FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

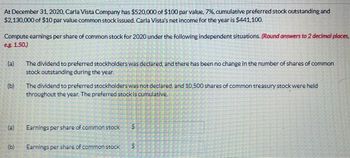

Transcribed Image Text:At December 31, 2020, Carla Vista Company has $520,000 of $100 par value, 7%, cumulative preferred stock outstanding and

$2,130,000 of $10 par value common stock issued. Carla Vista's net income for the year is $441,100.

Compute earnings per share of common stock for 2020 under the following independent situations. (Round answers to 2 decimal places,

eg. 1.50.)

(a)

(b)

(a)

(b)

The dividend to preferred stockholders was declared, and there has been no change in the number of shares of common

stock outstanding during the year.

The dividend to preferred stockholders was not declared, and 10,500 shares of common treasury stock were held

throughout the year. The preferred stock is cumulative.

Earnings per share of common stock

Earnings per share of common stock

50

S

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Shown below is information relating to the stockholders' equity of Robertson Corporation at December 31, 2022: 12% cumulative preferred stock, $150 par Common stock, $1.50 par Additional paid-in capital: preferred stock Additional paid-in capital: common stock Treasury stock (at cost: 6,000 common shares) Retained earnings Refer to the above data. How many shares of common stock are outstanding? O a. 600,000 O b. 406,000 O c. 594,000 O d. 394,000 $1,500,000 600,000 300,000 900,000 180,000 1,350,000arrow_forwardPet Boutique Corp, reported $4,365.410 of profit for 2023. On November 2, 2023, it declared and paid the annual preferred dividends of $283,560 On January 1, 2023, Pet Boutique had 111,410 and 567,000 outstanding preferred and common shares, respectively. The following transactions changed the number of shares outstanding during the year: Feb. 1 Declared and issued a 20% common share dividend. Apr.30 Sold 111,060 common shares for cash. May 1 Sold 45,550 preferred shares for cash. Oct. 31 Sold 32,760 common shares for cash. a. What is the amount of profit available for distribution to the common shareholders? Earnings available to common shareholders $ 4,081,850 Check my wark b. What is the weighted-average number of common shares for the year?arrow_forwardVikrambhaiarrow_forward

- The following information is available for ConocoPhillips on December 31, 2022: Common Stock, $1.75 par, 400,000 shares authorized Additional Paid in Capital - Common Stock Retained Earnings Total Stockholders' Equity During 2023, ConocoPhillips completed these transactions (in chronological order): 1) Declared and issued a 2.0% stock dividend on the outstanding stock. At that time, the stock was quoted at a market price of $20 per share. 2) Issued 2,400 shares of common stock at the price of $18 per share. 3) Net Income for the year was $410,400. Determine the ending balance in the Additional Paid in Capital - Common Stock account on December 31, 2023: Select one: O O $651,000 840,000 756,000 $2,247.000 a. $1,014,780 b. $1,025,000 c. $1,032,000 d. $975,780 e. $879,000 4arrow_forwardDengararrow_forwardStockholders' equity accounts, arranged aphabetically are the ledger of Pina Colada Corp. at December 31, 2020. Common Stock ($5 stated value) $1,675,000 Paid-in capital inexcess of par-preferred stock 279,000 Paid-in capital in excess of stated value-common stock. 936,000 Preferred stock (8%, $103 par) 489,250 Ratained Earnings 1,120,000 Treasury Stock (12,000 common shares) 144,000 Prepare the stockholders' equity section of the balance sheet at December 31, 2020. *please solve and explain process. Thank youarrow_forward

- On January 1, 2019, Concord Corporation had $1,470,000 of common stock outstanding that was issued at par. It also had retained earnings of $741,500. The company issued 41,500 shares of common stock at par on July 1 and earned net income of $400,000 for the year.Journalize the declaration of a 15% stock dividend on December 10, 2019, for the following independent assumptions. (a) Par value is $10, and market price is $18. (b) Par value is $5, and market price is $21.arrow_forwardThe Stockholders' Equity accounts of ExxonMobil on December 31, 2022 were as follows: Preferred Stock ( 6%, $100 par, cumulative, 800 authorized) $720,000 Common Stock ($3 par, 1,500,000 authorized) 1,080,000 APIC - Preferred Stock APIC-Common Stock Retained Earnings Treasury Stock - Common ($9 cost) During 2023, ExxonMobil had the following transactions and events pertaining to its stockholders' equity: March 21: Issued 24,000 shares of Common Stock in exchange for Land. On the date of purchase, the Land had a Fair Market Value of $210,000 and the stock was selling for $11 per share. April 17: Sold 1,800 shares of Treasury Stock - Common for $12 per share. November 22: Purchased 800 shares of Common Stock for the Treasury at a cost of $7,560. December 31: Determine that net income for the year was $556,000. Dividends were declared and paid during December. These dividends included a $0.20 per share dividend to common stockholders of record as of December 12. Preferred dividends are…arrow_forwardShamrock Corporation has 9,400 shares of $100 par value, 8%, preferred stock and 48,400 shares of $10 par value common stock outstanding at December 31, 2020.Answer the questions in each of the following independent situations.(a) If the preferred stock is cumulative and dividends were last paid on the preferred stock on December 31, 2017, what are the dividends in arrears on December 31, 2020, balance sheet? The amount of dividends in arrears on the December 31, 2020 $ How should these dividends be reported? The cumulative dividend is reportednot reported as a liability. (b) If the preferred stock is convertible into 6 shares of $10 par value common stock and 3,400 shares are converted, what entry is required for the conversion assuming the preferred stock was issued at par value? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required,…arrow_forward

- On January 1, 2022, Blossom Corporation had $1,485,000 of common stock outstanding that was issued at par. It also had retained earnings of $751,000. The company issued 45,000 shares of common stock at par on July 1 and earned net income of $390,000 for the year. Journalize the declaration of a 14% stock dividend on December 10, 2022, for the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Par value is $10, and market price is $18. b. Par value is $5, and market price is $20. a. No. Account Titles and Explanation a. b. Debit Creditarrow_forwardFollowing are four separate dividend scenarios. a. On April 1, 2020, Meriter Corporation declared a cash dividend of $5.00 per share on its 32,000 outstanding shares of common stock ($1 par). The dividend is payable on April 21, 2020, to stockholders of record on April 14, 2020. b. Axe Co. has issued and outstanding 1,000 shares of $100 par, cumulative, 5% preferred stock and 20,000 shares of $5 par common stock. Dividends are in arrears for the past year (not including the current year). On December 15, 2020, the board of directors of Axe Co. declared dividends of $25,000 to be paid to shareholders at the end of its fiscal year. c. Siri Corp. holds 1,000 shares of Mobile Co. common stock, purchased at the beginning of the year for $30 a share (carrying value on February 1, 2020). On February 1, 2020, Siri Corp. declared a property dividend of 450 shares of Mobile Co. common stock when the shares were selling at $28 per share. d. Treck Corporation declared a common stock dividend of…arrow_forwardMobley Corp. has 9,468,000 shares of common stock and 504,000 shares of preferred stock outstanding for the entirety of 2023. During 2023, Mobley Corp. reports $91,270,000 of net income reports $91,148,000 of comprehensive income declares and pays dividends of $1.13 per common share declares and pays dividends of $3.00 per preferred share What will Mobley report on its 2023 income statement as Earnings Per Share?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education