FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

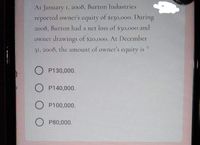

Transcribed Image Text:At January 1, 2008, Burton Industries

reported owner's equity of $130,00o. During

2008, Burton had a net loss of $30,000 and

owner drawings of $20,000. At December

31, 2008, the amount of owner's equity is

O P130,000.

O P140,000.

O P100,000.

O P80,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Novak Corporation's net income for the current year was $622000, Depreciation recorded on plant assets was $58000 and amortization expense was $93000. Accounts receivable and inventories increased by $49000 and $20000, respectively. Supplies and accounts payable decreased by $2000 and $39000, respectively. The equipment account balance increased by $55,000 and a $500,000 convertible bond was retired through the issuance of common stock. How much cash was provided by operating activities? O $565000 $667000 O $585000 $879000arrow_forwardDietrich Corp. disclosed the following information for 2021. The firm issued $65,000 new equity and $4,790 in dividends. The firm acquired $23,186 in new fixed assets and sold $17,600 of old fixed assets. Net working capital increased by $2,470 during the year. Dietrich Corp. had sales revenue of $264,596, cost of goods sold of $63,864, selling expenses of $53,200, depreciation of $6,780, and tax rate is 20%. a) What is the cash flow from assets of Dietrich Corp. in 2021? b) What is the cash flow to creditors of Dietrich Corp. in 2021? without excelarrow_forwardSmashed Pumpkins Company paid $208 in dividends and $631 in interest over the past year. The company increased retained earnings by $528 and had accounts payable of $702. Sales for the year were $16,580 and depreciation was $756. The tax rate was 40 percent. What was the company's EBIT? Multiple Choice $6,632 $1,511 $1,227 $1,858 $2,129arrow_forward

- McEwen mining recently reported $130000 off sales$68500 of operating cost other than depreciation and $10200 off depreciation. The company has $20000 of outstanding bonds that carry a 6% interest rate and its tax rate was 35%. what was the firms net incomearrow_forwardPlease answer to the below questionarrow_forwardThe financial statements of a ltd and b ltd at 1 july 2020 are as follows. A Ltd B Ltd cash 25000 plant 60000 35000 Accumulated depreciation (15000) (120000) inventories 12000 24000 Account receivable 20000 36000 goodwill 0 10000 Total assets 102600 117000 Account payable 1800 17000 Net assets 100800 100000 Share capital Retained earnings 50000 81000 General reserve 8800 4000 Total equity 2000 15000 100800 100000 All the assets and liabilities of B Ltd were recorded for fair value except for the following assets. Plant 47000(Fair value) Inventory 22000(Fair value) A Ltd agreed to pay B Ltd $6000 in cash plus 16000 fully paid shares having a fair value of $7.5 per share. The business combination was completed and B ltd liquidation. Cash of liquidation amounted to $1200. A Ltd incurred legal and accounting costs amounted to $482 in relation to the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education