Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

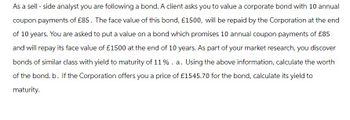

Transcribed Image Text:As a sell - side analyst you are following a bond. A client asks you to value a corporate bond with 10 annual

coupon payments of £85. The face value of this bond, £1500, will be repaid by the Corporation at the end

of 10 years. You are asked to put a value on a bond which promises 10 annual coupon payments of £85

and will repay its face value of £1500 at the end of 10 years. As part of your market research, you discover

bonds of similar class with yield to maturity of 11 % . a. Using the above information, calculate the worth

of the bond. b. If the Corporation offers you a price of £1545.70 for the bond, calculate its yield to

maturity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- After careful consideration, you decide that you want to diversify your portfolio and invest in the bonds of HCA Healthcare. The bonds pay interest annually, will mature in 25 years, and have a coupon rate of 4% on a face value of $1,000. Currently, the bonds are selling for $910. If you are looking for a required return of 7% for this bond, what is the highest price you would be willing to pay?What is the current yield of these bonds?What is the yield to maturity on these bonds if you purchase them at the current price? (Use the Rate function) If you hold the bonds for two years, and interest rates do not change, what total rate of return will you earn, assuming that you pay the market price? If the bonds can be called in 4 years with a call premium of 6% of the face value, what is the yield to call?arrow_forwardAn investor is considering the purchase of a(n) 6.000%, 15-year corporate bond that's being priced to yield 8.000%. She thinks that in a year, this bond will be priced in the market to yield 7.000%. Using annual compounding, find the price of the bond today and in 1 year. Next, find the holding period return on this investment, assuming that the investor's expectations are borne out. The price of the bond today is $ (Round to the nearest cent.)arrow_forwardAssume you can buy a bond that has a par value of $1000, matures in 10 years, yielding 6% and has a duration of 5. If you would like to use this bond to form a guaranteed investment contract “GIC” and offer a guaranteed rate of return to investors for certain years. a. what is the maximum yield you can offer? Why? Explain. b. For how many years would you make the guarantee? Explain.arrow_forward

- Hi, I'm working on this corporate finance question from my textbook. How do I solve it using formulas or the financial calculator? A bond promises a risk-free payment of $1000 in one year. The risk-free rate of interest is2.64%. a) What is the price of the bond? b) If the price of the bond is actually $960, what is the arbitrage strategy? Illustrate all cash flowstoday and one year from today.arrow_forwardAn investment firm recommends that a client invest in bonds rated AAA, A, and B. The average yield on AAA bonds is 4%, on A bonds 5%, and on B bonds 8%. The client wants to invest twice as much in AAA bonds as in B bonds. How much should be invested in each ype of bond if the total investment is $9,000, and the investor wants an annual return of $470 on the three investments? The client should invest $ in AAA bonds, $in A bonds, and $[ in B bonds.arrow_forwardAs a bond analyst at Morgan Stanley Investment Banking, you are performing an analysis on bond yield. You have the following data for a bond issued by Intel Corp. The bond has 7% coupon and 20-year maturity. The bond sells for $1,150 and is callable in 10 years at a call price of $1,250. The bond has a face value of $1000 and makes semiannual coupon payments.a. What is the annual Yield to Call? (sample answer: 12.45%)b. What is the annual Yield to Maturity? (sample answer: 12.45%) Give typing answer with explanation and conclusionarrow_forward

- Please show work You want to purchase a bond that will pay you $300 per year for the next four years. If the annual interest rate is 4%, then what is the price of your bond if the market is in equilibrium? You buy a stock that is expected to pay a dividend of $300 per year for the next four years. If the discount rate is 5.5%, then what is the stock price in this case? Is this result the one you would expect when comparing this answer to the one you obtained in question 3? Why or why not?arrow_forwardA firm considers to invest in two zero-coupon bonds (A and B) in order to cover for a selection of its future liabilities. These zero-coupon bonds will be redeemed in 7 years' and in 20 years' time, respectively. The given selection of its liabilities consist of £11 million due in 11 years' time and £14 million due in 16 years' time. Find the value of bond B at a rate of interest of 5% per annum effective such that the first two conditions for Redington's theory of immunisation are satisfiedarrow_forwardAn investor holds a callable bond of BD Motors Ltd. with a face value of BDT 15,000, a coupon rate of 6%, and 20 years to maturity. The bond becomes callable in 12 years at a call price of BDT 16,500. Given that the current market price is BDT 17,800, calculate the yield of holding BD Motors' bond until it is called. b. What would be the yield if the call price were BDT 18,500? Does the Yield to Call (YTC) increase or decrease? Briefly explain your understanding.arrow_forward

- You are a financial manager and you have bonds worth $3,000,000 in your portfolio which have a 7 percent coupon rate and will be maturing in 10 years from now. What type of risk exposure do you face on these bonds? Suppose a futures contract on these bonds is available with a standard contract size of US$300,000 per contract. How will you hedge your exposure? If the market interest rates change to 9 percent, what will be your position?arrow_forwardImagine that, during a job interview, you are handed the following quotes on U.S. Treasuries: Bond Maturity Coupon rate Yield to (years) maturity 1 1 5% 4.5% 2 2 5% 5.0% 3 3 0% 5.0% Assume that the par value is $100 and coupons are paid annually, with the first coupon payment coming in exactly one year from now. The yield to maturity is also quoted as an annual rate. What should be the 1-year forward rate between years 2 and 3? a. 6.482% ○ a. O b. 6.137% c. 6.507% O d. 6.736% NAVAarrow_forwardYou manage a bond portfolio worth $400 million. You wish to hedge your portfolio against rise in interest rates by using T-bond futures that will mature in 9 months. The duration of your bond portfolio is 6 years, the duration of the T-bond is 7 years. The bond futures price is 98,000, (a) What action must you take and how many contracts? (b) Why do you need to use the duration of the bonds to get the answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education