FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

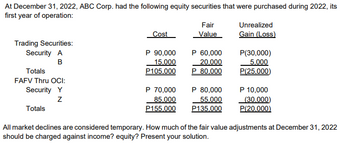

Transcribed Image Text:At December 31, 2022, ABC Corp. had the following equity securities that were purchased during 2022, its

first year of operation:

Trading Securities:

Security A

B

Totals

FAFV Thru OCI:

Security Y

Z

Totals

Cost

P 90,000

15,000

P105.000

P 70,000

85,000

P155.000

Fair

Value

P 60,000

20,000

P 80.000

P 80,000

55,000

P135.000

Unrealized

Gain (Loss)

P(30,000)

5,000

P(25.000)

P 10,000

(30,000)

P(20.000)

All market declines are considered temporary. How much of the fair value adjustments at December 31, 2022

should be charged against income? equity? Present your solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stoll Co.'s long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Cost Fair Value Company A bonds $ 534,900 $ 492,000 Company B notes 159,290 145,000 Company C bonds 662,500 641,740 Stoll enters into the following transactions involving its available-for-sale debt securities this year. Jan. 29 Sold one-half of the Company B notes for $78,130. July 6 Purchased bonds of Company X for $125,100. Nov. 13 Purchased notes of Company Z for $268,000. Dec. 9 Sold all of the bonds of Company A for $515,300. The fair values at December 31 are B, $80,300; C, $606,800; X, $101,000; and Z, $271,000. Required:1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities.2. Determine the amount Stoll reports on its December 31 balance…arrow_forwardAdjusting AFS Debt Securities to Fair Value A portfolio of investments of available-for-sale securities held by Dow Inc. is as follows. Dece. 31, Year 1 Cost Fair Value Eastern Corp. bonds $240,000 $256,000 Western Corp. bonds 400,000 410,000 Total $666,000 $640,000 Dece. 31, Year 2 Cost Fair Value $280,000 Eastern Corp. bonds $240,000 Western Corp. bonds 400,000 380,000 Total $640,000 $660,000 The Fair Value Adjustment account had a $0 balance on January 1 of Year 1. No sales or purchases took place in the available-for-sale investment portfolio in Year 1 and Year 2. a. Record the adjusting entry on December 31 of Year 1 to adjust the debt investments to fair value. b. Record the adjusting entry on December 31 of Year 2 to adjust the debt investments to fair value. Date a. Dec. 31, Year 1 b. Dec. 31, Year 2 Account Name To record adjusting entry. To record adjusting entry. Amount in income statement Net gain (loss) on investment $ Dr. c. Indicate how the adjustment to fair value in…arrow_forwardDarrow_forward

- DO NOT GVIE SOUTION IN IMAGEarrow_forwardStoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Cost Fair Value Company A bonds $ 534,100 $ 492,000 Company B notes 159,140 155,000 Company C bonds 662,400 642,140 Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122,100. November 13 Purchased Company Z notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $82,300; C, $603,800; X, $120,000; and Z, $276,000. Problem 15-3A (Algo) Part 3 3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll report on its income statement for this year?arrow_forwardPlease help me with correct answer thankuarrow_forward

- Novi purchased ABC bonds on 1/1/22. Data regarding these available-for-sale securities follow: Cost MV December 31, 2022 $150,000 $130,000 December 31, 2023 150,000 161,000 December 31, 2024 150,000 155,000 On 1/1/25, Novi sold $40,000 (cost) of the securities for $40,100. Market Value of the remaining securities at 12/31/25 was $108,000. The balance of the Fair Value Adjustment account included on the 12/31/25 balance sheet is: a.$2,000 debit b.$2,000 credit c.$2,100 debit d.$1,900 credit e.$1,900 debitarrow_forwardQuestion: Akers Company invests its excess cash in marketable securities. At the beginning of 2019, it had the following portfolio of investments in trading debt securities: SecurityPar ValueAmortized Cost12/31/18 Fair ValueIvan Company 5% bonds, maturing on Dec. 31, 2028$10,000$8,400$9,400Taylor Company 6% bonds, maturing on Dec. 31, 2023$40,000$43,200$41,800Totals$51,600$51,200During 2019, the following transactions occurred: Mar. 31Purchased Hill Company 8% bonds with a face value of $20,000 for $20,000 plus accrued interest; interest is payable on the bonds each June 30 and December 31.Mar. 31Sold the Taylor Company investment for $42,000 plus accrued interest. The Taylor bonds pay interest on December 31 of each year.June 30Received the semiannual interest on the Hill Company bonds.Dec. 31Received the annual interest on the Ivan Company bonds and the semiannual interest on the Hill Company bonds.The December 31 closing market prices were as follows: Ivan Company bonds, $9,000;…arrow_forwardDo not give answer in imagearrow_forward

- ● Assume Sunset Company purchased this entire bond issue sold y Omar, i.e., 7% of $1,000,000 bonds, at $913,540 on January 1,2024. Market yield was 8% and interest is paid semiannually on June 30 and December 31. Sunset is holding the bond investment as trading securities. The fair value of the bonds on December 31, 2024 is $920,000. 1. At what amount will Sunset report this investment in the December 31, 2024 balance sheet? 2. What is the amount related to the bond investment that Sunset will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 3. What is the amount related to the bond investment that Sunset will report in its statement of cash flows for the year ended December 31, 2024? Be sure to list the category of activity in which the cash flow is in. activities activitiesarrow_forwardBased on the information below, I have to prepare the adjusting entry at December 31, 2022 to report the securities at fair value. Thank you in advance!arrow_forwardRequired information [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Company A bonds Fair Value $ 495,000 Company B notes Cost $530,500 159,080 663,000 Company C bonds 147,000 648,390 Stoll enters into the following transactions involving its available-for-sale debt securities this year. Sold one-half of the Company B notes for $78,170. Purchased Company X bonds for $127,000. January 29 July 6 November 13 Purchased Company Z notes for $267,500. December 9 Sold all of the Company A bonds for $517,400. Fair values at December 31 are B, $80,600; C, $600,800; X, $120,000; and Z, $279,000. Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education