Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

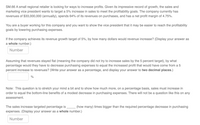

Transcribed Image Text:SM.66 A small regional retailer is looking for ways to increase profits. Given its impressive record of growth, the sales and

marketing vice president wants to target a 5% increase in sales to meet the profitability goals. The company currently has

revenues of $33,000,000 (annually), spends 64% of its revenues on purchases, and has a net profit margin of 4.75%.

You are a buyer working for this company and you want to show the vice president that it may be easier to reach the profitability

goals by lowering purchasing expenses.

If the company achieves its revenue growth target of 5%, by how many dollars would revenue increase? (Display your answer as

a whole number.)

Number

Assuming that revenues stayed flat (meaning the company did not try to increase sales by the 5 percent target), by what

percentage would they have to decrease purchasing expenses to equal the increased profit that would have come from a 5

percent increase to revenues? (Write your answer as a percentage, and display your answer to two decimal places.)

Note: This question is to stretch your mind a bit and to show how much more, on a percentage basis, sales must increase in

order to equal the bottom-line benefits of a modest decrease in purchasing expenses. There will not be a question like this on any

assessment.

The sales increase targeted percentage is

(how many) times bigger than the required percentage decrease in purchasing

expenses. (Display your answer as a whole number.)

Number

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The company’s marketing manager estimates that there is a 60% chance that demand will rise faster than the current rate, a 30% chance that it will continue to rise at the current rate and a 10% chance that it will increase at a slower rate or fall. Assuming that the company’s objective is to maximize expected net present value, determine (a)The course of action which it should take (b)The expected value of perfect information.arrow_forwardWhich of the following statement is true? O For any type of derivatives, the payoffs will never be negative For any type of derivatives, the profit will never be negative There is no derivative that offers non-negative payoffs There is no derivative that offers non-negative profit All of the statements above are wrongarrow_forwardIf all the individual land parcels in a new housing development are sold for $300,000 each, the developer projects total revenue from land sales will be $120 million. If the land lender requires that their $60 million land loan be completely paid off by the time that 75% of the individual land parcels have been sold, what would be the lender’s minimum release price for each parcel? a. $150,000 b. $200,000 c. $250,000 d.$300,000arrow_forward

- Benefits and Costs of Buying vs. Renting Reem & Kareem are trying to decide whether to rent or purchase housing. Reem favors buying and Kareem leans toward renting, and both seem able to justify their particular choice. Reem thinks that the tax advantages are a very good reason for buying. Kareem, however, believes that cash flow is so much better when renting. See whether you can help them make their decision. Does the home buyer enjoy tax advantages? Explain. Discuss Kareem’s belief that cash flow is better with renting. Suggest some reasons why Reem might consider renting rather than purchasing housing. Suggest some reasons why Kareem might consider buying rather than renting housing. Is there a clear-cut basis for deciding whether to rent or buy housing? Explain why or why not.arrow_forwardImagine that you run a business that manufactures a unique medical product. The potential demand for the product is very short lived and uncertain. Your production cycle is very long, which means you need to have the products ready in advance. If the demand for your product arises (only 30% chance), they will be sold well; if not, the products will remain unsold and you will need to liquidate them for $500 each. You predict that the demand will be normally distributed with mean= 15000 and standard deviation= 7000. The production cost of your product is, on average, $5500. You will sell your product for $12500. Suppose you make 18000 products, and you get lucky and demand will occur this year. What is your expected profit?arrow_forwardYou are managing a firm with market power, and you think the price elasticity of demand for your product is between 1.3 and 1.5. You estimate that your marginal cost is between $50 and $75. The price that you should set would range between $ and $ (Round your answers to two decimal places.) If you refine your estimate of the marginal cost to $80, the price you should set would now range between $ and S. (Round your answers to two decimal places.)arrow_forward

- In the prospectus for the Brazos Aggressive Growth fund, the fee table indicates that the fund has a 12b-1 fee of 0.35 percent and an expense ratio of 1.55 percent that is collected once a year on December 1. Joan and Don Norwood have shares valued at $114,500 on December 1. What is the amount of the 12b-1 fee this year? What is the amount they will pay for expenses this year?arrow_forwardEight years ago, Burt Brownlee purchased a government bond that pays 3.60 percent interest. The face value of the bond was $1,000. What is the dollar amount of annual interest that Burt received from his bond investment each year? Assuming that comparable bonds are now paying 2.40 percent, will Burt's bond increase or decrease in value? Why did the bond increase or decrease in value?arrow_forwardWhich of the following statements is correct for the Black-Scholes model? A) The price of an American call written on a stock is: c = SN(d1)-Ke-rTN(d2) B) The stock price at a future point in time follows a log-normal distribution. C) The continuously compounded return on the stock follows a log-normal distribution. D) Black-Scholes prices may allow for arbitrage opportunities. Please explain and justify your choice.arrow_forward

- help!arrow_forwardYou are planning to rent a car for a one-week vacation. You have the option of buying an insurance that costs $80 dollars for a week. If you do not purchase insurance, you would be personally liable for any damages. You anticipate that a minor collision will cost $2,000, whereas a major accident might cost $16,000 in repairs. Develop a payoff table for this situation. What decision should you make using each strategy? Aggressive (Optimistic) Conservative (Pessimistic) Opportunity Loss You have recently read in a magazine that that the probability of a major accident is 0.05% and that the probability of a minor collision is 0.18%. Construct a decision tree and identify the best expected value decision.arrow_forwardIf an economy can produce a maximum of 10 units of good X and the opportunity cost of 1X is always 6Y, then what is the maximum units of good Y the economy can produce? 0 60 O 600 050 500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.