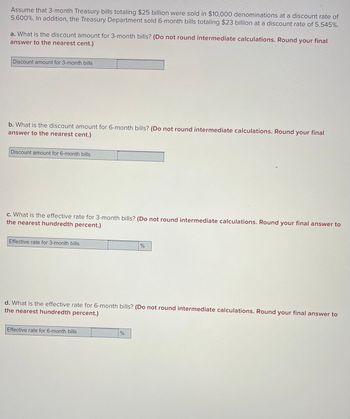

Assume that 3-month Treasury bills totaling $25 billion were sold in $10,000 denominations at a discount rate of 5.600%. In addition, the Treasury Department sold 6-month bills totaling $23 billion at a discount rate of 5.545%. a. What is the discount amount for 3-month bills? (Do not round intermediate calculations. Round your final answer to the nearest cent.) Discount amount for 3-month bills b. What is the discount amount for 6-month bills? (Do not round intermediate calculations. Round your final answer to the nearest cent.) Discount amount for 6-month bills c. What is the effective rate for 3-month bills? (Do not round intermediate calculations. Round your final answer to the nearest hundredth percent.) Effective rate for 3-month bills Effective rate for 6-month bills **** d. What is the effective rate for 6-month bills? (Do not round intermediate calculations. Round your final answer to the nearest hundredth percent.) % %

Assume that 3-month Treasury bills totaling $25 billion were sold in $10,000 denominations at a discount rate of 5.600%. In addition, the Treasury Department sold 6-month bills totaling $23 billion at a discount rate of 5.545%. a. What is the discount amount for 3-month bills? (Do not round intermediate calculations. Round your final answer to the nearest cent.) Discount amount for 3-month bills b. What is the discount amount for 6-month bills? (Do not round intermediate calculations. Round your final answer to the nearest cent.) Discount amount for 6-month bills c. What is the effective rate for 3-month bills? (Do not round intermediate calculations. Round your final answer to the nearest hundredth percent.) Effective rate for 3-month bills Effective rate for 6-month bills **** d. What is the effective rate for 6-month bills? (Do not round intermediate calculations. Round your final answer to the nearest hundredth percent.) % %

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Incomplete question please repost the question

Your Question:

Transcribed Image Text:Assume that 3-month Treasury bills totaling $25 billion were sold in $10,000 denominations at a discount rate of

5.600%. In addition, the Treasury Department sold 6-month bills totaling $23 billion at a discount rate of 5.545%.

a. What is the discount amount for 3-month bills? (Do not round intermediate calculations. Round your final

answer to the nearest cent.)

Discount amount for 3-month bills

b. What is the discount amount for 6-month bills? (Do not round intermediate calculations. Round your final

answer to the nearest cent.)

Discount amount for 6-month bills

c. What is the effective rate for 3-month bills? (Do not round intermediate calculations. Round your final answer to

the nearest hundredth percent.)

Effective rate for 3-month bills

Effective rate for 6-month bills

****

d. What is the effective rate for 6-month bills? (Do not round intermediate calculations. Round your final answer to

the nearest hundredth percent.)

%

%

Recommended textbooks for you