FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Accurate answer

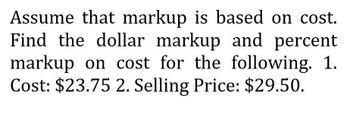

Transcribed Image Text:Assume that markup is based on cost.

Find the dollar markup and percent

markup on cost for the following. 1.

Cost: $23.75 2. Selling Price: $29.50.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that markup is based on cost. Find the dollar markup and percent markup on cost for the following. 1. Cost: $23.75 2. Selling Price: $29.50.arrow_forwardAssume that markup is based on the costarrow_forwardAssume that markup is based on cost. Find the dollarmarkup and percent markup on cost for the following. 1. Cost: $24.65 2. Selling Price: $28.70. Help me tutorarrow_forward

- Find the dollar markup and percent markup ?arrow_forwardAbcarrow_forwardAssume that markup is based on cost. Find the dollar markup and percent markup on cost for the following. Note: Round your "Dollar markup" answer to the nearest cent and "Percent markup on cost" to the nearest hundredth percent. Cost 16.40 Selling price 24.60 Dollar markup Percent markup on cost %arrow_forward

- If selling price is $2.08 and cost is $1.60, what is the price/cost ratio?arrow_forwardComplete the following table by filling in the missing amounts: See attached tablearrow_forwardIf an item will be priced according to a 55 percent gross margin and the item costs $20, use that gross margin percentage to directly calculate the item’s pricearrow_forward

- Assume markup percentage equals desired profit divided by total costs. What is the correct calculation to determine the dollar amount of the markup per unit? Select one: a. Total cost per unit times markup percentage per unit. b. Total cost per unit divided by markup percentage per unit. c. Total cost times markup percentage. d. Markup percentage divided by total cost. e. Markup percentage per unit divided by total cost per unit.arrow_forwardAccounting Questionarrow_forward2. FIFO 3. LIFO 4. Weighted average method (Round average unit cost to the nearest cent, and round all other calculations and your final answers to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education