ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

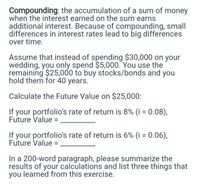

Transcribed Image Text:Compounding: the accumulation of a sum of money

when the interest earned on the sum earns

additional interest. Because of compounding, small

differences in interest rates lead to big differences

over time.

Assume that instead of spending $30,000 on your

wedding, you only spend $5,000. You use the

remaining $25,000 to buy stocks/bonds and you

hold them for 40 years.

Calculate the Future Value on $25,000:

If your portfolio's rate of return is 8% (i = 0.08),

Future Value =

If your portfolio's rate of return is 6% (i = 0.06),

Future Value =

In a 200-word paragraph, please summarize the

results of your calculations and list three things that

you learned from this exercise.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Pretend that today is your birthday and you decide to start saving for your retirement. You will retire on your 65th birthday and need $4,000 per month for the next 20 years, increasing $100 per month after the first month. You will make your first withdrawal on your 65th birthday, the day you retire. You will make the first deposit today in an account paying 7% interest compounded daily, and continue to make the same $123.07 equal weekly deposits up to your 60th birthday, then you stop making deposits. What birthday are you celebrating today? Create a cash flow diagram.arrow_forwardIf the interest rate is 10%, what is the present value of a security that pays you $1,150 next year, $1,230 the year after, and $1,344 the year after that? ← Present value is $ (Round your response to the nearest penny.)arrow_forwardIf the current price of a bond is greater than its face value: A) There is no right answer. B) the yield to maturity must be larger than the current yield. C) the coupon rate must be equal to the current yield.arrow_forward

- You own a 10-acre blueberry farm. You could farm the land yourself or rent it out for $7,000 per year. Another option is to sell the land this year at its current market price of $80,000. The price of the land next year will be $78,000. If you sell it, your group has an investment opportunity from which you expect to make a return of 6 percent per year. What is the opportunity cost to you of using the land to grow blueberries for a year? O a. $2,000 O b. $4,800 OC. $5,000 d. $9,800arrow_forwardConsider a bond with a face value of $2,000 that pays a coupon of $50 for 1 year (that is, you will receive both the face value and one coupon payment next year). Suppose the bond is purchased at $2,000. What is the yield to maturity of the bond? 2.5% 25% 1.025% 1.25%arrow_forwardQuestion 6 Suppose you are interested in buying a one-year 1,000 dirham bond. You have two options available in the bond market: Option 1 - Emirates Airline bond that pays a coupon rate of 4.75% per year paid annually. Option 2 - Emaar bond that pays a coupon rate of 6.0% per year paid annually. If you decide to buy the Emirates Airline bond, which of the prices below will give you a return approximately equal to the Emaar bond? O a. 956.9 dirhams Ob.973.2 dirhams O. 995.2 dirhams Od. 988.2 dirhamsarrow_forward

- Economics Annual premiums are paid into a 3 year unit linked endowment policy where 98% of each premium is allocated to units in a fund that carries a 3% bid- offer spread and charges management fees of 0.75% of assets at the end of each policy year. The policy has a death benefit of the bid value of units payable at the end of the year of death subject to a minimum of £12,500. The survival benefit is the bid value of units at the end of the term. The life assurance company estimates that expenses are £95 per policy per year. (a) Produce projected revenue accounts for each year of a policy with an annual premium of £5,000 assuming the annual rate of mortality is 0.00498, an investment return of 6.9% per annum and an interest rate on cash balances of 3% per annum. (b) Does the life assurance company meet its internal profit margin objective of 5% on this policy if its risk discount rate is 5.5% per annum?arrow_forwarddo fastarrow_forwardAs a manager of your company, you are considering to go for a project, with an initial outlay of $200,000. The project has a life of three years and yields (year-end) cash inflows of $ 100,000 in year-1, $150,000 in year-2 and $200,000 in year 3. What is the net present value of the project if the interest rate is 10 percent? Show your steps. Should you recommend to go for the project? Explain in details.arrow_forward

- You are purchasing a 20-year, zero-coupon bond. The yield to maturity is 9.76 percent and the face value is $1,000. What is the current market price? Assume a semiannual interest rate payment.arrow_forwardThe price of a bond with no expiration date is originally $1,000 and has a fixed annual interest payment of $150. If the price of the bond then falls by $100, what will be the interest rate yield to a new buyer of the bond? Multiple Choice 16.7 percent 8.4 percent 15 percent 13.6 percent 10 percentarrow_forwardWhat is the expected return from an investment if there is a 20 percent chance of a 4 percent return, a 40 percent chance of a 8 percent return, and a 40 percent chance of a 12 percent returnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education