FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:On December 31, 2025, American Bank enters into a debt restructuring agreement with Tamarisk Company, which is now

experiencing financial trouble. The bank agrees to restructure a 12%, issued at par, $3,760,000 note receivable by the following

modifications:

1.

2.

3.

Reducing the principal obligation from $3,760,000 to $3,008,000.

Extending the maturity date from December 31, 2025, to January 1, 2029.

Reducing the interest rate from 12% to 10%.

Tamarisk pays interest at the end of each year. On January 1, 2029, Tamarisk Company pays $3,008,000 in cash to American Bank.

(a)

Your answer is correct.

Will the gain recorded by Tamarisk be equal to the loss recorded by American Bank under the debt restructuring?

No O

eTextbook and Media

List of Accounts

Attempts: 2 of 7 used.

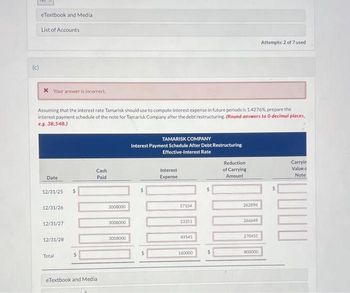

Transcribed Image Text:(c)

eTextbook and Media

List of Accounts

x Your answer is incorrect.

Assuming that the interest rate Tamarisk should use to compute interest expense in future periods is 1.4276%, prepare the

interest payment schedule of the note for Tamarisk Company after the debt restructuring (Round answers to 0 decimal places,

e.g. 38,548.)

Date

12/31/25

12/31/26

12/31/27

12/31/28

Total

$

$

Cash

Paid

eTextbook and Media

3008000

3008000

3008000

TAMARISK COMPANY

Interest Payment Schedule After Debt Restructuring

Effective-Interest Rate

$

Interest

Expense

57104

53351

49545

160000

$

$

Reduction

of Carrying

Amount

262896

266649

270455

Attempts: 2 of 7 used

800000

$

Carryin

Value c

Note

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Complete the following, using ordinary interest. (Use Days in a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. Principal Interest rate 2,400 9% Date borrowed March 05 Date repaid Exact time June 15 Interest Maturity valuearrow_forwardComplete the following, using ordinary interest. (Use Days in a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. $ Principal 1,328 Interest rate 5% Date borrowed June 08 Date repaid January 19 Exact time Interest Maturity valuearrow_forwardThe information in the following table relates to the accounts receivable and allowance for doubtful debts of Prime Moving Ltd. The company’s accounting period ends on 30 June each year. The company policy is to provide an allowance for doubtful debts at the rate of 3% of accounts receivable at 30 June each year. The balance of the Allowance for Doubtful Debts account on 1 July 2019 was $10 000. The following information is given for the year ending 30 June 2020 and 30 June 2021, to determine the bad debts expense for each year and the balance of allowance for doubtful debts at the end of each year. 2020 2021 Accounts receivable (ending balance at 30 June) $400,000 $450,000 Bad debts written off during the year 6,000 0 Allowance for doubtful debts at 1 July (Beginning of the period) (a) (d) Bad debts expense for the year (b) (e) Allowance for doubtful debts at 30 June (Ending balance) (c) (f) Required: Determine the missing…arrow_forward

- Complete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,900 Interest rate 9% Date borrowed May 21 Date repaid August 9 Exact time Interest Maturity valuearrow_forwardComplete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations.Round the "Interest" and "Maturity value" to the nearest cent. Principal $ 2,100 Interest rate 5% Date borrowed May 9 Date repaid August 14 Exact time Interest Maturity valuearrow_forwardThe loan below was paid in full before its due date. (a) Obtain the value of h from the annual percentage rate table. Then (b) use the actuarial method to find the amount of unearned interest, and (c) find the payoff amount. Regular Monthly Payment $445.22 Remaining Number of Scheduled Payments after Payoff 6 APR 11.0% Click the icon to view the annual percentage rate table. (a) h=$ (b) The unearned interest is $ (c) The payoff amount is $ (Round to the nearest cent as needed.) (Round to the nearest cent as needed.)arrow_forward

- Assuming a 360-day year, when a $11,392, 90-day, 10% interest-bearing note payable matures, total payment will be a. $11,677 Ob. $12,531 Oc. $1,139 Od. $285 That's Built PlueAarrow_forwardThe loan below was paid in full before its due date: (a). Obtain the value of h from the annual percentage rate table. Then (b) use the actuarial method to find the amount of unearned interest, and (c) find the payoff amount. Regular Monthly Payment $494.14 APR 4.0% Remaining Number of Scheduled Payments after Payo!! 12 Click the icon to view the annual percentage rate table. (b) The unearned interest is (Round to the nearest cent as needed) (c) The payoff amount is $(Round to the nearest cent as needed)arrow_forward6) A company receives a 5%, 90-day note for $5,400. The total interest due on the maturity date is: (Use 360 days a year.) A) $67.50. B) $270.00. C) $157.50. D) $135.00. E) $90.00.arrow_forward

- Complete the following, using exact interest. (Use Days in a year table.) Note: Do not round intermediate calculations. Round the "Interest" and "Maturity value" to the nearest cent. Principal Interest rate 5% 590 Date borrowed Date repaid Exact time June 10 December 12 Interest Maturity valuearrow_forwardOn January 1, 2024, Cullumber Company issued for cash a $590000, 5-year note bearing annual interest at 10% to Taylor, Inc. The market rate of interest for a note of similar risk is 12 %, What should be the balance of the Discount on Notes Payable account on the books of Cullumber at December 31, 2026 after adjusting entries are made, assuming that the effective-interest method is used? $16798 O $51501 O $19942 O $28341arrow_forwardAmerican Express and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 17.25%, with interest paid monthly, what is the card's EFF%? Select the correct answer. a. 18.68% b. 12.88% c. 9.98% d. 24.48% e. 15.78%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education