ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

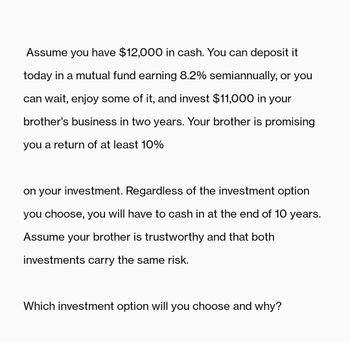

Transcribed Image Text:Assume you have $12,000 in cash. You can deposit it

today in a mutual fund earning 8.2% semiannually, or you

can wait, enjoy some of it, and invest $11,000 in your

brother's business in two years. Your brother is promising

you a return of at least 10%

on your investment. Regardless of the investment option

you choose, you will have to cash in at the end of 10 years.

Assume your brother is trustworthy and that both

investments carry the same risk.

Which investment option will you choose and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Wow and beautiful expert Hand written solution is not allowedarrow_forwardYou have $10,000 to invest. Your bank offers the following 10 year CD's. Account 1 offers 6.85% simple interest. Account 2 offers 6.57% compounded annually. a. How much money will you have at the end of 10 years if Account 1 is chosen? s b. How much money will you have at the end of 10 years if Account 2 is chosen?S Account is the better choice.arrow_forwardNow that young King Solomon has inherited the kingdom of Israel, and a massive amount of wealth that he can invest, he wants to plan for his "retirement." Since he doesn't know how long he'll live, and data on life expectancy is scarce, he reasons that he just wants a regular "cash flow" over the course of his life. With that in mind, how many shekels would he need to deposit at 20 percent interest compounded every year in order to be able to withdraw 50 shekels at the end of every year for seventy years?arrow_forward

- Kevin invested part of his $5000 bonus in a certificate of deposit (CD) that paid 2% annual simple interest, and the remainder in a mutual fund that paid 4% annual simple interest. If his total interest for that year was $140.00, how much did Kevin invest in the mutual fund? Group of answer choices Kevin invested $4986.00 in the mutal fund. Kevin invested $4846.00 in the mutal fund. Kevin invested $2000.00 in the mutal fund. Kevin invested $2140.00 in the mutal fund.arrow_forwardFind the present value of $750 to be paid four years from now when the prevailing interest rate is 10 percent, if interest is compounded annually.arrow_forwardEmily recently graduated with a B.A. in economics and was offered a job with a small but growing company for $40,600 per year. About the same time, Emily inherited $65,000. She decided to pass up the job and use her inheritance to purchase a bubble tea shop rather than put the money into a bond fund (as her uncle suggested), which would have paid 6 percent per year interest. Emily works full-time at her new business, and at the end of the year she had revenues of $77,000 and total explicit costs of $30,000. a. What was Emily's accounting profit or loss for the year? Accounting (Click to select) $ b. What was her economic profit or loss for the year? Economic (Click to select)arrow_forward

- Please use a Timeline, a physical onearrow_forwardYou have a bank deposit now worth $4500.How long will it take for your deposit to be worth more than $8600 if: The account pays 6 percent actual interest every half-year and is compounded every half-year?arrow_forwardFind the present value of $750 to be paid four years from now when the prevailing interest rate is 10 percent, if interest is compounded annually.arrow_forward

- Many retirement funds charge an administrative fee equal to 0.25% on managed assets. Suppose that Alexx and Spenser each invest $4,000 in the same stock this year. Alexx invests directly and earns 4% a year. Spenser uses a retirement fund and eams 3.75%. If Alexx and Spenser leave their investments in place for 30 years, with annual compounding of the interest, how much more will Alexx have than Spenser at the end of the 30-year period? Alexx will have more than Spenser after 30 years. (Enter your response rounded to two decimal places.)arrow_forwardEmily recently graduated with a B.A. In economics and was offered a job with a small but growing company for $40,200 per year. About the same time, Emily inherited $60,000. She decided to pass up the job and use her inheritance to purchase a bubble tea shop rather than put the money into a bond fund (as her uncle suggested), which would have paid 5 percent per year interest. Emily works full-time at her new business, and at the end of the year she had revenues of $78,000 and total explicit costs of $38,600. a. What was Emily's accounting profit or loss for the year? Accounting (Click to select) : $ b. What was her economic profit or loss for the year? Economic (Click to select) : $arrow_forwardto be valid, a trust must have a trustor, a trustee, at least one beneficiary, and a lawful trust purpose, True or False?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education