Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

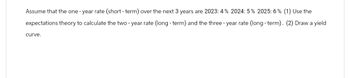

Transcribed Image Text:Assume that the one-year rate (short-term) over the next 3 years are 2023: 4% 2024: 5% 2025: 6% (1) Use the

expectations theory to calculate the two-year rate (long-term) and the three-year rate (long-term). (2) Draw a yield

curve.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- market has an expected return of 9% per year with a standard deviation of 25%. You have designed a financial asset that will only pay out money if the market return i between 0% and 30%. The probability the asset will pay out money isarrow_forwardYou had the following rates of return for on your portfolio for the last four years: 2019: -10.1%2020: 15.4%2021: 7.3%2022: 12.8%Calculate the geometric average return on your portfolio. Enter your answer as a decimal, rounded to four decimal places.arrow_forwardSuppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1 = 6%, E(2r1) = 7%, E(3r1) = 7.60%, E(4r1) = 7.95% Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Round your answers to 2 decimal places.)arrow_forward

- DONE IN EXCEL especify how to donthe graph step by step okease 5. (a) Use rate of return analysis to decide which one will you select if your MARR is 14% per year? (b) Graph interest rate vs. present value for both option 1 and 2. (c) Discuss how your selection between option 1 and 2 will change when MARR is changed and at which interest rate the two options are the same economically. The following two alternatives are mutually exclusive. Annual Benefit Salvage Value Alternative Initial Life, Cost years 4. Option 1 Option 2 $42,000 $45,000 $10,000 $11,500 $4,000 $4,200 6.arrow_forwardYogesharrow_forwardConsider a 2-year European put with a strike price of $52 on a stock whose current stock price is $50. Suppose that there are two time steps, and in each time step the stock price either moves up by 30% or moves down by 30%. Also suppose that risk-free rate is 7% per annum with continuous compounding. What is the value of the European put option?arrow_forward

- Assume the following states of the world could exist in the economy tomorrow. Find the expected return for this stock. Reminder that the states of the world have to add to 100%. Probability Return 30% -1 50% 3 xx% 8arrow_forwardGive typing answer with explanation and conclusionarrow_forwardSuppose that the current one-year rate (one- year spot rate) and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1=6%, E(2r1) =7%, E(3r1) =7.5% E(4r1)=7.85% 1 Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. Show your answers in percentage form to 3 decimal places.arrow_forward

- You note the following yield curve in The Wall Street Journal. According to the unbiased expectations theory, what is the 1-year forward rate for the period beginning one year from today, 2f1? Note: Do not round intermediate calculations. Round your percentage answer to 2 decimal places (i.e., 0.1234 should be entered as 12.34). Maturity One day One year Two years Three years. Forward rate Yield 2.80% 6.30 7.30 9.80arrow_forwardFinding Forward Rates Suppose the following yield curve: 1-period rate = 4.75%, 2-period rate=4.85%, 3-period rate= 4.90%, 4 period rate=5.01%. What is the 2 year forward rate in 2 years? What is 1 year rate in 2 years?arrow_forwardIf the value of sustainable investing is $158.7 and the discount rate is 5.8% while the value of non-sustainable investing is $22.81 and the expected value of the company is $27.14. What is the assumed probability of being sustainable given a 5 year horizon? (Answer in percent to 2 decimals)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education