FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't give image format

Transcribed Image Text:Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Caule uuring

2025

($ in millions)

Beginning of 2025

Service cost

Interest cost, 10%

Loss (gain) on PB0

Less: Retiree benefits

End of 2025

Show Transcribed Text

($ in millions)

Balance, January 1, 2024

Service cost

Interest cost, 10%

Expected return on assets

Loss on assets

Amortization of

PBO

$ 420

45

Prior service cost-AOCI

Net loss-AOCI

Gain or Loss on PBO

Cash contributions

Retiree benefits

Balance, December 31, 2024

42

5

(23)

$ 409

PBO

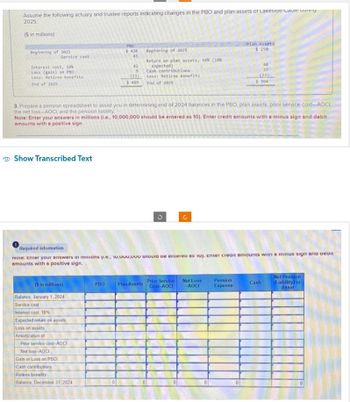

3. Prepare a pension spreadsheet to assist you in determining end of 2024 balances in the PBO, plan assets, prior service cost-AOCI,

the net loss-AOCI, and the pension liability

Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amounts with a minus sign and debit

amounts with a positive sign.

Beginning of 2025

Return on plan assets, 16% (10%)

expected)

Cash contributions

Less: Retiree benefits

End of 2025

Plan Assets

G

Required information

Note: Enter your answers in milions (Le., Iv,uuu,uuu snouia de entered as 10). Enter creart amounts with a minus sign and dedit

amounts with a positive sign.

U

Plan Assets

$ 250

Prior Service Net Loss

Cost-AOCI -AOCI

40

37

(23)

$ 304

Pension

Expense

Cash

Net Pension

(Liability) or

Asset

![[The following information applies to the questions displayed below]

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2024:

Prior service cost at January 1, 2024, from plan amendment at the beginning of 2022

(amortization: $5 million per year)

Net loss-pensions at January 1, 2024 (previous losses exceeded previous gains)

Average remaining service life of the active employee group

Actuary's discount rate

($ in millions)

Beginning of 2024

Service cost

Interest

10%

Loss (gain) on PBO

Less: Retiree benefits.

End of 2024

($ in millions)

PBO

$ 370

49

37

(3)

(03)

$ 420

Beginning of 2024

Return on plan assets, 9.5% (10%

expected)

Cash contributions

Less: Retiree benefits

End of 2024

$39 million

$ 47 million

10 years:

10%

Plan Assets

$200

19

64

(33)

$250

Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during

2025;](https://content.bartleby.com/qna-images/question/0ef30333-002e-4001-8a6b-4dc376258695/52b107c5-9ce6-4219-998f-ddda6201c436/aiznfj_thumbnail.jpeg)

Transcribed Image Text:[The following information applies to the questions displayed below]

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2024:

Prior service cost at January 1, 2024, from plan amendment at the beginning of 2022

(amortization: $5 million per year)

Net loss-pensions at January 1, 2024 (previous losses exceeded previous gains)

Average remaining service life of the active employee group

Actuary's discount rate

($ in millions)

Beginning of 2024

Service cost

Interest

10%

Loss (gain) on PBO

Less: Retiree benefits.

End of 2024

($ in millions)

PBO

$ 370

49

37

(3)

(03)

$ 420

Beginning of 2024

Return on plan assets, 9.5% (10%

expected)

Cash contributions

Less: Retiree benefits

End of 2024

$39 million

$ 47 million

10 years:

10%

Plan Assets

$200

19

64

(33)

$250

Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during

2025;

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identify the minimum cardinality of any REA diagram relationship. O or 1. O or N. 1 or N. None of these.arrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forwardPlease do not give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education