FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:As of December 31, Year 1, Flowers Company had total assets of $220,000, total liabilities of $66,000, and common stock of $110,000.

The company's Year 1 Income statement contained revenue of $40,000 and expenses of $23,000. The Year 1 statement of changes in

stockholders' equity stated that $3,200 of dividends were paid to investors.

Required

a. Determine the before-closing balance in the Retained Earnings account on December 31, Year 1.

b. Determine the after-closing balance in the Retained Earnings account on December 31, Year 1.

c. Determine the before-closing balances in the Revenue, Expense, and Dividend accounts on December 31, Year 1.

d. Determine the after-closing balances in the Revenue, Expense, and Dividend accounts on December 31, Year 1.

f. On January 1, Year 2, Flowers Company raised $40,000 by Issuing additional common stock. Immediately after the additional capital

was raised, Flowers reported total stockholders' equity of $194,000. Are the stockholders of Flowers in a better financial position than

they were on December 31, Year 1?

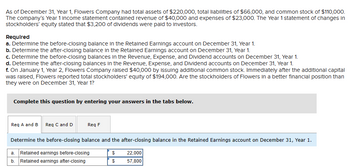

Complete this question by entering your answers in the tabs below.

Req A and B Req C and D

Req F

Determine the before-closing balance and the after-closing balance in the Retained Earnings account on December 31, Year 1.

a. Retained earnings before-closing

b. Retained earnings after-closing

$

$

22,000

57,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below is certain information pertaining to Edson Company. Assets, January 1 P240,000; Assets, December 31 230,000; Liabilities, January 1 150,000; Share capital, December 31 80,000; Retained earnings, December 31 31,000; Ordinary shares sold during the year 10,000; Dividends declared during the year 13,000; Compute the net income for the year. 24,000 11,000 37,000arrow_forwardStatement of stockholders' equity Financial information related to Webber Company for the month ended June 30, 20Y7, is as follows: Common Stock, June 1, 20Y7 Stock issued in June Net income for June Dividends during June Retained earnings, June 1, 20Y7 Balances, June 1, 20Y7 Issuance of common stock Net income Dividends $59,000 Balances, June 30, 20Y7 41,000 Prepare a statement of stockholders' equity for the month ended June 30, 20Y7. If an amount box does not require an entry, leave it blank or enter "0". Webber Company Statement of Stockholders' Equity For the Month Ended June 30, 20Y7 101,490 11,160 774,400 Common Stock Retained Earnings 59,000 ✓ 774,400 ✓ 41,000✔ Total DO 101,490 11,160arrow_forwardThe following information was extracted from the records of Cascade Company at the end of the fiscal yea were completed: Common stock ($0.01 par value; 230,000 shares authorized, 55,500 shares issued, 53,500 shares outstanding) Additional paid-in capital Dividends declared and paid during the year Retained earnings at the end of the year Treasury stock at cost (2,000 shares) Net income Current stock price Required: 1. Prepare the stockholders' equity section of the balance sheet at the end of the fiscal year. 2. Compute the dividend yield ratio. Determine the number of shares of stock that received dividends. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the dividend yield ratio. Determine the number of shares of stock that received dividends. Note: Do not round your intermediate calculations. Round Dividend yield ratio to 2 decimal places. Dividend yield ratio Number of shares % $ 555 459,000 23,500 315,000 (16;500) $ 96,500 $ 10 >arrow_forward

- Please Do not Give image formatarrow_forwardPlease do not give solution in image formatarrow_forwardMarkus Company’s common stock sold for $1.75 per share at the end of this year. The company paid a common stock dividend of $0.42 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 27,000 $ 43,800 Accounts receivable $ 48,000 $ 41,300 Inventory $ 45,100 $ 48,000 Current assets $ 120,100 $ 133,100 Total assets $ 312,000 $ 263,800 Current liabilities $ 49,500 $ 34,500 Total liabilities $ 82,000 $ 73,800 Common stock, $1 par value $ 105,000 $ 105,000 Total stockholders’ equity $ 230,000 $ 190,000 Total liabilities and stockholders’ equity $ 312,000 $ 263,800 This Year Sales (all on account) $ 580,000 Cost of goods sold $ 336,400 Gross margin $ 243,600 Net operating income $ 49,500 Interest expense $ 3,000 Net income $ 32,550 7. What are the working capital and current ratio at the end of this year?arrow_forward

- Assume that the stockholders' equity section on the balance sheet of Mangum's, a popular department store, is shown below. During the year, the company reported net income of $241,125,000 and declared and paid dividends of $11,909,000. Stockholders' Equity: Common stock, Class A-116,610,308 and 116,535,495 shares issued; ? and ? shares outstanding Common stock, Class B (convertible)-4,170,929 shares issued and outstanding Additional paid-in capital Retained earnings Less treasury stock, at cost, Class A- 47,176,748 and 45,340,148 shares $ Current Year 1,166,000 42,000 769,055,000 2,607,727,000 (1,891,581,000) $ Last Year 1,165,000 42,000 796,987,000 ? (941,560,000) Required: 1. What is the par value of Magnum's Class A common stock? 2. How many shares of Class A Common Stock were outstanding at the end of last year and the end of the current year? 3. What amount was reported in the Retained Earnings account at the end of last year? 4. How is the dollar amount in the treasury stock…arrow_forwardAt the beginning of Year 2, Jones Company had a balance in common stock of $300,000 and a balance of retained earnings of $15,000. During Year 2, the following transactions occurred: Issued common stock for $90,000 Earned net income of $50,000 Paid dividends of $8,000 Issued a note payable for $20,000Based on the information provided, what is the total stockholders' equity on December 31, Year 2?arrow_forwardMarkus Company’s common stock sold for $4.75 per share at the end of this year. The company paid preferred stock dividends totaling $4,400 and a common stock dividend of $1.09 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 44,000 $ 43,200 Accounts receivable $ 92,000 $ 66,200 Inventory $ 73,300 $ 92,000 Current assets $ 209,300 $ 201,400 Total assets $ 750,000 $ 809,000 Current liabilities $ 84,000 $ 87,000 Total liabilities $ 210,000 $ 189,000 Preferred stock $ 50,000 $ 50,000 Common stock, $1 par value $ 108,000 $ 108,000 Total stockholders’ equity $ 540,000 $ 620,000 Total liabilities and stockholders’ equity $ 750,000 $ 809,000 This Year Sales (all on account) $ 1,080,000…arrow_forward

- The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 6% $1,500,000 Preferred $5 stock, $50 par $182,000 Common stock, $12 par $163,800.00 Income before income tax was $342,000, and income taxes were $50,800 for the current year. Cash dividends paid on common stock during the current year totaled $43,680. The common stock was selling for $160 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio fill in the blank 1 times b. Earnings per share on common stock $fill in the blank 2 c. Price-earnings ratio fill in the blank 3 d. Dividends per share of common stock $fill in the blank 4 e. Dividend yieldarrow_forwardMarkus Company’s common stock sold for $4.75 per share at the end of this year. The company paid a common stock dividend of $0.57 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 44,000 $ 43,200 Accounts receivable $ 92,000 $ 66,200 Inventory $ 73,300 $ 92,000 Current assets $ 209,300 $ 201,400 Total assets $ 750,000 $ 809,000 Current liabilities $ 84,000 $ 87,000 Total liabilities $ 210,000 $ 189,000 Common stock, $1 par value $ 158,000 $ 158,000 Total stockholders’ equity $ 540,000 $ 620,000 Total liabilities and stockholders’ equity $ 750,000 $ 809,000 This Year Sales (all on account) $ 1,080,000 Cost of goods sold $ 626,400 Gross margin $ 453,600 Net operating income $ 276,500 Interest expense $ 14,000 Net income $ 183,750 Foundational 14-4 (Algo) 4. What is the return on total assets (assuming a 30% tax rate)?arrow_forwardCatena's Marketing Company has the following adjusted trial balance at the end of the current year. Cash dividends of $590 were declared at the end of the year, and 510 additional shares of common stock ($0.10 par value per share) were issued at the end of the year for $2,830 in cash (for a total at the end of the year of 840 shares). These effects are included below: Catena's Marketing Company Adjusted Trial Balance End of the Current Year Cash Accounts receivable Interest receivable Prepaid insurance Long-term notes receivable Equipment Accumulated depreciation Accounts payable Dividends payable Accrued expenses payable Income taxes payable Unearned rent revenue Common Stock (840 shares) Additional paid-in capital Retained earnings Sales revenue Rent revenue Interest revenue Wages expense Depreciation expense Utilities expense Insurance expense Rent expense Income tax expense Total Debit $1,380 2,320 160 1,730 2,860 15, 100 19,700 1,690 250 780 Credit $3,150 2,310 590 3,820 2,207 550…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education