FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

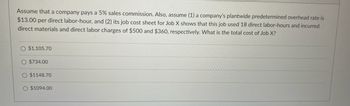

Transcribed Image Text:Assume that a company pays a 5% sales commission. Also, assume (1) a company's plantwide predetermined overhead rate is

$13.00 per direct labor-hour, and (2) its job cost sheet for Job X shows that this job used 18 direct labor-hours and incurred

direct materials and direct labor charges of $500 and $360, respectively. What is the total cost of Job X?

O $1,105.70

O $734.00

O $1148.70

O $1094.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Valencia Company uses the job order cost system of accounting. Job 915 has material cost P1,180 and direct labor cost P1,040. The factory overhead is applied at 180% of direct labor costs. What is the total cost of Job 915 when completed? * O P1,872 O P2,220 O P4,092 O P2,400 O None of the abovearrow_forwardPlease help me with show all calculation thankuarrow_forwardAdams, Inc. estimates manufacturing overhead costs for the Year 3 accounting period as follows. Equipment depreciation Supplies Materials handling Property taxes Production setup Rent Maintenance Supervisory salaries $190,800 20,800 32,800 14,800 20,000 44,500 38,600 157,700 The company uses a predetermined overhead rate based on machine hours. Estimated hours for labor in Year 3 were 212,000 and for machines were 130,000. Required a. Calculate the predetermined overhead rate. (Round your answer to 2 decimal places.) b. Determine the amount of manufacturing overhead applied to Work in Process Inventory during the Year 3 period if actual machine hours were 145,000. (Do not round intermediate calculations.) a. Predetermined overhead rate b. Applied manufacturing overhead per machine hourarrow_forward

- Happy Clicks Inc. uses a predetermined overhead allocation rate of $4.75 per machine hour. Actual overhead costs incurred during the year are as follows: Indirect materials $5,200 Indirect labor $3,750 Plant depreciation $4,800 Plant utilities and insurance $9,530 Other plant overhead costs $12,700 Total machine hours used during the year 7,520 hours What is the amount of manufacturing overhead cost allocated to Work-in-Process Inventory during the year? Is the manufacturing overhead account under or over-allocated and if so by how much? Journalize the under or over allocation.arrow_forwardAssume that RamCo applies overhead to jobs based on direct labor cost. Job A1 was started and completed and sold to customer for $500. The Job A1 cost sheet shows $200 for direct materials, $100 for direct labor, and $60 for overhead on its job cost sheet. Job A2 is still in process at year end and shows charges of $280 for direct materials and $150 for direct labor. How much overhead should be charged to Job A2 at year end? $0 $60 $90 $120 000arrow_forwardThe following information pertains to Whitestone Industries for the year: Estimated total overhead costs Estimated direct labor costs Actual direct labor costs Actual overhead costs Activity base $37,500 25,000 22,500 36,000 Direct labor costs What is the predetermined overhead rate for Whitestone Industries for the year? Oa. 62.5% Ob. 66.7% Oc. 150% Od. 160%arrow_forward

- Osborn Manufacturing uses a predetermined overhead rate of S19.00 per direct labor hour. This predetermined rate wae based on a cost formula that estimates $243,200 of total manufacturing overhead for an estimated activity level of 12 800 direct labor-hours The company actually incurred $241,000 of manufacturing overhead annd 12,300 direct labor-hours during the period Required: 1. Determine the amount of underapplied or overapplied manufecturing averhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dis pose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1 Manufacturing overhead underappled by 2 The gross margin would decreasearrow_forwardMickley Company’s predetermined overhead rate is $14.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-500: Direct materials $230 Direct labor $108 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 40 units, what is the average cost assigned to each unit included in the job? (Round your answer to 2 decimal places.)arrow_forwardEe.78.arrow_forward

- Puzzle Company uses a job order costing system. The company's executives estimated that direct labor would be $1,650,000 (150,000 hours at $11/hour) and that factory overhead would be $1,500,000 for the current period. At the end of the period, the records show that there had been 180,000 hours of direct labor and $1,200,000 of actual overhead costs. Using direct labor hours as a base, what was the predetermined overhead rate?arrow_forwardMackey Company's plantwide predetermined overhead rate is $25.00 per DLH and its direct labor wage is $21.00 per hour. For Job N, Direct materials is $1,000 and Direct labor is $420. a. What is the total manufacturing cost assigned to Job N? b. If Job N consists of 60 units, what is the unit product cost for this job?arrow_forwardPLEASE ANSWER PO AND SHOW SOLUTIONarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education