Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

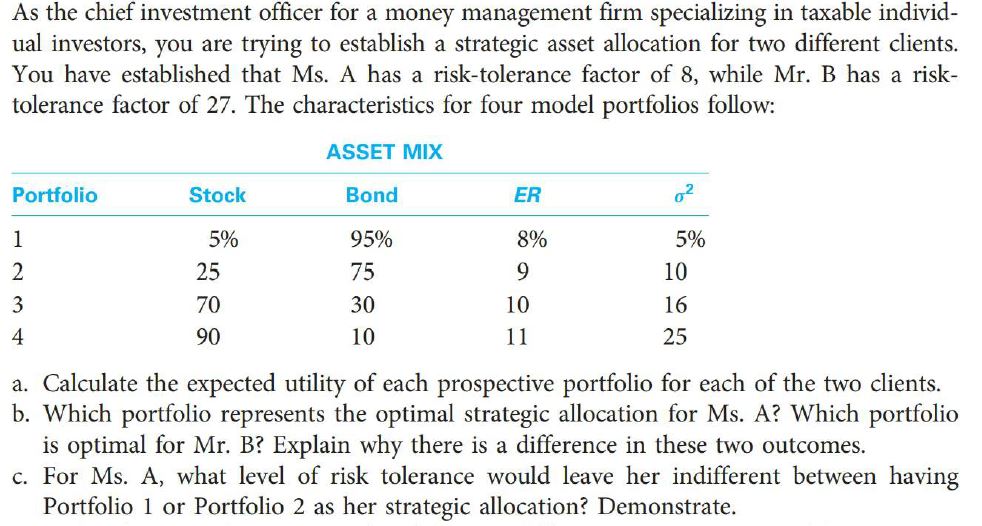

Transcribed Image Text:As the chief investment officer for a money management firm specializing in taxable individ-

ual investors, you are trying to establish a strategic asset allocation for two different clients.

You have established that Ms. A has a risk-tolerance factor of 8, while Mr. B has a risk-

tolerance factor of 27. The characteristics for four model portfolios follow:

ASSET MIX

o2

Portfolio

Stock

Bond

ER

5%

95%

8%

5%

9.

2

25

10

75

3

70

30

10

16

4

90

10

11

25

a. Calculate the expected utility of each prospective portfolio for each of the two clients.

b. Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio

is optimal for Mr. B? Explain why there is a difference in these two outcomes.

c. For Ms. A, what level of risk tolerance would leave her indifferent between having

Portfolio 1 or Portfolio 2 as her strategic allocation? Demonstrate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Similar questions

- Investing in mutual funds allows an investor to achieve O A. Diversification B. Professional portfolio management C. Guaranteed reservations at your favorite restaurant D. Returns equal to the S&P 500 O E. Both A & Barrow_forwarda. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three stocks if you want to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG.b. How would the portfolio be affected if you distributed your investment in the following way: 30% in ADRE; 25% on MSFT and 45% on GOOG?c. Which of the two portfolios would a risk seeking investor prefer and why?arrow_forwardMr. Ota is an analyst for a large pension fund and he has been assigned the task of evaluating two different external portfolio managers (K and C). He considers the following historical average return, standard deviation, and CAPM beta estimates for these two managers over the past five years: Actual Average Standard deviation Portfolio Beta Return Manager K Manager C 7.80% 10.05% 0.75 12.0% 15.50% 1.45 Additionally, Mr. Ota estimate for the risk premium for the market portfolio is 5.40% and the risk-free rate is currently 2.50%. a. For both Managers K and C, calculate the expected return using the CAPM. Express your answers to the nearest basis point (i.e., xX.XX%)arrow_forward

- As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Fund Expected rate of return Risk (Standard deviation) Equity fund 16% 32% Corporate bond fund 12% 18% T-bill money market fund 2% Correlation between equity fund and bond fund returns is 0.4. Find the Expected return of the minimum variance portfolio formed from Equity and Bond fundsarrow_forward(c)) Discuss the following graphic, which shows the relationship between expected return and portfolio weights. The portfolio is comprised of a debt security D and an equity security E. What would the portfolio strategy be when Wp = 2 and ba WE = -1? 38 (33) -0.5 Expected Return 13% 8% Debt Fund 0 (ebenso) esenicut adol leu@ ledol (loorba (ognerloxel) Ismet tametnl Equity Fund 1.0 0 OC) becida nieu to 2.0 w (stocks) AB -1.0 68 XO.YOUTS RO w (bonds)=1-w (stocks) 15 V10 anollesup Figure 7.3 Portfolio expected return as a function of investment proportions la 21101TOarrow_forwardThe table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3), and the returns of sector indexes in column (4). (1) (2) (3) (4) Actual Actual Benchmark Index Return Weight Weight Return Equity 16% 80% 60% 10% Bonds 9% 15% 35% 7% Cash 3% 5% 5% 1% What was the manager's return in the month? What was the benchmark's return in the month? Did the manager over or under perform the benchmark? a. Over perform b. Under perform c. Equal performance d. Cannot tell from the information given e. None of the above By how much did the manager over or under perform the benchmark? What is the contribution of security selection to relative performance? What is the contribution of asset allocation to relative performance?arrow_forward

- An insurance fund is analysing the performance of three different fund managers A, B and C. Each manager invests in one third of all asset classes to maintain a well diversified portfolio. The following information is available: A B C Market portfolio Average net return (%) 5 8 9 9 Volatility (%) 18 24 21 20 Beta 0.8 1.1 1.3 A risk free rate is established to be 2%. Calculate for each of the fund managers the expected return using CAPM, ex post Sharpe Ratio, Treynor Ratio, M2 alpha and Jensen’s alpha. Interpret your results.arrow_forwardVijayarrow_forwardQuestion 1: Assume that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 27%. The T-bill rate is 7%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. Stock A Stock B Stock C 1. Calculate the client expected return on the complete portfolio 2. Calculate the reward-to-variability ratio (Sharpe ratio): Part B A three-asset portfolio has the following characteristics: Expected Return Asset X Y Z 15% 10 6 Standard Deviation What is the expected return on this three-asset portfolio? 27% 33% 40% 22% 8 3 Weight 0.50 0.40 0.10arrow_forward

- Considering the attached set of securities and portfolio returns: Find the combination of the weights that minimizes CV of the portfolio. How does the CV of the optimal portfolio compare with the CVs of its constituents?arrow_forwardSuppose Neha is choosing how to allocate her portfolio between two asset classes: risk-free government bonds and a risky group of diversified stocks. The following table shows the risk and return associated with different combinations of stocks and bonds. Combination A B с D E There is a Fraction of Portfolio in Diversified Stocks (Percent) 0 25 50 75 100 Average Annual Return (Percent) 2.50 4.50 6.50 8.50 Place the entirety of her portfolio in bonds 10.50 relationship between the risk of Neha's portfolio and its average annual return. Accept a lower average annual rate of return Sell some of her bonds and use the proceeds to purchase stocks Sell some of her stocks and use the proceeds to purchase bonds Standard Deviation of Portfolio Return (Risk) (Percent) 0 5 10 15 20 Suppose Neha currently allocates 75% of her portfolio to a diversified group of stocks and 25% of her portfolio to risk-free bonds; that is, she chooses combination D. She wants to reduce the level of risk associated…arrow_forwardAfter learning the course, you divide your portfolio into three equal parts (i.e., equal market value weights), with one part in Treasury bills, one part in a market index, and one part in a mutual fund with beta of 1.11. What is the beta of your overall portfolio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education