Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

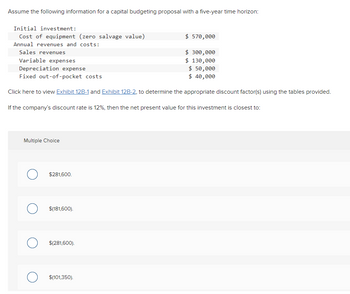

Transcribed Image Text:Assume the following information for a capital budgeting proposal with a five-year time horizon:

Initial investment:

Cost of equipment (zero salvage value)

$ 570,000

Annual revenues and costs:

Sales revenues

$ 300,000

Variable expenses

$ 130,000

$ 50,000

Depreciation expense

Fixed out-of-pocket costs

$ 40,000

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided.

If the company's discount rate is 12%, then the net present value for this investment is closest to:

Multiple Choice

$281,600.

$(181,600).

$(281,600).

$(101,350).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider each of the after-tax cash flows shown in the table below. Suppose that projects B and C are mutually exclusive. Suppose also that the required service period is eight years and that the company is considering leasing comparable equipment with an annual lease expense of $3,000, payable at the end of each year for the remaining years of the required service period. Which project is a better choice at 15%? Click the icon to view the cash flows for the projects. Click the icon to view the interest factors for discrete compounding when i=15% per year. The present worth of project B is $thousand. (Round to one decimal place.) More Info Capital Single Payment Compound Amount Factor (F/P, i, N) Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, i, N) Compound Amount Factor (F/A, i, N) 1.0000 More Info Recovery Factor (A/P, i, N) 1.1500 (P/A, i, N) 1.1500 1.0000 0.8696 1.3225 2.1500 0.4651 1.6257 0.6151 B с 1.5209 3.4725 0.2880 2.2832 0.4380 - $7,000 -$5,000 1.7490…arrow_forwardHudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,700 units at $300 each) Variable costs (10,700 units at $240 each) Contribution margin Fixed costs $3,210,000 2,568,000 642,000 504,000 $ 138,000 Pretax income If the company raises its selling price to $320 per unit. 1. Compute Hudson Co's contribution margin per unit. 2. Compute Hudson Co's contribution margin ratio. 3. Compute Hudson Co's break-even point in units. 4. Compute Hudson Co's break-even point in sales dollars. 1. Contribution margin per unit 2. Contribution margin ratio ... Nextarrow_forwardYou are tasked with calculating the property tax needed to fund construction and operation of a $22.5 million complex. The facility’s annual operating budget is forecast at $3.6 million, to be covered by revenues from programs offered at the facility. A 30-year general obligation bond with a rate of 5.5% will be issued to pay for the facility’s construction costs. The net assessed value of property in the municipality is $725 million. 3. For an owner of property with a total assessed value of $15,000, by how much will his/her property tax increasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,