FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

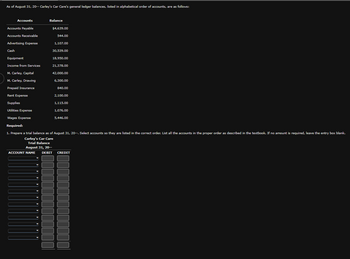

Transcribed Image Text:As of August 31, 20-- Carley's Car Care's general ledger balances, listed in alphabetical order of accounts, are as follows:

Accounts

Accounts Payable

Accounts Receivable

Advertising Expense

Cash

Equipment

Income from Services

Balance

$4.639.00

544.00

1,107.00

30,539.00

18,950.00

21,378.00

42,000.00

M. Carley, Capital

M. Carley, Drawing

Prepaid Insurance

Rent Expense

Supplies

Utilities Expense

Wages Expense

Required:

1. Prepare a trial balance as of August 31, 20--. Select accounts so they are listed in the correct order. List all the accounts in the proper order as described in the textbook. If no amount is required, leave the entry box blank.

Carley's Car Care

Trial Balance

August 31, 20--

ACCOUNT NAME DEBIT CREDIT

6,300.00

840.00

2,100.00

1,115.00

1,076.00

5,446.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ! Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Cash Debit Credit $25,300 Accounts Receivable 14,300 Allowance for Uncollectible Accounts $1,600 Supplies 3,200 Notes Receivable (6%, due in 2 years) 27,000 Land 77,700 Accounts Payable 9,800 103,000 33,100 $147,500 $147,500 Common Stock Retained Earnings Totals During January 2024, the following transactions occur: January 2 Provide services to customers for cash, $42,100. Write off accounts receivable as uncollectible, $1,800. (Assume the company uses the allowance method) Pay cash for salaries, $32,100. January 6 Provide services to customers on account, $79,400. January 15 January 20 January 22 Receive cash on accounts receivable, $77,000. January 25 Pay cash on accounts payable, $6,200. January 30 Pay cash for utilities during January, $14,400. 3. Prepare an adjusted trial…arrow_forwardI could use a hand with thisarrow_forwardPA4. Use the journals and ledgers that follow. Total the journals. Post the transactions to the subsidiary ledger and (using T-accounts) to the general ledger accounts. Then prepare a schedule of accounts receivable.arrow_forward

- Consider the following financial data for Larry’s Computer Stores: Statement of Financial Position as of December 31, 2012 Cash & equivalents $ 94,500 Accounts payable $ 122,500 Receivables 202,500 Short-term bank note 162,500 Inventories 364,000 Accrued wages and taxes 110,500 Total current assets $ 661,000 Total short-term liab. $ 395,500 Long-term debt 418,000 Net fixed assets 468,500 Common equity 316,000 Total assets $ 1,129,500 Total liabilities & equity $ 1,129,500 Statement of Earnings for the Year Ended December 31, 2012 Sales revenue $ 450,000 Cost of merchandise sold 250,000 Gross profit $ 200,000 Operating expenses 97,500 Earnings before interest and taxes (EBIT) $ 102,500 Interest expense 46,500 Earnings before taxes (EBT) $ 56,000 Federal and state income taxes (45 percent) 25,200 Net earnings $ 30,800…arrow_forwardBelow are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable Ending Accounts Receivable Net Sales WalCo TarMart $1,815 $2,762 $322,427 6,166 6,694 67,878 CostGet 629 665 68,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your rounded to 1 decimal place.) WalCo TarMart CostGet Choose Numerator Receivables Turnover Ratio Choose Denominator Average Collection Period Choose Numerator Choose Denominator = Receivables turnover ratio times times times = Average collection periodarrow_forwardAccounts receivable analysis. The following data are taken from the financial statement of sigmon Inc. Terms of all sales are 2/ 10, n / 45. Accounts receivable the end of the year $725,000 20y3 $ 650,000 20y2 $600,000 20y 1 Sales on account 5,637,500 20y 3 4,687,500 20y 2 A. 20y 2 and 20 y3, determine (1) the accounts receivable turnover and (2) the number of days sales in receivable. Round interim calculations to the nearest dollar final answer to one decimal place assume a 365-day year. 1. Accounts receivable turnover 20y3 2. Number of days sales in receivable 20y2 B. The collection of accounts receivable has_______ this can be seen in both the_______ in accounts receivable turnover and the_______ in the collection period.arrow_forward

- Accounts Receivable Balance Beginning accounts receivable were $135,720 and ending accounts receivable were $128,640. All sales were on credit and totalled $1,682,480. Required: Determine how much cash was collected from customers.arrow_forwarddevubenarrow_forwarddon't give answer in image formatarrow_forward

- A company reported the following information: Accounts receivable, December 31, 2023: $122,000 Accounts receivable, December 31, 2022: $113,000 Sales (all on credit) for 2023: $850,000 Accounts receivable, December 31, 2023 $122,000 Accounts receivable, December 31, 2022 113,000 Sales (all on credit) for 2023 850,000 How much cash was collected from customers during 2023?arrow_forwardTanger Company has three customers: E, F, and G. The beginning accounts receivable subsidiary ledger of customers F and G have $2,600 and $1,500, respectively. The beginning Accounts Receivable balance in the general ledger is $12,000. Calculate the ending amount in the accounts receivable subsidiary ledger account of customer E, if customer E also made a $3,900 payment. OA. $4,000 OB. $3,900 OC. $1,500 OD. $2,600arrow_forwardPrivett Company Accounts payable Accounts receivable Accrued liabilities Cash $36,632 72,986 6,134 15,305 38,400 71,968 119,728 79,667 31,336 20,560 662,428 2,681 Based on the data for Privett Company, what is the amount of quick assets? Oa. $119,627 Ob. $781,037 Oc. $46,641 Od. $1,601,593 Intangible assets Inventory Long-term investments Long-term liabilities Marketable securities Notes payable (short-term) Property, plant, and equipment Prepaid expensesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education