Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

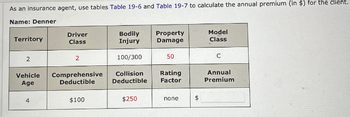

Transcribed Image Text:As an insurance agent, use tables Table 19-6 and Table 19-7 to calculate the annual premium (in $) for the client.

Name: Denner

Territory

Driver

Class

Bodily

Injury

Property

Damage

Model

Class

2

2

100/300

50

C

Vehicle

Age

Comprehensive

Deductible

Collision

Deductible

Rating

Factor

Annual

Premium

4

$100

$250

none

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wind damage occurs to your car costing $1,700 to repair. If you have a $110 deductible for collision and full coverage for comprehensive, what portion of the claim will the insurance company pay? Multiple Choice $850 $1,590 $110 $1,810 $1,700arrow_forwardHi I need an answer key to the questions in the picture thank youarrow_forwardfgarrow_forward

- A company is considering two insurance plans with the following types of coverage and premiums: Plan A Plan B $27,000 $34,000 $182,000 $140,000 Monthly Premium $80 $69 Fire/Theft Liability Premiums are sold in units. For example, one can buy one unit of plan A insurance for $80 per month and receive $27,000 in Fire/Theft insurance. Two units of plan A insurance cost $160 per month and give $54,000 in Fire/Theft insurance. The company wants at least $718,000 in coverage for Fire/Theft insurance and $3,948,000 in coverage for liability insurance. How many units of each plan should be purchased to meet the needs of the company while minimizing cost? The company should purchase units of plan A and units of plan B. What is the minimum monthly premium for the company? $arrow_forwardWhen Margie's Convenience Store buys building supplies from Kent and is granted 30 days to pay the final invoice for the materials, Kent is offering ______ to Margie's. Question 28 options: A) an interfirm understanding B) trade credit C) a promissory note D) a secured loan E) a line of creditarrow_forwardQUESTION 12 Abeer has a major medical pblicy with a 5200o deductible. She is required to pay 25 percent of covered expenses in excess of the deductble. The insurer will pay 75 percent of expenses in excess of the deductble. f Abeer has eligible medical expenses of $10.000. how much will be pad by her insurer? Da57.300 Ob. $7.500 C S0.800 Cd. $7.350arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education