ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:As a result of this change, the unemployment rate

Use the sticky-wage theory of aggregate supply to think about what will happen to output and the price level in the long run (assuming there is no

change in policy).

On the graph, illustrate the change that will occur in the long run.

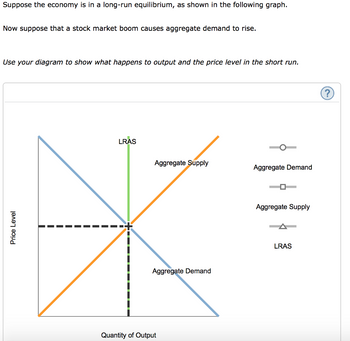

Transcribed Image Text:Suppose the economy is in a long-run equilibrium, as shown in the following graph.

Now suppose that a stock market boom causes aggregate demand to rise.

Use your diagram to show what happens to output and the price level in the short run.

Price Level

LRAS

Aggregate Supply

Aggregate Demand

Quantity of Output

Aggregate Demand

Aggregate Supply

LRAS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the FRED database (https://fred.stlouisfed.org/) to find out what happened to theprice of oil (WTISPLC) and the New Zealand unemployment rate(LRUNTTTTNZQ156S) in 2022. What does our model of labour marketdetermination predict will happen to the natural unemployment rate when oil pricesincrease? What is the consequence for inflation given these developments, and why(Be careful to distinguish between the natural and actual unemployment rate)arrow_forwardBrent, the international oil marker, hit US$130 a barrel on 8th March 2022. The oil price is close to 90 per cent above their level at the same point in time last year. Suppose that the rise in oil price is permanent. It creates an inflation shock and, at the same time, reduces potential output. With the aid of AD-AS model, show the difference in the effects of the oil price increase on output and the inflation rate in the long run if the government does not engage in stabilization policy and if the government does engage in stabilization policy to keep the inflation level low. Please elaborate your answer verbally.arrow_forwardexplain what happens in the short run if the Federal Reserve raises interest rates in the economy? Assume that the economy is at full employment before the interest rate increase. Be sure to detail what happens to: aggregate demandthe price levelthe level of GDPand unemployment. (Provide a detailed explanation of the graph provided).arrow_forward

- For each of the following, use an AD-AS diagram to show the short-run and long-run effects on output and inflation. Assume the economy starts in long-run equilibrium. Instructions: In all the diagrams below, click and drag the appropriate curve or curves to show the short-run changes on the left side and long-run changes (which must also include the short-run changes) on the right side. d. A sharp drop in oil prices (assume the change in oil prices is permanent and no policy actions are taken). Inflation rate Short-Run Effects LRAS Output Y SRAS ADO Inflation rate Long-Run Effects LRAS Output Y SRAS ADarrow_forwardNot quite understanding this one. Please helparrow_forwardUsing aggregate supply and aggregate demand analysis illustrate with the use of a graph the effect of cost-push inflation on the economy.arrow_forward

- Starting from a zero rate of inflation, suppose some event decreases aggregate demand. Use flow diagrams and the labor market graph to explain what happens to wages and prices which results in the “wage-price spiral”. What happens to the rate of inflation?arrow_forwardQUESTION 13 "Consider the labor market in year 2021 but now assume that wages are totally rigid and cannot adjust during 2021. In this year business owners predict low sales for the years to come. As a result, they reduce labor demand. Draw the new equilibrium in a diagram and label it as point C. Use the following equations to find the new equilibrium: LD-70.000-w, LS-b+2w, where b-10,000. What is the unemployment rate? Keep in mind that wages are totally rigid and use the diagram to help you understand what is going on." 43 percent 22 percent. O 20 percent None of the other optionsarrow_forwardI need the answer as soon as possiblearrow_forward

- Look at the graph below. Labor demand falls from D0 to D1 due to an economic recession. What is the resulting wage in the short-run due to this shift in demand? HINT: Consider whether this is a situation in which the wages are sticky or flexible. Wage $? Look at the graph below. Labor demand falls from D0 to D1 due to an economic recession. What is the resulting wage in the short-run due to this shift in demand? HINT: Consider whether this is a situation in which the wages are sticky or flexible. 40 35 30 Wage Rate 25 20 15 10 5 0 DO DI 5 10 15 20 25 30 35 40 Quantity of Laborarrow_forwardName one problem with the way the BLS computes the unemployment rate.arrow_forwardExplain briefly three important reasons why firms have sticky prices in the short run. Given an example of a price that is sticky in the short run but flexible in the long run.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education