FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Assume prices were stable during the period. The following values were obtained from the inventory records of Harris Company which has a fiscal year ending on December 31:

| Inventory, January 1, 2019, LIFO | $80,000 |

| Inventory, March 31, 2019, LIFO | 70,000 |

| Required: | |

| 1. | Under what conditions is Harris’s inventory liquidation not reflected in its first-quarter interim financial statements? |

| 2. | Assuming that the liquidation is not to be reflected, what |

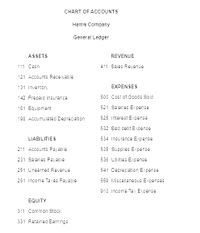

Transcribed Image Text:CHART OF ACCOUNTS

Harris Company

General Ledger

ASSETS

REVENUE

111 Cash

411 Sales Revenue

121 Accounts Receivable

131 Inventory

EXPENSES

142 Prepaid Insurance

500 Cost of Goods Sold

181 Equipment

521 Salaries Expense

198 Accumulated Depreciation

525 Interest Expense

532 Bad debt Expense

LIABILITIES

534 Insurance Expense

211 Accounts Payable

535 Supplies Expense

231 Salaries Payable

536 Utilities Expense

251 Unearned Revenue

541 Depreciation Expense

261 Income Taxes Payable

559 Miscellaneous Expenses

910 Income Tax Expense

EQUITY

311 Common Stock

331 Retained Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. In 2021, Jules Company realized that its ending inventory was understated by P1,500 in 2019. How should Jules Company handle this? a. An adjustment to reduce inventory by P1,500 needs to be made b. An adjustment to increase cost of goods sold by P1,500 needs to be made. c. An adjustment to increase inventory by P1,500 needs to be made d. No adjustment needs to be made. 2. For interim reporting, a gain on disposal of land occurring in the third quarter is a. Recognized and allocated over the quarters b. Recognized and allocated over four quarters c. Recognized immediately in the third quarter d. Deferred until the annual reportingarrow_forwardDuring 2021, P Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2019 $ 120,000 understated 2020 $ 150,000 overstated *Note any error of 2019 ending inventory is carried over to 2020 as an error of the beginning inventory. P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2021, would be: O Correct. O $30,000 overstated O $150,000 overstated. O $270,000 overstated.arrow_forwardGoddard Company has used the FIFO method of inventory valuation since it began operations in 2018. Goddard decided to change to the average cost method for determining inventory costs at the beginning of 2021. The following schedule shows year-end inventory balances under the FIFO and average cost methods: Year FIFO Average Cost 2018 $45,100 2019 78,300 2020 83,400 $54,200 71,100 78,300 Required: 1. Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. 2. How much higher or lower would cost of goods sold be in the 2020 revised income statement? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Ignoring income taxes, prepare the 2021 journal entry to adjust the accounts to reflect the average cost method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the adjustment…arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education