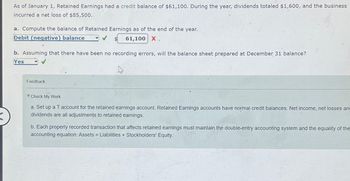

As of January 1,

. During the year, dividends totaled

$1,600, and the business incurred a net loss of

$85,500.\\na. Compute the balance of Retained Earnings as of the end of the year.\\nDebit (negative) balance

✓✓$

,x.\\nb. Assuming that there have been no recording errors, will the

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- he credit manager of Montour Fuel has gathered the following information about the company’s accounts receivable and credit losses during the current year: Net credit sales for the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $8,000,000 Accounts receivable at year-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,750,000 Uncollectible accounts receivable: Actually written off during the year . . . . . . . . . . . . . . . . . . . . . . . . . $96,000 Estimated portion of year-end receivables expected to prove uncollectible (per aging schedule). . . . . . . . . . . . . . . . . . . . . . . . 84,000 180,000 Prepare one journal entry summarizing the recognition of uncollectible accounts expense for the entire year under each of the following independent assumptions: a. Uncollectible accounts expense is estimated at an amount equal to 3.5 percent of net credit sales. b. Uncollectible accounts expense is recognized by adjusting the balance in the Allowance…arrow_forwardThe following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $106,000 $113,000 $120,600 Sales on account 602,250 584,000 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 daysarrow_forwardAt the end of the current year, Accounts Receivable has a balance of $675,000; Allowance for Doubtful Accounts has a credit balance of $6,000; and sales for the year total $3,040,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. $4 22,800 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Debit (Credit) Accounts Receivable $ 675,000 Allowance for Doubtful Accounts 2$ 16,800 X Bad Debt Expense 22,800 c. Determine the net realizable value of accounts receivable. $ 658,200 xarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education