FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Assets

Cash

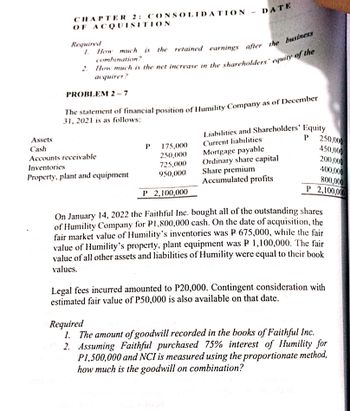

CHAPTER 2: CONSOLIDATION

OF ACQUISITION

Required

1. How much is the retained earnings after the business

combination?

2. How much is the net increase in the shareholders' equity of the

acquirer?

PROBLEM 2-7

The statement of financial position of Humility Company as of December

31, 2021 is as follows:

Accounts receivable

Inventories

Property, plant and equipment

DATE

P

175,000

250,000

725,000

950,000

P 2,100,000

Liabilities and Shareholders' Equity

Current liabilities

P

Mortgage payable

Ordinary share capital

Share premium

Accumulated profits

250,000

450,000

200,000

400,000

800,000

P 2,100,000

On January 14, 2022 the Faithful Inc. bought all of the outstanding shares

of Humility Company for P1,800,000 cash. On the date of acquisition, the

fair market value of Humility's inventories was P 675,000, while the fair

value of Humility's property, plant equipment was P 1,100,000. The fair

value of all other assets and liabilities of Humility were equal to their book

values.

Legal fees incurred amounted to P20,000. Contingent consideration with

estimated fair value of P50,000 is also available on that date.

Required

1. The amount of goodwill recorded in the books of Faithful Inc.

2. Assuming Faithful purchased 75% interest of Humility for

P1,500,000 and NCI is measured using the proportionate method,

how much is the goodwill on combination?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired in exchange for 5,000 shares of the parent company stock, and the investment accounts is recorded at P300,000, the current market value of the shares issued. The difference between the investment balance an the book value of the interest acquired is…arrow_forwardOn January 1, 2025, Artic Inc. had the following balance sheet: Cash Total Debt investments (available-for-sale) 363,000 $434,000 Assets Interest revenue ARTIC INC. BALANCE SHEET AS OF JANUARY 1, 2025 ARTIC INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2025 $11,000 Gain on sale of investments Net income $71,000 Common stock (a) The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities. The fair value of Artic Inc.'s available-for-sale debt securities at December 31, 2025, was $310,000; its cost was $277,000. No debt securities were purchased during the year. Artic Inc.'s income statement for 2025 was as follows: (Ignore income taxes.) 28,000 $39,000 (Assume all transactions during the year were for cash.) Accumulated other comprehensive income Total Equity $389,000 Debit 45,000 $434,000 Prepare the journal entry to record the sale of the available-for-sale debt securities in 2025. (Credit account titles are…arrow_forwardCash Accounts Receivable Inventory Property Plant & Equipment Other Assets Total Assets Acme Company Balance Sheet As of January 5, 2020 (amounts in thousands) 14,700 Accounts Payable 4,800 Debt 3,800 Other Liabilities 15,800 Total Liabilities 900 Paid-In Capital 2,400 3,700 5,000 11,100 6,000 Retained Earnings 22,900 Total Equity 28,900 40,000 Total Liabilities & 40,000 Equity Update the balance sheet above to reflect the transactions below, which occur on January 6, 2020 1. Receive payment of $12,000 owed by a customer 2. Buy $15,000 worth of manufacturing supplies on credit 3. Purchase equipment for $44,000 in cash 4. Issue $80,000 in stock 5. Pay $4,000 owed to a supplier 6. Borrow $58,000 from a bank 7. Buy $15,000 worth of manufacturing supplies on credit What is the final amount in Accounts Payable?arrow_forward

- Some recent financial statements for Smolira Golf Corporation follow. Assets Current assets 2023 2024 Cash $ 24,226 $ 25,900 Accounts receivable Inventory 14,248 27,802 17,000 Notes payable 28,900 Other Total $ 66,276 $ 71,800 Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Fixed assets Net plant and equipment $ 342,695 $ 364,200 Total SMOLIRA GOLF CORPORATION 2023 and 2024 Balance Sheets Liabilities and Owners' Equity Current liabilities Accounts payable 2023 $ 24,984 17,000 13,371 $ 55,355 $ 124,000 2024 $ 28,900 12,600 17,500 $ 59,000 $127,662 $ 60,000 189,338 $ 249,338 $ 60,000 169,616 $ 229,616 Total assets $ 408,971 $ 436,000 Total liabilities and owners' equity $ 408,971 $ 436,000 SMOLIRA GOLF CORPORATION 2024 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (23%) Net income $ 390,477 261,500 50,900 $ 78,077 16,100 $ 61,977 14,255 $ 47,722 Dividends…arrow_forwardCash Accounts receivable (net) Other current assets Investments Property, plant, and equipment (net) Current liabilities Long-term debt Common stock, $10 par Retained earnings Blue Corporation Balance Sheets December 31 Net income 2025 $31,000 $21,000 51,000 95,000 60,000 500,000 $86,000 150,000 370,000 $737,000 $612,000 $81,000 325,000 176,000 $737,000 Blue Corporation Income Statements For the Years Ended December 31 Sales revenue Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses (including income taxes) 2024 46,000 100.000 2025 75,000 90,000 315,000 $745,000 41,000 704,000 430,000 2023 $19,000 49,000 126,000 114,000 $612,000 $545,000 69,000 2024 50,000 358,000 $545,000 $71,000 55,000 305,000 $605,000 31,000 574,000 355,000 219,000 151,000 274,000 181,000 $93,000 $68,000arrow_forwardCotton Company has the following balance sheets and retained earnings statements: 2022 2021 Cash $10,000 $15,000 Receivables 15,000 10,000 Inventories (FIFO) 18,000 23,000 Other Assets 40,000 15,000 $83,000 $63,000 Capital Stock $40,000 $30,000 Retained Earnings 43,000 33,000 $83,000 $63,000 Retained Earnings Jan 1 $33,000 $35,000 Income 15,000 12,000 Dividends -5,000 -14,000 Retained Earnin Dec 31 $43,000 $33,000 The above incomes and Retained Earnings balances are based on FIFO Cost of Goods Sold. Cotton changed from FIFO to LIFO on January 1, 2022. December 31, 2022 inventory at LIFO is $17,000 while December 31, 2021 inventory at LIFO is $21,000. Inventory at January 1, 2021 was zero. a. Prepare statements in the format above assuming 2022 will…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education