ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

need E,F,G

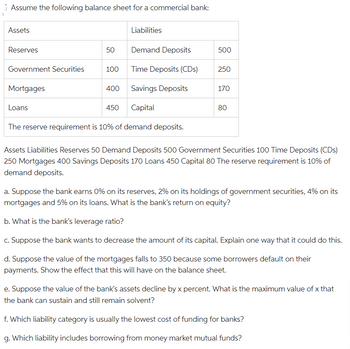

Transcribed Image Text:Assume the following balance sheet for a commercial bank:

Assets

Liabilities

Reserves

50

Demand Deposits

500

Government Securities

100

Time Deposits (CDs)

250

Mortgages

400

Savings Deposits

170

Loans

450

Capital

80

The reserve requirement is 10% of demand deposits.

Assets Liabilities Reserves 50 Demand Deposits 500 Government Securities 100 Time Deposits (CDs)

250 Mortgages 400 Savings Deposits 170 Loans 450 Capital 80 The reserve requirement is 10% of

demand deposits.

a. Suppose the bank earns 0% on its reserves, 2% on its holdings of government securities, 4% on its

mortgages and 5% on its loans. What is the bank's return on equity?

b. What is the bank's leverage ratio?

c. Suppose the bank wants to decrease the amount of its capital. Explain one way that it could do this.

d. Suppose the value of the mortgages falls to 350 because some borrowers default on their

payments. Show the effect that this will have on the balance sheet.

e. Suppose the value of the bank's assets decline by x percent. What is the maximum value of x that

the bank can sustain and still remain solvent?

f. Which liability category is usually the lowest cost of funding for banks?

g. Which liability includes borrowing from money market mutual funds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Describe the importance of banking

VIEW Step 2: Determine the maximum value of x that the bank can sustain and still remain solvent

VIEW Step 3: Explain which liability category is usually the lowest cost of funding for banks

VIEW Step 4: Explain which liability includes borrowing from money market mutual funds

VIEW Solution

VIEW Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education