Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

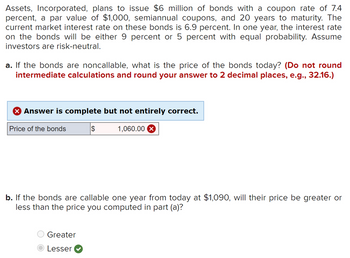

Transcribed Image Text:Assets, Incorporated, plans to issue $6 million of bonds with a coupon rate of 7.4

percent, a par value of $1,000, semiannual coupons, and 20 years to maturity. The

current market interest rate on these bonds is 6.9 percent. In one year, the interest rate

on the bonds will be either 9 percent or 5 percent with equal probability. Assume

investors are risk-neutral.

a. If the bonds are noncallable, what is the price of the bonds today? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

1,060.00

Price of the bonds

$

b. If the bonds are callable one year from today at $1,090, will their price be greater or

less than the price you computed in part (a)?

Greater

Lesser

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- need answer in step by steparrow_forwardA bond is issued with a coupon of 5% paid annually, a maturity of 31 years, and a yield to maturity of 8%. What rate of return will be earned by an investor who purchases the bond for $659.51 and holds it for 1 year if the bond's yield to maturity at the end of the year is 9% ? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus sign.) Rate of return %arrow_forwardThere is a risk of loss associated with selling bonds before the maturity date. A funds manager is holding 10-year bonds with a current value equal to the face value of $100,000. The bonds pay a fixed annual coupon of 8 per cent per annum. Interest rates for similar types of bonds increase to 9 per cent per annum. Calculate the new value of the bonds.arrow_forward

- Katle Pairy Fruits Incorporated has a $2,400 16-year bond outstanding with a nominal yield of 17 percent (coupon equals 17% × $2,400 = $408 per year). Assume that the current market required interest rate on similar bonds is now only 12 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the current price of the bond. Note: Do not round Intermediate calculations. Round your final answer to 2 decimal places. Assume Interest payments are annual. Current price of the bond b. Find the present value of 5 percent × $2,400 (or $120) for 16 years at 12 percent. The $120 is assumed to be an annual payment. Add this value to $2,400. Note: Do not round Intermediate calculations. Round your final answer to 2 decimal places. Assume Interest payments are annual. Present valuearrow_forwardSandhill Company is issuing eight-year bonds with a coupon rate of 6.8 percent and semiannual coupon payments. If the current market rate for similar bonds is 10 percent. Assume face value is $1,000. What will the bond price be? (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and bond price to 2 decimal places, e.g. 15.25.) Bond price $ If company management wants to raise $1.25 million, how many bonds does the firm have to sell? (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and number of bonds to O decimal places, e.g. 5,275.) Number of bondsarrow_forward(Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will mature in 20 years with an annual coupon rate of 11 percent. Their par value will be $1,000, and the interest will be paid semiannually. Pybus is hoping to get a AA rating on its bonds and, if it does, the yield to maturity on similar AA bonds is 9.5 percent. However, Pybus is not sure whether the new bonds will receive a AA rating. If they receive an A rating, the yield to maturity on similar A bonds is 10.5 percent. What will be the price of these bonds if they receive either an A or a AA rating? a. The price of the Pybus bonds if they receive a AA rating will be $ (Round to the nearest cent)arrow_forward

- (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will mature in 24 years with an annual coupon rate of 9 percent. Their par value will be $1,000, and the interest will be paid semiannually. Pybus is hoping to get a AA rating on its bonds and, if it does, the yield to maturity on similar AA bonds is 12 percent. However, Pybus is not sure whether the new bonds will receive a AA rating. If they receive an A rating, the yield to maturity on similar A bonds is 13 percent. What will be the price of these bonds if they receive either an A or a AA rating? a. The price of the Pybus bonds if they receive a AA rating will be $ (Round to the nearest cent.)arrow_forward(Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will mature in 25 years with an annual coupon rate of 8 percent. Their par value will be $1,000, and the interest will be paid semiannually. Pybus is hoping to get a AA rating on its bonds and, if it does, the yield to maturity on similar AA bonds is 9.5 percent. However, Pybus is not sure whether the new bonds will receive a AA rating. If they receive an A rating, the yield to maturity on similar A bonds is 10.5 percent. What will be the price of these bonds if they receive either an A or a AA rating? Question content area bottom Part 1 a. The price of the Pybus bonds if they receive a AA rating will be $enter your response here. (Round to the nearest cent.)arrow_forwardKIC Inc. plans to issue $7.2 million of bonds with a coupon rate of 16 percent paid semiannually and 36 years to maturity. The current one-year market interest rate on these bonds is 15 percent. In one year, the interest rate on the bonds will be either 18 percent or 9 percent with equal probability. Assume investors are risk neutral. a. If the bonds are non-callable, what is the price of the bonds today? (Do not round Intermediate calculations. Enter the answer in dollars. Round the final answer to 2 decimal places. Omit $ sign in your response.) Price of the bonds $ $3,799,246.63 b. If the bonds are callable one year from today at $1,575, will their price be greater or less than the price you computed in part (a)? Greater than Less than c. If the bonds are callable one year from today at $1,575, what is the current price of the bond? (Do not round Intermediate calculations. Enter the answer in dollars. Round the final answer to 2 decimal places. Omit $ sign in your response.) Current…arrow_forward

- Bearcat Corporation is offering bonds to the market with a coupon of 15 percent. The bonds make semiannual payments and currently have a yield to maturity of 11.78 percent. The bonds will mature in 14 years and have a face value of $1,000. What should be the current market price of each bond? O $815.67 O $1,215.85 O $652.75 О $1,218.29 O $1,150.67arrow_forwardAirborne Airlines Inc. has a $1,000 par value bond outstanding with 20 years to maturity. The bond carries an annual interest payment of $100 and is currently selling for $900. Airborne is in a 25 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar. a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. Yield on new issue :arrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education