FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Note: the answer is not 451200.

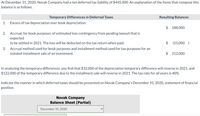

Transcribed Image Text:At December 31, 2020, Novak Company had a net deferred tax liability of $445,000. An explanation of the items that compose this

balance is as follows.

Temporary Differences in Deferred Taxes

Resulting Balances

1.

Excess of tax depreciation over book depreciation.

$ 188,000

2.

Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is

expected

to be settled in 2021. The loss will be deducted on the tax return when paid.

$

(55,000 )

3. Accrual method used for book purposes and installment method used for tax purposes for an

isolated installment sale of an investment.

$ 312,000

In analyzing the temporary differences, you find that $32,000 of the depreciation temporary difference will reverse in 2021, and

$122,000 of the temporary difference due to the installment sale will reverse in 2021. The tax rate for all years is 40%.

Indicate the manner in which deferred taxes should be presented on Novak Company's December 31, 2020, statement of financial

position.

Novak Company

Balance Sheet (Partial)

December 31, 2020

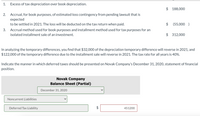

Transcribed Image Text:1.

Excess of tax depreciation over book depreciation.

$ 188,000

2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is

expected

to be settled in 2021. The loss will be deducted on the tax return when paid.

$

(55,000 )

3.

Accrual method used for book purposes and installment method used for tax purposes for an

isolated installment sale of an investment.

$ 312,000

In analyzing the temporary differences, you find that $32,000 of the depreciation temporary difference will reverse in 2021, and

$122,000 of the temporary difference due to the installment sale will reverse in 2021. The tax rate for all years is 40%.

Indicate the manner in which deferred taxes should be presented on Novak Company's December 31, 2020, statement of financial

position.

Novak Company

Balance Sheet (Partial)

December 31, 2020

Noncurrent Liabilities

Deferred Tax Liability

$

451200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gg.36.arrow_forwardThe ex-rights price of 69.42 is not correct The value of a right of 2.58 is not correct the question requests not to round intermediate calculations, could that be your error?arrow_forwardUnder current GAAP, extraordinary items are reported as other gains/losses in the nonoperating section. A) True B Falsearrow_forward

- If certain conditions are met, which of the following properties could be classified as section 1231 property? A. Stock. B. Inventory. C. Accounts Receivable. D. Computer. E. None of the above.arrow_forwardWhy does the Section 404 is perhaps the most controversial provision of SOX?arrow_forwardWhat is a promissory note, and what are some terms that arenormally included in promissory notes?arrow_forward

- 10. Theoretically, unearned items (deferred revenues) should not be classified as a. deferred creditsb. contra to certain assetsc. long-term liabilitiesd. current liabilitiesarrow_forwardTrue (t) or False (f) _____ Contingent liabilities should be recorded in the accounts if there is a remote possibility that the contingency will actually occur)arrow_forwardWhich of the following statements is correct? A. The receipt of boot in a § 1031 like-kind exchange can result in the recognition of gain B. The receipt of boot in a § 1031 like-kind exchange cannot result in the recognition of loss C. The giving of boot in a § 1031 like-kind exchange can result in the recognition of gain D. Only A, and B E.A, B, and C Please without plagiarism pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education