ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

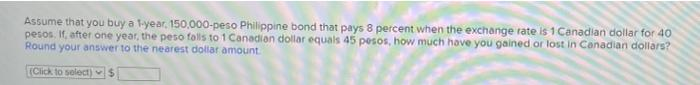

Transcribed Image Text:Assume that you buy a 1-year, 150,000-peso Philippine bond that pays 8 percent when the exchange rate is 1 Canadian dollar for 40

pesos. If, after one year, the peso falls to 1 Canadian dollar equals 45 pesos, how much have you gained or lost in Canadian dollars?

Round your answer to the nearest dollar amount

(Click to select)S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A UK-manufactured car sells for GBP 14.000. A french-manufactured car sells for EUR 15.750. If the EUR/GBP exchange rate is 1.17, how much does the french-made car cost in GBP? a. 13.467 b. 14.500 c. 16.380 d. 18.427arrow_forward3. In which country would you save if the nominal interest rate equals 4% in the U.S. and 1% in Germany, the current dollar-Euro exchange rate (E$/ €) is equal to 1.2 and your expected exchange rate one year from now (Ee$/ €) equals 1.25.arrow_forwardSuppose DeGraw Corporation, a U.S. exporter, sold a solar heating station to a Japanese customer at a price of 143.5 million yen, when the exchange rate was 140 yen per dollar. In order to close the sale, DeGraw agreed to be paid in yen, thus agreeing to take some exchange rate risk for the transaction. The terms were net 6 months. a. If the yen fell against the dollar such that one dollar would buy 154.4 yen when the invoice was paid, what dollar amount would DeGraw receive after it exchanged yen for U.S. dollars? b. What is the difference (in dollars) between what DeGraw could have received had they asked for payment immediately (before the devaluation of the yen) instead of six months later?arrow_forward

- Imagine you are a German investor trying to decide whether to buy American or European bonds. A ten-year bond issued by America’s Treasury today offers about 3%; German bonds return only 1.2%. But buying American means taking a gamble on the euro-dollar exchange rate. You are interested in the return in euros. The bond issued in the US will be attractive only if the extra yield exceeds any expected loss due to swings in currency markets. This thinking explains why the dollar has recently soared against the euro. In July 2022 the dollar reached a one-for-one exchange rate with the euro for the first time since 2002. Is it always true that a currency appreciates in value when the interest rate it offers increases relative to foreign interest rates? Explain.arrow_forwardA box of chocolate candy costs 28.80 Swiss francs in Switzerland and $20 in the United States. Assuming that purchasing power parity (PPP) holds, what is the current exchange rate? Ⓒa 1 U.S. dollar equals 1.44 Swiss francs Ob. 1 U.S. dollar equals 1.21 Swiss francs Oc1 US dollar equals 1.29 Swiss francs d. 1 U.S. dollar equals 0.69 Swiss francs e. 1 U.S. dollar equals 0.85 Swiss francsarrow_forwardIf Boblandia had a flexible exchange rate, it would cost 10 Bobos to purchase a Canadian dollar. The Central Bank of Boblandia (aka, the Bank of Boblandia, or BoB) has fixed the exchange rate, saying it will buy or sell Bobos at C$0.12 for each Bobo. Which of the following represents a choice it is currently facing? O In order to not have to buy Canadian dollars, it could buy bonds from domestic banks. O In order to not have to buy Canadian dollars, it could sell bonds to domestic banks. O In order to not have to sell Canadian dollars, it could buy bonds from domestic banks. O In order to not have to sell Canadian dollars, it could sell bonds to domestic banks.arrow_forward

- Assume that you buy a 1-year, 168,000-peso Philippine bond that pays 9 percent when the exchange rate is 1 Canadian dollar for 42 pesos. If, after one year, the peso falls to 1 Canadian dollar equals 45 pesos, how much have you gained or lost in Canadian dollars? Round your answer to the nearest dollar amount. loss * $ 4353arrow_forwardOptions are gain or loss. Note : don't use chat gp8arrow_forwardSuppose you & classmates are marketing team assembled by your Brazil based firm To estimate demand in the U.S. market for its newly developed product. The market Research firm you hired requires $150,000 to perform a thorough study. But your Group is informed that total research budget for the year is 3 million Brazilian real & That no more than 20% of the budget can be spent on any one project. 16 points a. If the current exchange rate is 5 real/$, will you have the market study Conducted? Why or why not? (show your calculations) b. If the current exchange rate is 3 real/$, will you have the market study Conducted? Why or why not? (show your calculations) c. At what exchange rate your decision from rejecting the proposed research project to accept the Project?arrow_forward

- Purchasing-power parity (PPP) theory states that exchange rates would need to equalize the prices of goods in any two countries. For the dollar price Activity Frame o be the same in both countries, a U.S. citizen would need to be able to convert $5.74 into exactly GBP 3.29. To find the exchange rate at which hamburger purchasing power is the same in both countries, divide the price in the United States by the price in the United Kingdom: PPP Exchange Rate (U.S. Dollars per British pound) = $5.74 GBP 3.29 = $1.74 per pound The exchange rate that would have equalized the dollar price of a Big Mac in the United States and the Euro area (that is, the PPP exchange rate for Big Macs) is . This change would mean that the euro had against the dollar. If Big Macs were a durable good that could be costlessly transported between countries, which of the following would present an arbitrage opportunity? Check all that apply. Exporting Big Macs from the Euro area to the United States Exporting Big…arrow_forwardDetermine for each, whether the interest parity condition holds or not, if Ese = 1.10 Interest Rate for the Dollar R$ 0.07 0.08 0.09 0.1 0.12 Page 9 of 11 Interest Rate for the Euro Re 0.02 0.08 0.04 0 0.04 Expected Rate of Dollar Depreciation Against Euro (Ese-Este)/Ese 0.11 0.16 0.05 0.11 0.16 Interest Parity Condition Holds? (YES/NO)arrow_forwardOolong tea is produced in China and sold in many countries. In the province of Fujian, per 100 grams of Oolong tea sells for 50 yuan. In Kuala Lumpur, per 100 grams of the same Oolong tea sells for RM20. Suppose that the exchange rate is RM0.45 1 yuan. Please do the following calculations based on the above information: 1. How much would it cost in Malaysian currency to buy the tea in Fujian? 2. How much would it cost in China currency to buy the tea in Kuala Lumpur?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education