FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

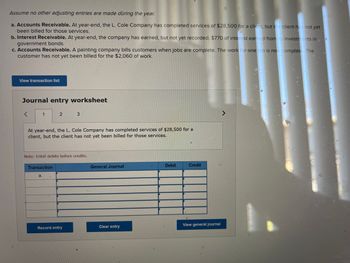

Transcribed Image Text:Assume no other adjusting entries are made during the year.

a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $28,500 for a client, but the client has not yet

been billed for those services.

b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $770 of interest earned from its investments in

government bonds.

c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now.complete. The

customer has not yet been billed for the $2,060 of work.

View transaction list

Journal entry worksheet

<

1

2

At year-end, the L. Cole Company has completed services of $28,500 for a

client, but the client has not yet been billed for those services.

Transaction

a.

Note: Enter debits before credits.

3

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

^

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Casper Company uses its receivables in estimating uncollectible accounts (Bad Debt) expense. The company prepares an adjusting entry to recognize this expense at theend of the month. The beginning credit balance in the Allowance for Doubtful Accounts at July 1 was $64,000. During the month of July, the company wrote of 9,000 in Accounts Receivable but also collected a receivable of 3,000 that had been written off back in April. An aging analysis at July 31 indicated that the new credit balance in the Allowance for Doubful Accounts should be $69,000. On the adjusting entry on July 31, the debt to the Bad Debt Expense would be:arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $660,000, Allowance for Doubtful Accounts has a credit balance of $6,000, and sales for the year total $2,.970,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $25.200. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardAfter the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $450,000 and Allowance for Doubtful Accounts has a balance of $25,000. What is the net expected realizable value of the accounts receivable? $25,000 O $450,000 O $455,000 $425,000arrow_forward

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $950,000, Allowance for Doubtful Accounts has a credit balance of $8,500, and sales for the year total $4,280,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $29,800. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardAt the end of the current year, Accounts Receivable has a balance of $94,790; Allowance for Doubtful Accounts has a debit balance of $3,279; and sales for the year total $1,099,000. Bad debt expense is estimated at 1% of sales. a. Determine the amount of the adjusting entry for bad debt expense.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts fill in the blank 3 Bad Debt Expense fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forwardDo not give solution in imagearrow_forward

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $400,000; Allowance for Doubtful Accounts has a debit balance of $3,500; and sales for the year total $1,800,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $15,800. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.arrow_forwardAt the end of the current year, Accounts Receivable has a balance of $128,310; Allowance for Doubtful Accounts has a debit balance of $3,095; and sales for the year total $947,000. Bad debt expense is estimated at 1/2 of 1% of sales. a. Determine the amount of the adjusting entry for bad debt expense.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts fill in the blank 3 Bad Debt Expense fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forwardHi, Please with question, thank you.arrow_forward

- On December 31 of Swift Co.’s first year, $59,000 of accounts receivable is not yet collected. Swift estimates that $2,900 of its accounts receivable is uncollectible and records the year-end adjusting entry. (1) Compute the realizable value of accounts receivable reported on Swift’s year-end balance sheet. (2) On January 1 of Swift’s second year, it writes off a customer’s account for $300. Compute the realizable value of accounts receivable on January 1 after the write-off.arrow_forwardAt the close of its first year of operations, December 31, 2021, Mega Company had accounts receivable of $540,000, after deducting the related allowance for doubtful accounts. During 2021, the company had charges to bad debt expense of $90,000 and wrote off, as uncollectible, accounts receivable of $40,000. What should the company report on its statement of financial position at December 31, 2021, as accounts receivable before the allowance for doubtful accounts?arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $545,000; Allowance for Doubtful Accounts has a credit balance of $5,000; and sales for the year total $2,450,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $22,500. a. Determine the amount of the adjusting entry for uncollectible accounts.$ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ Allowance for Doubtful Accounts $ Bad Debt Expense $ c. Determine the net realizable value of accounts receivable.$arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education