ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

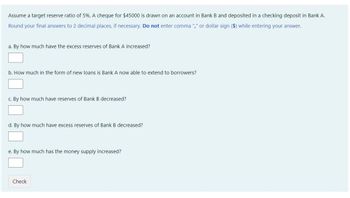

Transcribed Image Text:Assume a target reserve ratio of 5%. A cheque for $45000 is drawn on an account in Bank B and deposited in a checking deposit in Bank A.

Round your final answers to 2 decimal places, if necessary. Do not enter comma "," or dollar sign ($) while entering your answer.

a. By how much have the excess reserves of Bank A increased?

b. How much in the form of new loans is Bank A now able to extend to borrowers?

c. By how much have reserves of Bank B decreased?

d. By how much have excess reserves of Bank B decreased?

e. By how much has the money supply increased?

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the following information describes the banking system in Belarus. Currency = $940 billion Checking Deposits = $1,475 billion Total Reserves = S198 billion Required Reserves = $177 billion (a) Calculate the level of the monetary base (MB) in the banking system of Belarus. (b) Given the above data calculate the money multiplier (m). Round vour answer to 2 decimal places.arrow_forwardHelen deposits $10,000 of currency into her checking account deposit at Bank A and that the required reserve ratio is 20%. As a result of her deposit, Bank A can make a maximum loan of ____ . Checking account deposits in the banking system as a whole (including the original deposit) could eventually increase up to _____ . Select one: a. $10,000 , $100,000. b. $2,000 , $10,000. c. $8,000 , $50,000. d. $50,000 , $100,000. e. $9,000 , $40,000.arrow_forwardSuppose Southeast Mutual Bank, Walls Fergo Bank, and PJMorton Bank all have zero excess reserves. The required reserve ratio is presently set at 10%. Eric, a Southeast Mutual Bank customer, deposits $250,000 into his checking account at the local branch. Complete the following table to reflect any changes in Southeast Mutual Bank's T-account (before the bank makes any new loans). Assets Liabilities Complete the following table to show the effect of a new deposit on excess and required reserves when the required reserve ratio is 10%. Hint: If the change is negative, be sure to enter the value as negative number. Amount Deposited Change in Excess Reserves Change in Required Reserves (Dollars) (Dollars) (Dollars) 250,000 Now, suppose Southeast Mutual Bank loans out all of its new excess reserves to Cho, who immediately uses the funds to write a check to Bob. Bob deposits the funds immediately into his checking…arrow_forward

- Money/Banking/The Quantity of Money Theory (Chapter 14) 1.1 What are the four functions of money? Explain each in your own words. Can something be considered money if it does not fulfill all four functions? 1.2 Using the five criteria in the textbook, explain how U.S. currency is suitable to use as a medium of exchange. 1.3 Suppose that you decide that you no longer want to hold currency, and deposit all of your currency holdings to your checking account. What is the immediate or initial impact of this transaction on M1 and M2?arrow_forwardmacmillan learning Suppose that the legal reserve ratio set by the Fed is 10% and that the Fair Bank in Fairdealing, Missouri, initially has checkable deposit equal to $240 and a reserve account of $70. A customer of Fair Bank deposits $100 into her checking account. Fair Bank loans 80% of the deposit and places the rest in its reserves at the St. Louis Fed. For simplicity, assume the borrower received the loan as cash. How much does Fair Bank have in excess reserves after the deposit and loan? Number Place the figures below to represent changes in the accounts of Fair Bank and the Federal Reserve of St. Louis' balance sheets resulting from the deposit and loan. Hint Cash: Reserves: Loans: Property: $ +$100 +$80 Balance Sheet: Fair Bank Liabilities: Net equity: +$20 -$100 -$20 +$10 -$80 -$10 Balance Sheet: Saint Louis Fed Liabilities: Cash: Property: Loans: Previous Check Answer Next Exitarrow_forwardNonearrow_forward

- Suppose that Kesha deposits $8,000 into her savings account at First Bank. The reserve requirement facing First Bank Is 20%. Instructions: Enter your answer as a whole number. If you are entering a negative number include a minus sign. a. Use this information to show how First Bank's assets and liabilities Initially change when Kesha deposits the $8,000 in the bank. A Simple Bank Balance Sheet Assets Change in Reserves: $ Liabilities Change in Deposits: $ b. How much money can First Bank lend out to other people? $ c. Now suppose that First Bank holds no excess reserves and lends out all of the excess reserves resulting from Kesha's deposit. How do First Bank's assets and liabilities change? A Simple Bank Balance Sheet Assets Change in Reserves: $ Change in Loans: $ Liabilitiesarrow_forwardDiscuss the various functions of moneyarrow_forwardWhat is the value of the money multiplier when the required reserve ratio is: Instructions: Enter your responses rounded to two decimal places. (a) 16 percent? (b) 12 percent?arrow_forward

- The following data represents money from a small Island economy near Fuji. Cash in the hands of the public = $402 Public credit limit on all credit cards= 136 Demand deposits and all other checkable deposits= 693 Money market mutual funds = 618 Travelers check = 8 Large time deposits = 512 Small time deposits= 971 Public stock market holdings = 1,069 Savings-type account = 256 What is the value of M1 for this economy using data above? What is the value of M2 for this economy using data above?arrow_forwardCan i get you alls help with this one?arrow_forwardNo written by hand solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education