Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

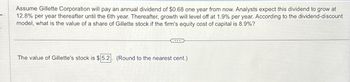

Transcribed Image Text:Assume Gillette Corporation will pay an annual dividend of $0.68 one year from now. Analysts expect this dividend to grow at

12.8% per year thereafter until the 6th year. Thereafter, growth will level off at 1.9% per year. According to the dividend-discount

model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.9%?

The value of Gillette's stock is $5.2 (Round to the nearest cent.)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Assume Highline Company has just paid an annual dividend of $1.05. Analysts are predicting an 10.5% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.1% per year. If Highline's equity cost of capital is 7.6% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $ (Round to the nearest cent.)arrow_forwardassume evco, inc., has a current stock price of $59 and will pay a $1.75 dividend in one year; its equity cost of capital is 13%. what price must you expect evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? the expected price is $ (round to the nearest cent.)arrow_forwardGillette Corporation will pay an annual dividend of $ 0.63 one year from now. Analysts expect this dividend to grow at 1 1.1 % per year thereafter until the 6th year. Thereafter, growth will level off at 1.6 % per year. According to the dividend- discount model, what is the value of a Gillette share if the firm's equity cost of capital is 8.4 %? Question content area bottom Part 1 The value of a Gillette share is $ enter your response here. (Round to the nearest cent.)arrow_forward

- Assume Gillette Corporation will pay an annual dividend of $0.63 one year from now. Analysts expect this dividend to grow at 12.6% per year thereafter until the 6th year. Thereafter, growth will level off at 1.6% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 7.7%? The value of Gillette's stock is $ (Round to the nearest cent.)arrow_forwardK thereafter Assume Gillette Corporation will pay an annual dividend of $0.65 one year from now. Analysts expect this dividend to grow at 11.5% per year until the 6th year. Thereafter, growth will level off at 2:2% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.4%? The value of Galetle's stock is $ (Round to the nearest cont.) CIDarrow_forwardAnle Corporation has a current price of $13, is expected to pay a dividend of $2 in one year, and its expected price right after paying that dividend is $22. What is Anle's expected dividend yield? (Round to two decimalplaces.) What is Anle's expected capital gain rate? (Round to two decimalplaces.) What is Anle's equity cost of capital? (Round to two decimalplaces.)arrow_forward

- Assume Gillette Corporation will pay an annual dividend of $0.61 one year from now. Analysts expect this dividend to grow at 11.5% per year thereafter until the 6th year. Thereafter, growth will level off at 2.3% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.4%? The value of Gillette's stock is $ (Round to the nearest cent.)arrow_forwardCullumber Wok Co. is expected to pay a dividend of $1.70 one year from today on its common shares. That dividend is expected to increase by 5.00 percent every year thereafter. If the price of Cullumber common stock is $17.00, what is the cost of its common equity capital? - Cost of common equity =?%arrow_forwardAssume Highline Company has just paid an annual dividend of $1.04. Analysts are predicting an 11.3% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.5% per year. If Highline's equity cost of capital is 8.1% per year and its dividend payout ratio remains constant, for what price does the dividend - discount model predict Highline stock should sell? The value of Highline's stock is $. (Roun to the nearest cent.) Assume Highline Company has just paid an annual dividend of $1.04. Analysts are predicting an 11.3% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.5% per year. If Highline's equity cost of capital is 8.1% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $…arrow_forward

- Maynard Steel plans to pay a dividend of $3.18 this year. The company has an expected earnings growth rate of 4.5% per year and an equity cost of capital of 10.8%. a. Assuming that Maynard's dividend payout rate and expected growth rate remain constant, and that the firm does not issue or repurchase shares, estimate Maynard's share price. b. Suppose Maynard decides to pay a dividend of $1.08 this year and use the remaining $2.10 per share to repurchase shares. If Maynard's total payout rate remains constant, estimate Maynard's share price. a. Assuming that Maynard's dividend payout rate and expected growth rate remain constant, and that the firm does not issue or repurchase shares, estimate Maynard's share price. Maynard's share price will be $. (Round to the nearest cent.)arrow_forwardGillette Corporation will pay an annual dividend of $0.61 one year from now. Analysts expect this dividend to grow at 11.4% per year thereafter until the 5th year. Thereafter, growth will level off at 2.2% per year. According to the dividend discount model, what is the value of a Gillette share if the firm's equity cost of capital is 8.9% ?arrow_forwardPearson stock will pay an annual divident of $.26 next year. If after that, the dividend grows 2% per year and Pearson has a 6% cost of equity capital, what is Pearson's projeted stock price under the Constant Dividend Growth Model? Choose the closest. a) $4.33 b) $6.50 c) $9.80 d) $13.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education