ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

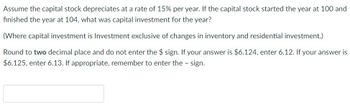

Transcribed Image Text:Assume the capital stock depreciates at a rate of 15% per year. If the capital stock started the year at 100 and

finished the year at 104, what was capital investment for the year?

(Where capital investment is Investment exclusive of changes in inventory and residential investment.)

Round to two decimal place and do not enter the $ sign. If your answer is $6.124, enter 6.12. If your answer is

$6.125, enter 6.13. If appropriate, remember to enter the - sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The sole proprietor of the Alton Plumbing Supply Company receives all accounting profits earned by his firm and a $30,000 a year salary. He has a standing salary offer of $40,000 a year working for a large corporation. If he had invested his capital outside his company, he estimates that would have returned $15,000 this year. If accounting profits for the year were $65,000, economic profits were:arrow_forwardThe formula M(t) = 1.14t + 13.21 gives the approximate total revenue for a corporation, in billions of dollars, t years after 2000. The formula applies to the years 2000 through 2013. (a) Explain in practical terms the meaning of M(5). The expression M(5) is the total revenue for the corporation, in billions of dollars, in 2005.The expression M(5) is the year in which the corporation will earn 5 billion dollars. The expression M(5) is the total revenue for the corporation, in billions of dollars, in 2013.The expression M(5) is the year in which the corporation will earn 5 billion dollars more than it earned in 2000.The expression M(5) is the total revenue for the corporation, in billions of dollars, in 2000. (b) Use functional notation to express the total revenue for 2010. M (c) Calculate the total revenue in 2010. billion dollarsarrow_forwardDetermine what the interesr would have been if a financial asset valued at $22,500 amounted to the total value of $29,800 after two years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education