purchase. e) The following cash expenses are incurred on a monthly basis: Rent ($5,300); Wages ($5,400); Utilities ($2,100); Insurance ($600). The business also recognises $3,000 of depreciation expense each month. f) The monthly drawings by the owner Paddle Up include: $2,000 cash and 1 board for…arrow_forwardViolet Sales Corp, reports the year-end information from 2019 as follows: Sales (35,500 units) $284,000 Cost of goods sold 105,000 Gross margin 179,000 Operating expenses 152,000 Operating income $27,000 Violet is developing the 2019 budget. In 2019 the company would like to increase selling prices by 3.5%, and as a result expects a decrease in sales volume of 14%. All other operating expenses are expected to remain constant. Assume that cost of goods sold is a variable cost and that operating expenses are a fixed cost. What is budgeted sales for 2019? (Round interim calculations to the nearest cent and the final answer to the nearest dollar.) Question 8 options: $335,092 $293,940 $252,788 $284,001arrow_forwardOriental Lamp Co. manufactures lamps. The estimated number of lamp sales for the last three months of 2020 are as follows: Units October 10,000 November 14,000 December 13,000 Finished Goods Inventory at the end of September was 3,000 units. Ending Finished Goods Inventory is budgeted to equal 25% of the next month’s sales. REQUIRED: How many lamps should be produced in November?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College