FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

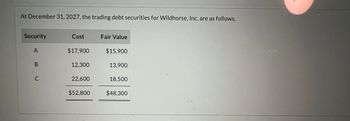

Transcribed Image Text:At December 31, 2027, the trading debt securities for Wildhorse, Inc. are as follows.

Security

Cost Fair Value

A

$17,900

$15,900

B C

12,300

13,900

22,600

18,500

$52,800

$48,300

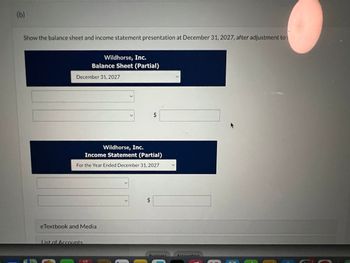

Transcribed Image Text:(b)

Show the balance sheet and income statement presentation at December 31, 2027, after adjustment to

Wildhorse, Inc.

Balance Sheet (Partial)

December 31, 2027

>

>

$

Wildhorse, Inc.

Income Statement (Partial)

For the Year Ended December 31, 2027

eTextbook and Media

List of Accounts

$

Rucinace

Accounting

5月

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help with problem. At the beginning of 2019, Ace Company had the following portfolio of investments in available-for-sale debt securities (all of which were acquired at par value): Security Cost 1/1/19 Fair Value A $25,000 $31,000 B 38,000 36,000 Totals $63,000 $67,000 During 2019, the following transactions occurred: Transactions: May 3 Purchased C debt securities at their par value for $50,000. July 1 Sold all of the A securities for $31,000 plus interest of $1,000. Dec. 31 Received interest of $1,000 on the B and C securities. Additionally the following information was available: Security 12/31/19 Fair Value B $42,000 C 53,000 Required: 1. Prepare journal entries to record the preceding information. 2. What is the balance in the Unrealized Holding Gain/Loss account on December 31, 2019? 3. Next Level What justification does the FASB give for its treatment of unrealized holding gains and losses…arrow_forward5.arrow_forwardBased on the information below, I have to prepare the adjusting entry at December 31, 2022 to report the securities at fair value. Thank you in advance!arrow_forward

- c5arrow_forwardHh3.arrow_forwardAt December 31, 2020, the available-for-sale debt portfolio for Windsor, Inc. is as follows. Security Cost Fair Value UnrealizedGain (Loss) A $27,125 $23,250 $(3,875 ) B 19,375 21,700 2,325 C 35,650 39,525 3,875 Total $82,150 $84,475 2,325 Previous fair value adjustment balance—Dr. 620 Fair value adjustment—Dr. $1,705 On January 20, 2021, Windsor, Inc. sold security A for $23,405. The sale proceeds are net of brokerage fees. 1). Prepare the adjusting entry at December 31, 2020, to report the portfolio at fair value. 2). Show the balance sheet presentation of the investment-related accounts at December 31, 2020arrow_forward

- OurNewCO sold its Boring bond (AFS) for its fair value, $900,000) January 1, 2021. The balances from 12/31/2020 are follows: CASH REVENUE АMORT CV 885301 6/30/2020 50,000 53118.06 3,118 888,419 12/31/2020 50,000 53305.14 3,305 891,724 On 12/31/2020 the FV adjustment account had a debit balance of $8276. The face amount of the Boring Bonds is $1,000,000. Write out the journal entries needed to record this sale. Then complete the statements below.arrow_forward8. On January 1,2020, Care Company purchased Bay Cormpany's 9% bonds with a face amount of P4000,000 for P3,756000 to yield to 10%. The bonds are dated Jonvary 1,2020,mature on December 31,2029, and pay interest annualy on December 31. Care uses the interest method. Whatamount should Care report as interest revenve for 20207 Q. 400,000 b. 344,400 C. 360,000 d. 375,600 purchosed P5.000.000 foce omount.8% bonoS ofarrow_forwardP16.1 (LO 1) (Debt Securities) Presented below is an amortization schedule related to Spangler Company's 5-year, $100,000 bond with a 7% interest rate and a 5% yield, purchased on December 31, 2023, for $108,660. Date Cash Received 12/31/23 12/31/24 $7,000 12/31/25 7,000 12/31/26 7,000 12/31/27 12/31/28 7,000 7,000 Interest Revenue $5,433 5,354 5,272 5,186 5,095 Bond Premium Amortization The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end. Instructions Amortized cost Fair value 12/31/24 $107,093 106,500 12/31/25 $105,447 107,500 $1,567 1,646 1,728 1,814 1,905 Carrying Amount of Bonds $108,660 107,093 105,447 103,719 101,905 100,000 12/31/26 $103,719 105,650 12/31/27 $101,905 103,000 a. Prepare the journal entry to record the purchase of these bonds on December 31, 2023, assuming the bonds are classified as held-to-maturity securities. b. Prepare the journal entry (entries) related to the held-to-maturity bonds for 2024. c. Prepare…arrow_forward

- On December 31, 2018, Marsh Company held Xenon Company bonds in its portfolio of available-for-sale securities. The bonds have a par value of $14,000, carry a 10% annual interest rate, mature in 2025, and had originally been purchased at par. The market value of the bonds at December 31, 2018 was $12,000. The December 31, 2018, balance sheet showed the following: Marsh Company Partial Balance Sheet December 31, 2018 1 Assets 2 Investment in Available-for-Sale Securities $14,000.00 3 Less: Allowance for Change in Fair Value of Investment (2,000.00) 4 $12,000.00 5 Shareholders’ Equity: 6 Unrealized Holding Gain/Loss $(2,000.00) On January 1, 2019, Marsh acquired bonds of Yellow Company with a par value of $16,000 for $16,200. The Yellow Company bonds carry an annual interest rate of 12% and mature on December 31, 2023. Additionally, Marsh acquired Zebra Company bonds with a face value of 19,000 for…arrow_forwardB. On 1 July 2021, Zackry Berhad issued 8 percent bonds of nominal value RM24,000,000 at a discount of 10 percent. Transaction cost incurred amounted RM120,000. The effective rate is 5 percent and interest date is 30 June every year. The market price of bonds in year 2021 and 2022 are shown below: 30 June 2021 30 June 2022 The liability is measured at fair value. Required: Prepare the journal entries for the issuance bonds and payment of interest for the year ended 30 June 2021 and 30 June 2022. RM23,400,000 RM24,800,000arrow_forwardPrepare adjusting entry to record fair value, and indicate statement presentation. E16.11 (LO 3), AP Financial Statement Writing At December 31, 2022, available-for-sale debt securities for Storrer, Inc. are as follows. The securities are considered to be a long-term investment. Fair Value $16,000 14,000 21,000 $51,000 Security A B с Cost $17,500 12,500 23,000 $53,000 Instructions a. Prepare the adjusting entry at December 31, 2022, to report the securities at fair value. b. Show the statement presentation at December 31, 2022, after adjustment to fair value. c. E. Kretsinger, a member of the board of directors, does not understand the reporting of the unreal- ized gains or losses. Write a letter to Ms. Kretsinger explaining the reporting and the purposes that it serves.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education