Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

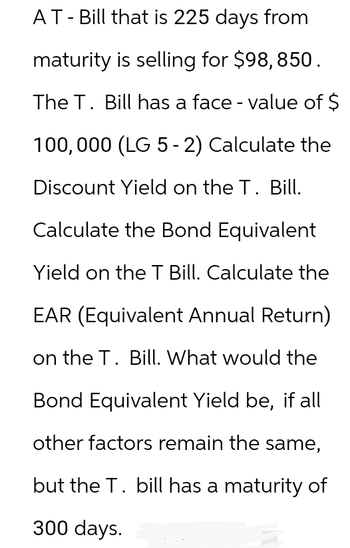

Transcribed Image Text:AT - Bill that is 225 days from

maturity is selling for $98, 850.

The T. Bill has a face - value of $

100,000 (LG 5 - 2) Calculate the

Discount Yield on the T. Bill.

Calculate the Bond Equivalent

Yield on the T Bill. Calculate the

EAR (Equivalent Annual Return)

on the T. Bill. What would the

Bond Equivalent Yield be, if all

other factors remain the same,

but the T. bill has a maturity of

300 days.

B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Key information that is required from question:

VIEW Step 2: Calculate discount yield on the T-bill:

VIEW Step 3: Calculate Effective yield on the T-Bill:

VIEW Step 4: Calculate the effective annual rate of return as follows:

VIEW Step 5: Calculate discount yield on the T-bill if the maturity is 300 days:

VIEW Step 6: Calculate Effective yield on the T-Bill if the maturity is 300 days:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 4) A coupon bond pays this amount every 6 months; $ 30.00 bgs for the number of payments/year; 2 The bond also pays at maturity the par (face) value; $ 1,000.00 Number of years until maturity 15 The required return of holders of this bond is; 8.00% bgs a) What is the PV of the CFs, or what would be the fair price to purchase this bond? b) If the required return of holders of this bond is; 6.00% bgs What is the PV of the CFs, or what would be the fair price to purchase this bond? c) If the required return of holders of this bond is; 4.00% What is the PV of the CFs, or what would be the fair price to purchase this bond? to purchase this bond? bgs d) If the previous bond sells for; $ (976.00) What must be the yield to maturity for this bond (aka IRR) ? (to…arrow_forwardAT-bill with face value $10,000 and 87 days to maturity is selling at a bank discount ask yield of 3.4%. What is its bond equivalent yield? (Use 360 days a year. Do not round intermediate calculations. Round your answer to 2 decimal places.) The answer is 3.43 %, show how to get this answerarrow_forwardPlease answer the following question: The modified duration and convexity of a 6%, 25 year bond selling toyield 9% is 10.62 and 91.46 respectively. If the required yield increasesby 300 basis points from 9% to 12% what is the approximate percentagechange in the price of the bond due toa) duration,b) convexity,c) duration and convexity?d) If the actual change is -26.50%, compare your results from a) and c)which provides a better approximation?arrow_forward

- A T-bill with face value $10,000 and 82 days to maturity is selling at a bank discount ask yield of 2.9%. What is the price of the bond equivalent yield? Use 365 days per year.arrow_forwarda bond currently has a price of $1050 the yield on the bond is 6%. If the yield increases by 25 basis points the price of the bond will go down to $1030. What would the modified duration of this bond be?arrow_forwardWhat is the yield on a corporate bond with a $1000 face value purchased at a discount price of $850, if it pays 8% fixed interest for the duration of the bond? yield = [?] % Give your answer as a percent rounded to the nearest hundredth. Hint: yield = interest paid price paid Enterarrow_forward

- Suppose you are given the following information about four different, default-free bonds, each with a face value of $1,000. The coupon bonds have annual payments. The yield to maturity of bond A with a maturity of 1 year and a coupon rate of 0% is 2%. The yield to maturity of bond B with a maturity of 2 year and a coupon rate of 10% is 3.908%. The yield to maturity of bond C with a maturity of 3 year and a coupon rate of 6% is 5.840%. The yield to maturity of bond D with a maturity of 4 year and a coupon rate of 12% is 5.783%. Given this information, what is the four-year spot rate?arrow_forwardConsider a bond with a Par Value of $1,000. It pays a coupon of 7% and the coupon is paid monthly. It matures in 2 years. Calculate the NPV if the yield on the bond is 5% and the price of the bond is $1,100. $37.99 -$62.01 $1,037.99 None of the answers are correctarrow_forwardWhat is the discount yield, bond equivalent yield, and effective annual return on a $1 million Treasury bill that currently sells at 93.375 percent of its face value and is 70 days from maturity? (Use 360 days for discount yield and 365 days in a year for bond equivalent yield and effective annual return. Do not round intermediate calculations. Round your percentage answers to 3 decimal places. (e.g., 32.161)) Discount yield Bond equivalent yield Effective annual return % % %arrow_forward

- Consider a 26-week $12000 face value T-bill with an asked discount yield of 10%. What is the price of this bond? = $ What is the effective yield of the bond? TWO PART QUESTION!arrow_forwardShow me the steps with explanations to calculate the bond's time to maturity given the a discount bound is bought at a current price of $1000 and it promises to pay $1340 with an interest rate (yield) of 5%.arrow_forwardWhat is the yield on a corporate bond with a $1000 face value purchased at a discount price of $850, if it pays 6% fixed interest for the duration of the bond? yield = [ ? ] % Give your answer as a percent rounded to the nearest hundredth. Hint: yield = interest paid price paid Enterarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education